IA) Political Developments: Pan-Regional and Global Issues

WANA Regional Security and Terrorism

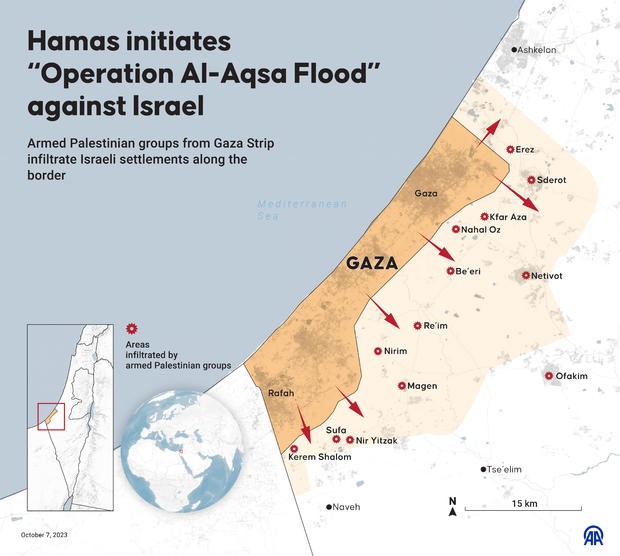

- On the October 7 day break, several specially trained units of the Izzat al-Din al-Qassam Brigades of Hamas (“Al-Harkat al-Muqawama al-Islamiya”, or Islamic Resistance Movement) and Palestine Islamic Jihad (PIJ) fighters launched a well-coordinated, multi-pronged attack titled “Amaliya Al-Aqsa Toofan” or “Operation Al-Aqsa Flood” (OAF) which succeeded in surprising Israeli intelligence and defence establishments. Over a thousand al-Qassam and PIJ fighters demolished the elaborate border structures and penetrated up to 25 kms into Israel rampaging through 20 Israeli Kibbutz (farming villages) and three defence establishments. From Israeli accounts, they killed over 1200 persons, mostly Israeli civilians, but also foreign nationals and abducted over 240 hostages to Gaza as hostages. They managed to affect a seemingly organised withdrawal, after engaging the Israeli army over the next 48 hours.

- While OAF was a tactical masterstroke, in retrospect, it appears more as an opening overture of a Greek tragedy with no victors. It unleashed a furious and disproportionate Israeli response aimed at destroying Hamas altogether. In an angry outburst in public, the Israeli defence minister called Hamas fighters “human animals” who have to be treated as such. (Further Reading: (i) Toofan Al-Aqsa jolts West Asian geostrategic architecture, Mahesh Sachdev, Oct 9.)

- On Oct 25, the Israeli government provided tentative details of the foreign victims of OAF. Of nearly 1400 dead, 328 were citizens of 40 countries. They included the US (34 killed, 5 missing), Ukraine (25+2), France (23+1), Russia (23+4), Nepal (5+5) and China (5+1). Of the estimated 240 taken hostages, more than half had foreign passports from 25 countries: They included 54 Thais, 15 Argentinians, 12 Germans, 12 Americans, 6 French, 6 Russians. 5 Nepalese, 2 Tanzanians, 2 Filipinos, 1 Chinese and 1 Sri Lankan. many of the foreign nationals had dual nationality with Israel. There was no report of any Indians being involved.

- After nearly three weeks of intensive air and missile attacks, Israel launched its ground offensive on Gaza on Oct 28 as a part of the following three phases outlined earlier by defence minister Gallant: (i) attacking the group with airstrikes and ground maneuvers, (ii) defeating pockets of resistance, and (iii) then, ceasing responsibility for life in Gaza. The exit strategy was still in the works till the end of the month under review with loud thinking about options such as a long-term military presence, handing it over to the Palestine Authority (PA), Egypt or an international body.

- Counting the differences with the previous wars over Gaza, this ongoing conflict is far bloodier and more destructive than all its predecessors. It has already lasted longer, except for the conflict in 2014. It was the first time that Israel suffered a major intelligence and security failure since 1973. It has resulted in Israel suffering the largest number of war deaths and hostage-taking in a single day. Unlike previous instances of Israel fighting a non-state actor, this time, it has to contemplate the real possibility of a combination of such as Hamas, PIJ, Hezbollah and Houthis with Iran-allied Shia groups harassing the US military presence in Iraq and Syria in tandem. Further, following the “Abraham Accords” three years ago and recent progress towards normalisation with Saudi Arabia, the regional geopolitics is now more complex. At the same time, Israel’s abject failures on Oct 7 have dimmed its anchoring role in a regional anti-Iran security alliance.

- This Israel-Hamas conflict has re-enforced some long-forgotten regional tenets. Firstly, it has dramatically re-established the centrality of the “Palestine Cause” in the region demonstrating that 35 years of US-sponsored peace-making has failed to bury it. Secondly, the conflict demonstrated that despite all talk of West Asia’s growing multipolarity, the US remains the ultimate arbiter of regional security. Thirdly, thanks to its hydrocarbon assets, trade choke points and the existence of potent non-state terror actors, West Asia’s geo-economic importance remains undiminished.

- Although humanity at large could be better without this conflict, it could have been worse. Once OAF happened, most outside actors worked to contain the conflagration and a wider regional war was avoided. Several factors, such as the US shuttle diplomacy and upping the military ante, disavowal of involvement by antagonists such as Iran, Syria, Russia and China and their proxies and economic fatigue contributed to containing its spread. Besides, the Russia – Ukraine war had already sapped the global energies, almost literally.

WANA and Ukraine Conflict:

The US decided on Oct 4 to hand over one million rounds of Iranian ammunition seized on the high seas to Ukraine to help its war efforts.

Pakistan and WANA Region:

- On Oct 12 Bloomberg reported that Saudi Aramco is exploring a potential bid for Shell Plc’s assets in Pakistan valued at about $123 mn. There were no comments from the two companies.

- $7 bn Reko Diq gold and copper mine in Pakistan’s Baluchistan was in the news during the month under review. The mine with one of the world’s largest undeveloped copper and gold deposits, is deemed to be capable of producing 200,000 tons of copper and 250,000 ounces of gold a year for over half a century. Canada-based Barrick Gold Corporation (BGC) owns half of the project with the governments of Pakistan and Baluchistan owning the other half. The Reko Diq project is set to be constructed in 2025 and targets production by 2028 and will rank among the world’s top 10 copper producers when it reaches full production. The BGC CEO was quoted as saying that the Pakistani government was negotiating with Saudi authorities to sell a stake in the project. Naguib Sawaris, an Egyptian gold billionaire, also expressed an interest in buying a part of it. The project could literally be a gold mine for Pakistan, which would like to monetise it to help its desperate economic situation, leveraging the current high gold prices. However, the investors are likely to be deterred by Pakistan’s political instability and a full-blown insurgency in Baluchistan.

China and WANA Region:

- On Oct 24, Chinese foreign minister Wang Yi had separate phone conversations with his Israeli and Palestinian counterparts. Although China has a pretence to be a major global player, her foreign minister waited for 17 days after the Israel-Hamas conflict exploded – thus leaving the heavy lifting to the US diplomacy. At the UNSC, too, Beijing did not adopt any proactive profile, except calling for a ceasefire in the conflict – a stance calculated to endear it to the Arab-Muslim countries.

WANA and Sports-related Issues:

- At the end of the FIFA bid round deadline on Oct 31, Saudi Arabia was the sole bidder for hosting the Football World Cup in 2034. The formal announcement was to follow in early November. Earlier on Oct 4, FIFA decided that the World Cup 2030 would be played jointly in Morocco, Spain and Portugal.

- There were unconfirmed reports about Saudi Arabia interested in acquiring $5 bn stakes in the Indian Professional League cricket tournament, managed by BCCI with a net worth of $30 bn.

- Saudi Arabia is to launch the Esports World Cup annually beginning the summer of 2024. • Asian Championship League match between Saudi Arabia’s Al-Ittihad and Iran’s Sepahan was postponed on Oct 2 after the Saudi team refused to play at the Isfahan Stadium, objecting to the bust of slain Iranian general Qassem Soleimani at its entrance. This was the first time in nearly a decade that such a match was being played on Iranian soil.

GCC:

- On Oct 20, the first summit of the Gulf Cooperation Council (GCC) and the Association of South East Asian Nations (ASEAN) was held in Riyadh under the co-chair of Saudi Crown Prince and PM Mohammed bin Salman (MbS) and Indonesian President Joko Widodo in Riyadh. They decided to have a successor summit in Malaysia in 2025. Their 42-point joint statement was short on actionable points and made no mention of the burning regional issues, including ongoing conflicts in Ukraine and Gaza and the global energy crisis. However, the significance of this event lay in it being part of MbS’s diplomatic overreach. For India, the growing contact between the two multinational groupings on either side is worth paying attention to.

IB) Political Developments

Iran:

Iranian leadership spoke with a forked tongue firmly in its cheek on Israel Hamas conflict often tying themselves in knots. Thus, Supreme Leader Ali Khamenei initially affirmed that Iran was not involved in OAF on Oct 7, but hailed Israel’s irreparable military and intelligence defeat it implied. On Oct 16, President Raisi said that while Iran supported the Palestine Cause, the “axis of resistance” made its own independent decisions. Ironically, both Israel and the United States publicly disavowed having any information about Iran having any prior knowledge of the OAF on Oct 7 thus helping Iran avoid any culpability and consequent retribution. On Oct 16, foreign minister Hossein Amirabdollahian, nevertheless bellicosely warned that the resistance front could take pre-emptive action to stall Israeli ground assault. On Oct 24, the Pentagon said it had not seen a direct order from the highest levels in Iran to carry out the attacks on the US bases in Iraq and Syria. Yet, White House spokesperson John Kirby said it was clear that Iran was facilitating them. Iran seems to be pulled by two contrarian objectives. Firstly, Iran does not want to become a direct target of Israel-US ire, which could be hugely disruptive of her national as well as regime’s interests. At the same time, Iran does not want to pass up an opportunity to position itself and its proxies as the true defenders of the “Muslim rights.” It is partly motivated by its belief that time is on its side – be it the nuclear quest or oil exports. Further, it sees bleeding Israel in a war of attrition serves its strategic interests. It also fits in well in its domestic demonisation narrative. Thus, Tehran breathes fire against Big Satan (the US) and Small Satan (Israel), nods and winks at Hezbollah and Houthis as well as motley proxies in Iraq and Syria when they stir the pot, yet does nothing that could unleash the full wrath of the two Satans against it.

Iranian deputy foreign minister Ali Baghiri Kani visited Moscow on Oct 27.

Narges Mohammadi, 51, a human and women’s rights activist was awarded the Nobel Peace Prize on Oct 6. Iran criticised the award as a “biased move aimed at politicising the prize.” She is currently serving a 12-year prison sentence.

Armita Geravand, a teenager, accused of breaching the dress code on the Tehran metro, died in the custody of Gasht-e-Irshad (guidance Patrol) on Oct 28, after 4 weeks in a coma.

Turkey:

On Oct 23, President Recep Tayyip Erdogan submitted Sweden’s bid for NATO membership to Turkey’s Grand National Assembly, the parliament, for ratification. The parliament was expected to approve the same in due course without any specific time limit.

The centenary of the formation of the Turkish Republic was celebrated in a low-key fashion on Oct 14. President Erdogan, the longest ruler of modern Turkey, has quietly but firmly rearranged the basic politico-religious architecture framed by Kemal Ataturk and other founders of the Republic. Instead of trenchant secularism, an assertive brand of Sunni Islamic piety has become the call sign of the Republic. Instead of Europeanising the society, Erdogan and his AK Party, have sought to Islamise it. After being rebuffed in his bid for EU membership, Erdogan went into an ultra-nationist binge that ruffled many feathers and ruined the Turkish economy. Of late, he has sought to soften his image and improve eco-political ties with important Sunni regimes in the region and Russia. Domestically, the Prime Ministerial form has been replaced by a Presidential government with centralised power. Civic liberties have been curbed. Most of these changes run counter to the intentions of the Republic’s founders. Hence, the festivities being somewhat muted stands to the context.

President Erdogan became increasingly stridently critical of Israel for its carpet bombing of Gaza civilians. He asserted on Oct 25 “Hamas is not a terrorist organisation, it is a liberation group, ‘mujahideen’ waging a battle to protect its lands and people,” He also announced the cancellation of his planned visit to Israel. In a speech on Oct 28, he described Israel as behaving like a “war criminal”, which led to the Jewish state withdrawing its diplomats from Turkey. Always a policy maverick with an Islamic bent, Erdongan’s recent invectives against Israel have pushed the relations back to the level of acrimony they have had for much of the last decade. It was only last year that Erdogan invested a lot of his diplomatic capital to resuscitate the bilateral ties. He had his first meeting with the Israeli PM on the sidelines of the UNGA session barely a month ago.

Turkey continued to bomb Kurdish militias’ sites in Iraq and Syria during the month in retaliation for the failed Ankara bombing attempt last month. Apart from bombing targets in Iraq on Oct 2, 4 and 6. It launched a major campaign in Syria claiming to have killed 58 Kurdish militants on Oct 7. On Oct 5, a USAF jet shot down a Turkish drone in Syria which had strayed close to the US military base. The Turkish bombing of Kurdish targets in Irasq continued even during the Iraqi defence minister’s visit to Ankara on Oct 4.

Saudi Arabia:

On Oct 30, US National Security Advisor Jake Sullivan met with Saudi Defence Minister Khaled bin Salman Al-Saud in Washington. The meeting acquired additional significance due to it being held against the backdrop of the ongoing Israel-Hamas conflict and the defence guarantees sought by Riyadh as one of the several preconditions for a rapprochement with Israel. Earlier on Oct 4, twenty US senators had sent a joint letter to President Biden opposing nuclear assistance and security guarantees to Saudi Arabia as an inducement for normalisation with Israel.

A Reuters report on Oct 30 disclosed that four Saudi soldiers died during the previous week in the fight with Houthi forces in the mountainous southwestern Jazan Province on the border with Yemen. It also mentioned that Saudi Arabia had brought down a Houthi missile fired over the Kingdom towards Israel. The flare-up on the common border was in contrast to the continued informal truce within Yemen despite the expiry of an UN-mediated ceasefire last year. It could be due to local factors, or may indicate Houthi dissatisfaction at the outcome of the recent reconciliation talks in Riyadh.

Israel

On Oct 3, Israel officially expanded the list of countries permitted to buy its military products. Now 61 countries are on the approved list, up from 40 in 2020. 56 countries were permitted to buy Israeli drone and UAV products instead of 40 before. Names of the specific countries were not given.

On Oct 5, the fifth day of Sukkot Jewish festivities a large number of settlers stormed Al-Aqsa Mosque revered by Muslims.

Qatar

US President Joe Biden phoned Qatari Emir Sheikh Tamim bin Hamad Al-Thani on Oct 3 to thank him for mediating with Iran to facilitate mutual release of prisoners.

On Oct 25, PM Sheikh Mohammed Bin Abdulrahman al-Thani that negotiations Qatar was leading to secure the release of hostages held by Hamas in Gaza are progressing and he is hopeful there will soon be a breakthrough.

Syria:

Israel air and missile attacks on Syrian targets continued during the month, hitting airports of Aleppo and Damascus on Oct 12 and Deir el-Zor on Oct 3. Most of these targets relate to the military presence of Iran or its proxies in Syria.

At least 100 persons died in a drone attack on the Homs-based Syrian military academy’s graduation ceremony on Oct 5. Luckily, the attack took place minutes after the Syrian defence minister had left the ceremony. This largest such attack by weaponised drones in Syria was blamed by authorities on unnamed “terrorists.”

Iraq:

Iraqi PM Mohammed Shia Sudani visited Moscow on Oct 10-11 during which he was received by President Vladimir Putin. This, first meeting between the two, took place in the context of Russia Energy Week and included a session of the bilateral joint commission. The visit was a sign of Iraq trying to come out of the shadows of the lingering US occupation and Iranian preponderance. Both Iraq and Russia are prominent members of OPEC+. Russian investments in Iraq totalling around $19 bn are mostly in the upstream hydrocarbon sector in projects located both in southern and Kurdish regions. For instance, Russia’s Lukoil now produces some 480,000 bpd of oil at Iraq’s southern West Qurna 2 oilfield, nearly a tenth of its total production. Iraqi PM also invited Russia to invest in the proposed north-south transport corridor in his country to connect Europe with the Middle East and Asia.

On Oct 5, the Iraqi central bank announced the banning of cash withdrawals and transactions in the US dollars w.e.f. Jan. 1 2024 in the latest push to de-dollarize the Iraqi economy and curb the misuse of its hard currency reserves in financial crimes. and. Nearly half of the $10 bn that Iraq imports in cash from the New York Federal Reserve each year is used for illegal purposes, mainly for evasion of the US sanctions on Iran through several private Iraqi banks. In recent months, the US treasury department has been twisting Iraqi arm to curb such practices.

In tandem with the Israel-Hamas conflict, the US military assets in Iraq and Syria also came under more frequent missile and drone attacks. Although no side claimed responsibility for these attacks which were said to number around 40 during the first month since Oct 7, pro-Iranian militia were believed to be responsible. The main US assets in these two countries are Iraq (Al-Asad and Baghdad airbases with approx. 2500 troops) and al-Tanaf based at the trijunction of Syria, Iraq and Jordan with some 900 troops.

Egypt:

On Oct 2, President Abdel Fattah el-Sisi announced his intention to seek the third term in the presidential elections to be held on Dec 10-12. While the incumbent is almost certain to win, he would face an economic sclerosis partly caused by his profligacy. (Further Reading: “Egypt’s rushed election shows Abdel-Fattah al-Sisi is nervous”, The Economist Oct 3.)

II) Economic Developments

Oil & Gas Related Developments:

Global Developments:

Oil prices ended the month with Brent crude trading at $87.41 a barrel, down 8.3% during October despite geopolitical uncertainty about the Israel-Hamas War and partially reversing the 29% gain during Q3/23. The causes for this counterintuitive behaviour lay on both the supply and demand sides. The OPEC average output rose by 180,000 bpd during the month while the US produced a record 13.05 mbpd during the month. On the demand side, the economic weakness of China, the world’s largest importer of hydrocarbons, and its gradual shift from hydrocarbon consumption also impacted the prices. Over half of the electrical vehicles (EVs) sold in 2022 came from Chinese brands. EVs accounted for a quarter of all new passenger car sales in China in 2022, a figure that had risen to 37% in September 2023. In California, too, the share of EVs was 21.5% of the total new cars sold during the first 9 months of 2023. Fitch issued a report on Oct 31 dwelling on these dramatic changes in energy ecosystems warning fossil fuel producers about elevated risk for failing to adapt to a low carbon future. Accordingly, the oil and gas companies stood out as the most vulnerable in coping with climate risks such as increasingly stringent emissions regulations. (Further Reading: “India’s Energy Endgame in an Era of Peak Fossil Fuels” by Mahesh Sachdev, The Quint, 27/10/23; “I.E.A. Sees Oil, Gas and Coal Demand Peaking By 2030” NYT Oct. 24.)

Dramatic escalation in the Israel-Hamas war impacted oil prices with Brent rising by 4.94% on Oct 9 – the biggest surge in over 6 months. Further war risks and insurance premiums on tankers also rose. However, as it became clear that the hostilities were going to be largely confined to Gaza, southern Lebanon and OWB, the market shed the gains and resumed the bearish trend. While Israel ordered Chevron to close the Tamar offshore gas field on its Mediterranean coast on Oct 11, the production was later resumed. Israel also awarded offshore gas concessions nearby to a consortium led by Eni and BP.

Iranian foreign minister urged the meeting of the Organisation of Islamic Cooperation on Oct 18 to impose an oil embargo on Israel was also ignored. Even earlier on Oct 8, some Arab oil ministers met in Riyadh during UN MENA Energy Week and reaffirmed their commitment to “collective and individual voluntary adjustments” to oil production. There was no attempt to revise the OPEC+ panel decision on Oct 4 to hold the policy steady and unchanged extending the voluntary production cuts by Saudi Arabia and Russia. The Iranian call was sheer grandstanding as it does not export any oil to Israel. Tehran also knew that the call would be ignored, but could embarrass some of the current or would-be Abraham Accord signatories.

A Reuters data analysis estimated that China is set to reap savings this year of nearly $10 bn through record purchases of oil averaging 2.765 mbpd from Russia, Iran and Venezuela, the three countries under the Western economic sanctions.

Country Specific Developments:

Saudi Arabia, the world’s largest oil exporter, has become the latest convert to the gas economy as it diversifies from near total reliance on crude exports. Aramco aims to spend $110 bn developing the Jafurah gas field that will help double output by 2030 and make the kingdom a gas exporter for the first time. It’s also weighing exporting that gas as LNG. As a part of that strategic shift, Saudi Aramco agreed to buy a stake in MidOcean Energy, marking its first investment in liquefied natural gas. MidOcean is poised to acquire assets in several Australian LNG projects. Saudi Aramco is also exploring entry into the US gas market. Most hydrocarbon experts believe that while oil and coal may soon reach their respective peak consumptions, natural gas, being less polluting, may remain in vogue much longer. Hence Saudi Arabia is ramping up their investments in this commodity at home and abroad.

On Oct 5, Saudi Arabia raised the price of its flagship Arab Light crude to Asian customers in November by 40 cents a barrel, this being a mark-up for a fifth straight month. The prices to most other destinations were also raised a day after Saudi Arabia extended its voluntary 1 mbpd cut by another month.

On Oct 5, the UAE’s ADNOC awarded contracts worth $16.9 bn to build a gas project in the Hail and Ghasha offshore fields. The project aims to produce more than 1.5 bcf of gas per day by 2030. It is claimed to be the world’s first project of its kind that aims to operate with net zero emissions and includes innovative decarbonisation technologies to capture and store 1.5 MT of CO2 per year. The concession is operated by ADNOC, Eni, OMV, Wintershall Dea and Lukoil. The construction work on the site has been entrusted to a joint venture between the Abu Dhabi-based National Petroleum Construction Company and Saipem of Italy with another Italian company, Tecnimont responsible for onshore infrastructure.

On Oct 2, COP28 president Sultan al-Jaber said that more than 20 oil and gas companies were rallying around his calls to curb carbon emissions ahead of the UN summit on climate change to be held in the UAE from Nov 30. Major oil and gas company chiefs held meetings with heavy industry bosses on Sunday in the UAE to discuss a decarbonization commitment ahead of COP28. The UAE, with perhaps the highest carbon footprint per capita, as well as al-Jaber, who is also the CEO of ADNOC, have been under pressure from the environmental groups for their symbiotic reliance on hydrocarbons, rendering them hypocritical about curbing their use to contain the global warming.

On Oct 4, Kuwait said that it expected the Durra offshore gas field, shared with Saudi Arabia, to be fully commissioned by 2029.

Despite official optimism from both Turkey and Iraq, the 450,000 bpd capacity Kirkuk-Ceyhan pipeline remained closed for operations during the month under review.

Following economy-related developments took place in WANA countries:

· According to preliminary official statistics released on Oct 31, the Saudi economy declined by 4.5% in Q3/23 y/y, the most since 2020. It was mainly as oil activities decreased by 17.3% due to the double whammy of lower oil prices and voluntary production cuts. This was despite non-oil growth of 3.6% and expansion in government activities of 1.9%. Earlier on Oct 5, the World Bank’s economic update foresaw the Saudi economy declining by 0.9% this year. In April 2023, the Bank had predicted Saudi economy to grow this year by 2.9%. Apart from decelerating the Saudi economy, the 7th annual Future Investment Initiative (FII) in Riyadh on Oct 25-26 was also overcast by the ongoing Israel-Hamas War. However, the Chinese presence at this year’s event doubled from last year. The Saudi finance minister announced at the event that the Kingdom would enforce the deadline of 1.1.2024 for limiting official contracts only to those companies with region headquarters based in Saudi Arabia. However, among the rare positive economic news, Cargo firm SAL Saudi Logistics Services Co. received orders worth $48.6 bin, 72 times its $678 mn IPO, set to be the kingdom’s second-largest this year. The Q3/23 data vividly illustrated how dependent the Kingdom’s economy remained on oil revenues, despite all efforts to diversify it. Most forecasters expect the annual data for 2023 to indicate a small contraction and a continuing fiscal deficit. In comparison, Saudi GDP recorded G20’s highest at 8.7% in 2022 when it had the decade’s first fiscal surplus. This change of fortune could put in doubt $1.3 tr worth of projects under the rubric Vision 2030 envisaging capex of $175 annually during 2025-28, as envisaged by McKinsey in its report released on Oct 4. Saudi economy’s lacklustre performance was not alone and the World Bank update expected the economies of GCC states and MENA region to record a growth of 1% and 1.9% in 2023 respectively.

· On Oct 26, Turkey’s central bank raised its bank rate by 5% to 35%, this being the fifth increase since the general elections in May 2023. Still, the rate was barely half of the inflation rate of 61.5% in September. The Borsa Istanbul 100 Index fell 9.9% in October, the biggest monthly drop since March 2020, after gaining more than 80% since the elections. The lira lost 3.1% against the US dollar during October. The decline in various indices showed the impact of the Israel-Hamas War on which President Erdogan has taken a stridently anti-Israel line.

· The UAE GDP grew by 3.7% during H1/23, the minister of economy said on Nov 1. The non-oil sector, 70% of the economy, grew 5.9%. Last year, the UAE economy grew 7.9% in real terms, boosted by an oil price windfall as well as a swift economic rebound in tourism and trade post the COVID pandemic. The IMF forecast for the UAE, released on Oct 16, sees a growth of 3.5% in 2023. Dubai cemented its status as the world’s busiest market for luxury homes, worth above $10 mn each, with buyers pouring $1.59 billion into such properties during Q3/23, according to Knight Frank LLP. On Oct 25, DP World signed a $250 mn deal to manage Daar al-Salam port for the next 30 years under which it would share 60% of the earnings with the Tanzanian government. The UAE’s Dubai emirate-owned company has single-mindedly focused on Baab al-Mandab strait – Horn of Africa area for acquiring port assets.

· Following the Israel-Hamas conflict, the Israeli economy, already reeling under the impact of the “judicial reforms” conundrum, came under severe strain. Israeli stocks became the world’s worst performers since the start of the war. The mobilisation of a record 350,000 reservists before its ground offensive on Gaza, drained roughly 8% of its workforce. On Oct 25, Standard and Poor’s lowered Israel’s outlook to negative. Although the Bank of Israel kept its policy rate unchanged, the Shekel underwent its longest decline against the US dollar since 1984. The country’s aviation and tourism sectors suffered following the cancellation of coverage for war insurance for Israel and Lebanon.

· On the other hand, the economic travails of Gaza, under Israel’s siege for the past 17 years, and OWB, have been largely stagnant – surviving either on bilateral or multilateral assistance or remittances, including those working in Israel.

· Egypt, already amidst serious economic difficulties, suffered the additional costs of being war-torn Gaza’s sole Arab neighbour. On Oct 6, Moody’s downgraded Egypt from B3 to Caa1, 7 levels into the junk grading. S&P followed on Oct 21 by downgrading the country to junk grade on Oct 21On Oct 5, the IMF Director told Bloomberg that Egypt would continue to bleed unless the currency was devalued.

III) Bilateral Developments

- Prime Minister Shri Narendra Modi remained actively engaged with the developments triggered by the Hamas-PIJ attack on southern Israel on Oct 7. On the same day, he tweeted, “Deeply shocked by the news of terrorist attacks in Israel. Our thoughts and prayers are with the innocent victims and their families. We stand in solidarity with Israel at this difficult hour.” The PM also had telephonic conversations with several regional leaders, including Israeli PM Benyamin Netanyahu (Oct 10), Palestine Authority President Mahmoud Abbas (Oct 19), King Abdullah bin Hussein of Jordan (Oct 23) and Egyptian President Abdel Fattah el-Sisi (Oct 28). EAM Dr S. Jaishankar spoke with his UAE counterpart Sheikh Abdullah bin Zayed Al-Nahyan on Oct 11. There were several other occasions during the month under review when Indian ministers articulated the country’s position on this issue. Separately, US President Joe Biden said that Hamas’ Oct 7 attack was perhaps intended to derail the India-Middle East-Europe Economic Corridor (IMEEC) project signed in New Delhi on Sept 10.

- Among the other initiatives taken by India on the Gaza situation were the following: (i) Dispatch of 38 tons of humanitarian relief material for Gaza citizens via the al-Arish airport in Sinai (Egypt); (ii) Issuance of a statement by the MEA official spokesman on Oct 12 on October 7 attack by Hamas reiterating “We see this as a terrorist attack,” and went on to add, “India has always advocated the resumption of direct negotiations towards establishing a sovereign, independent and viable State of Palestine living within secure and recognised borders, side-by-side at peace with Israel.” In a further balancing act he stated, “there is a universal obligation to observe international humanitarian law” in a conflict situation, but “There is also a global responsibility to fight the menace of terrorism in all its forms and manifestations.” India’s Deputy PR also reiterated this position to the UN Security Council in his intervention on Oct 23; (iii) Operation Ajay was launched on Oct 11 to bring back those among the 18,000 Indian diaspora in Israel who wanted to return as Air India stopped scheduled flights to Tel Aviv from Oct 7; (iv) India abstained on the UN General Assembly resolution passed on Oct 27 largely as it did not mention Hamas and its October 7 attack. (Further Reading: “Why is India edgy about Israel’s war? The threats that loom over India”, ET Online, Oct 16.)

- India participated in the 7th annual Future Investment Initiative event (dubbed “Devos in the Desert”) held in Riyadh on Oct 24-25 at the level of Shri Piyush Goyal, minister of commerce and industry. He met several Saudi dignitaries including the ministers of energy, commerce, Investment, Industry and Mineral Resources, the CEO of NEOM and the Governor of the Public Investment Fund. At the conference, India’s Essar group announced their proposal to set up a $4.5 bn 4 mn ton capacity steel plant at Ras al-Khair in Saudi Arabia. Separately, during a visit by minister of power Shri R. K. Singh to Riyadh, an MoU on electricity interconnectivity was signed on Oct 8.

- Shri Piyush Goyal, minister of commerce and industry visited the UAE on Oct 4-6 to co-chair the 11th session of the High-Level Talks on Foreign Investments with his UAE counterpart Sheikh Hamza bin Zayed. An MoU on the development of industries and advanced technologies was signed. The minister also met Abu Dhabi Chambers and some entrepreneurs in Dubai. Separately, petroleum and natural gas minister Shri H.S. Puri participated in the ADIPEC event in Abu Dhabi. In his speech on Oct 3, he asked the oil producers to show sensitivity in maintaining a sustainable price for crude. Shri Dharmendra Pradhan, minister for education and skill development began a 4-day visit to the UAE on Oct 31 aimed at deepening bilateral cooperation in the relevant sectors. IHC, one of the Abu Dhabi Sovereign Wealth Funds, reshuffled its investment portfolios in the Adani group, adding $1.65 bn to stakes in Adani Enterprises while reducing stakes in its two other companies. Separately, ADIA, another SWF of Abu Dhabi emirate, raised its stakes with Reliance Retail by $598 mn on Oct 6. According to the President and CEO of the Dubai Chamber of Commerce & Industry, a total of 6,717 Indian-owned companies signed up as its new members during H1/ 2023, representing 39%y/y growth. This brought the total number of Indian member companies to more than 90,118. India ranked 3rd largest investor in Dubai with a share of 12%.

- On Oct 26, a court in Qatar awarded a death sentence to 6 former Indian navy officers, arrested in August 2022, after a secret trial which upheld the charge of spying for Israel. They were employed by a Qatari private company working on a mini-submarine project. MEA’s official spokesman expressed “deep shock”, adding that India attaches high importance to this case and would take up the verdict with concerned Qatari authorities. The timing of the court verdict was possibly linked to Doha’s role in mediating the Gaza conflict which had been criticised by Israel.

- Reuters and Bloomberg, quoting multiple ship tracking agencies, claimed that India’s oil imports from Russia in October 2023 were in the range of 1.49 to 1.58 mbpd, down 8% to 12% over the previous month’s level. The decline was attributed to the maintenance shutdown of the RIL refinery as well as the lower discounts being offered. Earlier on Oct 20, Reuters quoted industry and government sources to report the following data for India’s crude imports during H1/FY24: (i) India imported on average 1.76 mbpd of Russian oil (~40% of total imports), more than double the 780,000 bpd in H1/FY23; (ii) Russia was the top oil supplier to India followed by Iraq (928,000 bpd) and Saudi Arabia (607,500 bpd). India’s imports from Iraq and Saudi Arabia fell by 12% and 23% y/y respectively. (iii) India’s imports from the Middle East declined by about 28% y/y to 1.97 mbpd (44% of the total imports). OPEC’s share of India’s global imports fell to 46% from 63% a year ago. On Oct 5, Reuters cited various ship monitoring agencies to say that Russia had overtaken the UAE as India’s largest supplier of Naphtha during the first 9 months of 2023. The Israel-Hamas war has not had any major impact on India’s crude imports. However, in case the war expands, the crude price and insurance premia could rise and India may be impacted. (Further Reading: “Oil on Fire: India must plan if Israel-Hamas conflict widens” by Mahesh Sachdev, ET, Oct 29.)

***