IA) Political Developments: Pan-Regional and Global Issues

WANA Regional Security and Terrorism

March was largely a month of suspended animation in the military aspects of the Gaza conflict. A relative lull in fighting in Gaza could attributed to several factors, such as Israeli failure to achieve its war objectives, dissensions within Israeli war cabinet about the endgame, growing burden of war on Israeli economy, delay of the US war aid bill due to filibuster in the Congress, advent of Islamic holy month of Ramadhan, threat of mass famine in Gaza, and extension of the conflict to other regional theatres such as Lebanon, West Bank, Red Sea and Syria. The much-threatened final assault on Rafah in the southern corner of Gaza by the Israel Defence Force (IDF) did not materialise, largely due to pressure from the international community and a “red line” drawn by US President Joe Biden. Israel withdrew some of its army units from the area. Israeli On March 19, the US NSA disclosed that an IDF attack had killed Marwan Issa in the previous week. He was one of the top three Hamas masterminds of the Oct 7 operation. On March 31, IDF claimed to have killed an unnamed senior leader of Palestine Islamic Jihad (PIJ), a militia involved in the Oct 7 attack. On March 18, IDF resumed attacking hospitals in northern Gaza such as al-Shifa, alleging that Hamas militants had regrouped there. The 4-day operations involved one of the most intense fighting so far and IDF claimed to have killed hundreds of fighters and detained over 500 suspects, including 358 members of the Hamas and PIJ, the largest number captured at the same time Prime Minister Benyamin Netanyahu claimed on March 10 that at least 13,000 terrorists have been killed in Gaza since Oct 7. By the end of the month, Gazan authorities counted at least 32,782 Palestinians killed and 75,298 wounded in Israeli military actions on Gaza since October 7. Approximately 1200 Israeli civilians died and their military deaths are thought to be approaching 600.

Despite repeated and intense attempts at peace-making during the month, the indirect negotiations by Qatar, Egypt, and the United States a grand bargain during Ramadhan remained elusive. According to various media reports, its cornerstones would have involved a 6-week-long ceasefire, withdrawal of IDF from Gaza, exchange of Israeli hostages with a large number of Palestinians in Israeli jails and creation of a non-Hamas administration in Gaza. Three rounds of multilateral negotiations took place during the month at Cairo (commenced on March 13 and March 30) and Doha (ended on March 26). These failed to bridge the gaps between the demands of the two sides. Israel boycotted the first round as Hamas rejected its demand to provide a list of the hostages still alive. On the other hand, Israel rejected any commitment to have a permanent ceasefire or withdraw from Gaza altogether. (Comments: Given the huge losses in men and material suffered by both sides and a military stalemate on the ground, neither Israel nor Hamas were willing to concede in the diplomatic domain whatever has been “gained” on the battlefield. In any case, running well into its sixth month in March, it has already been the longest of Israel-Arab wars since the IDF invasion of Lebanon in 1982.)

A relative lull in fighting in Gaza notwithstanding, the humanitarian situation in the territory continued to be precarious with little improvement in supplies of food aid. The UN executives and several NGOs repeatedly expressed fears that the situation was unsustainable and could lead to a famine in a few weeks. On March 19, the UN High Commissioner for Human Rights opined that Israeli restrictions on Gaza food aid may be a war crime. Israeli authorities denied that they were restricting the food supplies. Apart from the usual supplies of aid by land crossings and air dropping of food packets, two ships bearing such supplies from Cyprus arrived on March 15 and 30 respectively. (Comment: traditionally, a sense of piety and charity is high during the Islamic Holy month of Ramadhan and starvation in Gaza while food trucks wait for Israeli clearance was abhorrent for many in the Islamic world. Further Reading: “How bad is the humanitarian crisis in Gaza? | Explained”, The Hindu, March 24.)

For details on the Israel-Hezbollah tensions: Please see the para on Lebanon.

For the Houthi missile attacks on Israel and the Red Sea area: Please see the para on Yamen.

WANA and Multilateral Diplomacy:

On March 25, the United Nations Security Council finally adopted its first resolution on the situation in the Middle East, including the Palestinian question since the Gaza conflict erupted on Oct 7. Following is the text of this resolution:

“Resolution 2728 (2024)

Adopted by the Security Council at its 9586th meeting, on 25 March 2024

The Security Council

Guided by the purposes and principles of the Charter of the United Nations,

Recalling all of its relevant resolutions on the situation in the Middle East, including the Palestinian question,

Reiterating its demand that all parties comply with their obligations under international law, including international humanitarian law and international human rights law, and in this regard deploring all attacks against civilians and civilian objects, as well as all violence and hostilities against civilians, and all acts of terrorism, and recalling that the taking of hostages is prohibited under international law,

Expressing deep concern about the catastrophic humanitarian situation in the Gaza Strip,

Acknowledging the ongoing diplomatic efforts by Egypt, Qatar and the United States, aimed at reaching a cessation of hostilities, releasing the hostages and

increasing the provision and distribution of humanitarian aid,

- Demands an immediate ceasefire for the month of Ramadan respected by all parties leading to a lasting sustainable ceasefire, and also demands the immediate and unconditional release of all hostages, as well as ensuring humanitarian access to address their medical and other humanitarian needs, and further demands that the parties comply with their obligations under international law in relation to all persons they detain;

- Emphazises the urgent need to expand the flow of humanitarian assistance to and reinforce the protection of civilians in the entire Gaza Strip and reiterates its demand for the lifting of all barriers to the provision of humanitarian assistance at scale, in line with international humanitarian law as well as resolutions 2712 (2023) and 2720 (2023);

- Decides to remain actively seized of the matter.”

(Comments: (i) That it took well over six months of fierce conflict and vicious disregard for human rights and laws of war for the UNSC to pass a minimalistic resolution speaks evocatively about the ineffectiveness of this supposedly high temple of global security. The UNSC’s growing irrelevance to the global disorder is largely because of the misuse of five vetoes yielding nations to agree to disagree based on their mutual karma and their predilections with their respective client states. The lessons about how the UN’s predecessor, the League of Nations fell out leading to WW2 seem to have been lost as the ununified UNSC drifts towards the same sunset; (ii) The UNSCR 2728 could be passed only because the US shifted from negative vote to abstention on the usage of the word “ceasefire” goes to show how Washington still is the global prima donna, however inconsistent and bipolar it may be; (iii) This first-ever UNSCR on Gaza conflict lacks teeth to enforce a ceasefire, humanitarian relief, hostage release, reconstruction of the devastated areas, new governance structure for Gaza, etc. So, it is unlikely to have any definitive effect on the crisis which has killed more than 32,000 and uprooted nearly 2 mn people.)

On March 28, the International Court of Justice unanimously ordered Israel to take all necessary and effective action to ensure basic food supplies to Gaza’s population and halt the spreading of famine. The ICJ ruling was applauded by UNRWA Head who accused Israel of obstructing the entry of humanitarian relief resulting in a manmade catastrophic situation. Earlier on March 8, he accused Israel of coercing some of its employees to falsely admit to having links with Hamas.

In a significant gesture, UN Secretary-General Antonio Guterres visited the Rafah border crossing between Egypt and Gaza which is controlled by Israel. In his poignant speech, he pointed out “Here from this crossing, we see the heartbreak and heartlessness of it all: A long line of blocked relief trucks on one side of the gates, the long shadow of starvation on the other,” he said. “That is more than tragic. It is a moral outrage.”

On March 13, the Economist ran two detailed stories about how the Gulf states are becoming major players in Africa. (For details please see: (i) “The Gulf’s scramble for Africa is reshaping the continent”, The Economist, March 14; (ii) “Gulf countries are becoming major players in Africa” The Economist, March 13.)

WANA and the United States:

The Biden administration continued to move jerkily towards a more nuanced and seemingly neutral position in public on the Gaza conflict. On March 26, the US abstained from the UN Security Council resolution 2728 allowing its passage. In their public pronouncements, President Joe Biden and other members of his cabinet criticised Israeli military operations in Gaza and lamented the collateral damage it caused. They also advocated a “two-state” solution. This shift by Washington was also manifest on March 4 and 5 when the Bidenadministration welcomed Benny Gantz, a centrist member of Israel’s war cabinet, as if he were an alternative prime minister, granting him meetings with the vice president, Kamala Harris, and the national security adviser, Jake Sullivan, among others. Mr Netanyahu, who has yet to set foot in the Biden White House, was furious. On March 11, the President described the Israeli government’s plan to attack Rafah — currently home to as many as 1 million refugees from the war — as a “red line” that must not be crossed. Tellingly, the announcement of US Secretary of State Anthony Blinken’s sixth tour of WANA countries since Oct 7 did not mention a stopover in Israel which was subsequently included in the tour. Blinken began his tour in Saudi Arabia on March 21 where he was received by Crown Prince Mohammed bin Salman. He went on to Cairo to meet several Arab foreign ministers and the SG of PLO on March 21. Blinken eventually went to Israel the next day to meet PM Netanyahu to warn him that Israel risked further global isolation if it attacked Rafah in the Gaza Strip. In a post-meeting video statement, Netanyahu said “We have no way to defeat Hamas without going into Rafah and eliminating the rest of the battalions there. And I told him that I hope we will do it with the support of the US, but if we have to – we will do it alone.” (Further Reading: Deposing Israel’s king The Economist, March 17.)

Israeli defence minister Yoav Gallant paid an “unauthorised” visit to Washinton in the fourth week of March when the bilateral relations were particularly tense. He met his US counterpart Lloyd Austin who stressed that the IDF had a moral responsibility to protect the Gaza civilians. Gallant also met the US NSA twice. Following Gallant’s visit, the Washington Post revealed on March 29 that the US had authorized the transfer of $2.5 bn worth of bombs and F-35 fighter jets to Israel, even as Washington publicly opposed an anticipated Israeli military offensive in Rafah. However, only on the previous day chairman of the US Joint Chiefs of Staff said that Israel had not received every weapon it has asked for, in part because some of it could affect the U.S. military’s readiness and there were capacity limitations. (Comment: As the US diplomatic posturing on the Gaza conflict evolved towards a more neutral nuance, it began to contradict Washington’s self-styled “ironclad” military support to Israel’s security. This growing doublespeak left nearly everyone non-plussed and largely dissatisfied. While Israeli leadership was often livid with US diplomacy abandoning them, the moderate Arabs, including the PA were incensed with enhanced weapon and ammunition support to Israel enabling it to wreck more death and devastation on hapless Palestinians. While PM Netanyahu did not abandon his plan to invade Rafah, on March 31, he said that this would be done after moving the civilians from that area.)

The US conducted its first air-drop of food aid over Gaza on March 2. On March 8, the US also began construction of a temporary port on Gaza’s shoreline so that humanitarian relief can be accessed by the sea. The port is likely to be ready in 60 days.

WANA and Pakistan:

Following Pakistan’s Petroleum Minister’s statement that his country was seeking a U.S. sanctions waiver for the gas pipeline from Iran, the US State Department spokesman said on March 26 that the US does not support a Pakistan-Iran gas pipeline project from going forward and cautioned about the risk of sanctions in doing business with Tehran.

IB) Political Developments

Israel

Israel had to cope with increasing diplomatic isolation during the month as the ceasefire talks stalled and the international community was wary of Jerusalem’s intended assault on Rafah, the last redoubt of Hamas, but teeming with over a million refugees. Even the Biden administration began publicly distancing itself from Netanyahu’s uncompromising pursuit of the military option unmindful of the likely civilian consequences. The US abstention allowed the UN Security Council to pass its first resolution 2728 on March 26 on the Gaza war calling for a ceasefire and return of the hostages. The Israeli government reacted with contrived fury at Washington’s shift and cancelled the bilateral dialogue on military options in Rafah. However, it later asked for the dialogue to be rescheduled. On the other hand, on March 22, four EU members (viz. Spain, Ireland, Malta & Slovenia) agreed to take the first steps towards recognising a Palestinian state. Israel warned them that such a move would constitute a “prize for terrorism” that would reduce the chances of a negotiated resolution to the conflict. Canada, a minor weapons supplier to Israel, declared on March 20 that it had not approved new arms export permits to Israel since these were frozen on Jan 8.

There was greater friction in Israeli domestic polity as anti-government rallies protested at several issues such as the inability to get the hostages back and the exemption for ultra-orthodox Jews from military conscription as insisted by the far-right members of the ruling coalition. These Jewish seminary students called Heredi, comprise 12% of the total population. On March 28 PM Netanyahu asked Israel’s top court to defer a March 31 deadline for the government to come up with a new military conscription plan that would address mainstream anger at exemptions. A senior cabinet minister resigned on March 25 alleging diminution of his role.

On March 13 Knesset approved the country’s record budget to finance the war-related expenses. It envisaged the fiscal deficit at 6.6% of GDP, a ratio highest this century. After data revision, the Israeli economy was known to have contracted in Q4/23 by 20.7% instead of 19.4% the first estimates projected. The period coincided with the beginning of the Gaza conflict on Oct 7.

Palestine Authority:

On March 14, Palestinian President Mahmoud Abbas named Mohammad Mustafa as prime minister with a mandate to help reform the Palestinian Authority (PA). On March 28, a new PA cabinet with 23 ministers including at least 5 from Gaza was sworn in. Hamas criticised these appointments as unilateral moves by al-Fateh. (Comment: The appointment of the new cabinet was in response to the international and domestic pressures to revamp the PA as a precursor to the post-Gaza conflict administration of the Occupied Territories of both West Bank and Gaza. Even as the US welcomed the move, Israel, which has vowed to finish off Gaza, remained sceptical about the new cabinet as the new PM Mustafa,70, was a longstanding confidant of President Abbas who is 88.)

On March 4 Israel conducted its biggest raid in several years on Ramallah, the PA capital. Since the beginning of the Gaza war on Oct 7, till March 20, Israeli military action on the West Bank had led to the death of 358 Palestinians and arrests of 7350. On March 22, Israeli authorities seized 800 hectares of land in West Bank for settlement activities.

On March 31, Hamas accused Fateh of sending its security personnel to Gaza designated as security for the aid trucks entering the territory.

Lebanon:

The sporadic and episodical hostilities between IDF and Hezbollah militia across the Israel-Lebanon border continued with the former often seizing the initiative and the latter reacting to it. Thus, on March 29, an IDF action killed the deputy commander of the Hezbollah rocket and missile unit. On March 11, 12 and 24 IDF conducted air raids on the Hezbollah targets in Beka’a Valley and Baalbek. In response, Hezbollah fired missile barrage at Israeli locations in the Golan Heights area.

Citing several unnamed sources, Reuters reported on March 15 that during Feb meeting between visiting Inan’s Quds Force chief and Hezbollah leader, the former had emphasised that Iran did not want to get sucked into a war with Israel and the US over Hezbollah-IDF clashes. On his part, Hezbollah leader assured that Hezbollah would fight IDF on its own.

On March 22, Lebanon formally complained to the UN Security Council that Israel was disrupting its navigation system putting into jeopardy its civil aviation safety.

Yemen:

Several new benchmarks were created during the month as the Ansar Allah (popularly called al-Houthis) militia ruling much of Yemen continued to disrupt shipping in the Red Sea and the Gulf of Aden by attacking drones and anti-ship missiles despite the Western navies’ preventive actions. On March 3, Rubymar, a freighter, became the first ship to be sunk ship due to the hostilities in the Red Sea. The Houthis had attacked it on Feb 18. On March 5 reports came about four submarine cables in the Red Sea (viz. Seacom, TGN-Gulf, Asia-Africa-Europe 1 & Europe India Gateway) had been cut for the first time. An estimated 25% of traffic was affected. It is worth noting that some 80% of the westbound traffic from Asia passed through these 17 cables at the bottom of the Red Sea. Houthis denied any responsibility for the cable damage. Some observers believe that the cables were damaged by the sunk ship Rubymar’s anchor. On March 7, a Houthi attack on a ship ironically called “True Confidence” killed three sailors and injured four others, making them the first shipping fatalities in the Red Sea war. The ship was set ablaze and abandoned in the Gulf of Aden.

The US Navy led “Operation Prosperity Guardian” to try to intercept the Houthi projectiles. They also made several air and missile attacks on the Houthi missile and drone infrastructure. (Comment: The Houthis reportedly placed their missile launchers on the highlands close to the Red Sea shoreline, increasing their range and making them less vulnerable to attacks. Thus, a low-intensity asymmetric clash was likely to continue in the Red Sea at least till the Gaza conflict came to an end.)

Citing knowledgeable sources, Bloomberg reported on March 25 that following talks between their diplomats and the Houthi leader Mohammed Abdel Salam, a historic arrangement was reached. Under its terms, China and Russia got an assurance of safe passage through the region to keep their ships travelling through the Red Sea. In exchange, the two countries were expected to provide political support to the Houthis in bodies such as the United Nations Security Council. However, despite this unpublished arrangement, several Houthi attacks on their ships took place during March.

Iran:

The national elections for the Majlis, Iran’s parliament, were held on March 1. Despite exhortations by the ruling hierarchy for a robust turnout, only 41% of Iran’s 65 mn eligible voters cast their votes; the participation was the lowest in the Islamic Republic’s history. The election results indicated that the current domination of the conservatives and hardliners in the Majlis would continue for the next four years. The Majlis has 290 lawmakers of which 285 are elected every four years. A record high of 15,200 candidates were in the field. Votes will also be cast for 88 clerics who will each take a seat for eight years at the Assembly of Experts, which is tasked with selecting the country’s supreme leader. 144 candidates contested for positions in the 88-member Assembly of Experts, an institution exclusively composed of male Islamic scholars. The Assembly of Experts is expected to play a seminal role in deciding the successor of the current 84-year-old Supreme Leader Ali Khamenei.

The independent international fact-finding mission on Iran, created by the UN Human Rights Council in November 2022 into the socio-political unrest in Iran after the death of Mahsa Amini in September 2022 submitted its first report on March 9. It strongly indicted the conduct of the Iranian authorities in repressing the protest demonstrations saying that many of the violations uncovered “amount to crimes against humanity – specifically those of murder, imprisonment, torture, rape and other forms of sexual violence, persecution, enforced disappearance and other inhumane acts”. It added that the committing of such crimes, in the context of deprivation of fundamental rights and inflicted with discriminatory intent, “leads the mission to the conclusion that the crime against humanity of persecution on the grounds of gender has been committed”. The same day Iran condemned the report calling it “false and biased.”

Iran continued to have strong opposition from several Western countries about its nuclear program in general and the uranium enrichment project in particular. Tehran’s proposal to market its low-enrichment uranium internationally for nuclear power reactors’ fuel was seen by the Western countries as a ploy to justify its enrichment activities. On March 6, the US asked Iran to dilute all its weapons-grade enriched uranium to power reactor grade. Washington also cautioned Iran against stonewalling the IAEA supervision of its nuclear facilities.

A joint report published on March 5 by two NGOs based in Norway and France claimed that Iran had executed 834 persons in 2023. The number of such executions has been rising for the second year running. These executions were intended ‘to instil societal fear’, the report alleged. Most Iranian executions were undocumented and the government acknowledged only 125 executions in 2023.

In a detailed article published on March 18, the Economist examined the growth of the eco-political ties between Iran, China and Russia. (Further Reading: “How China, Russia and Iran are forging closer ties”, The Economist March 18.)

Turkey:

The municipal elections held on March 31 across Turkey handed over the worst defeat to President Recep Tayyip Erdogan and his AK Party in their 22 years at the helm of the country’s polity. The main opposition, the Republican People’s Party, known as CHP, won 37.8% of the vote to AKP’s 35.5%. AKP was set to win the mayor’s seat in 24 cities, down from 39 in the last election in 2019 while CHP was leading the race in 35 provinces, compared with 21. In Istanbul, CHP won 51.1% compared to 39.6% for AKP. In Ankara, CHP got 60.4% of the vote versus AKP’s 31.8%. (Comment: Although these were local elections, they acquired the form of a national referendum as the cities where elections were held account for more than 70% of Turkey’s population and almost 80% of its economy. Several factors contributed to the reversal in the fortunes of Erdogan and AKP when compared to their decisive election victories score last June in presidential and parliamentary elections. Firstly, Erdogan and AKP have relied on the rural voters as a block which was out of reckoning in these elections. Voters’ anger was caused mainly by their dire economic conditions. They blamed Erdogan for his flawed economic policies causing rampant 70% annual inflation, high interest rates of 50% and a precipitous decline in the value of the national currency. He was also held responsible for tardy relief after last year’s massive earthquake. Moreover, the Islamist block, his core support base, also largely abandoned him for insufficient response to the Israeli invasion of Gaza. Last, but not least, the Kurds, a 30% minority in the country, reacted against his strong-armed tactics not only in Turkey but also to quell their national aspirations in Iraq and Syria. The upshot of the election was the resuscitation of CHP as the resurgent opposition and the emergence of Ekrem Imamoglu, 52-year-old re-elected mayor of Istanbul as a putative successor of President Erdogan, 71, who has declared this to be his last election. Relevant to note that Istanbul, population 16 mn, has one-fifth of Turkey’s population and more than half of its GDP. Further, Erdogan was himself mayor of the city before joining the national politics. Further Reading: “Ekrem Imamoglu on Turkey’s renewed faith in democracy”, The Economist, April 4.)

President Recep Tayyip Erdogan held talks with his Ukrainian counterpart Volodymyr Zelenskyy in Istanbul on March 8. Speaking after their meeting, he expressed Turkey’s willingness to host a summit between Ukraine and Russia to end their war.

Turkey and the United States made efforts during the month to repair their ties under their bilateral strategic mechanism rubric. On March 8, the Turkish foreign minister travelled to Washington to meet with his counterpart as well as the US NSA. Later on March 28, the bilateral security talks were held in Ankara.

On March 14, a Turkish delegation comprising foreign and defence ministers as well as the chief of intelligence visited Baghdad to hold security and energy-related talks with their Iraqi counterparts. The Turkish side was received by the Iraqi PM. Turkey and Iraq reportedly reached a security deal to crack down on the Kurdish militants holed up in the mountains of northern Iraq. In a connected event, Turkey’s military strike killed 11 Kurdish militants in northern Iraq on March 23.

A Bloomberg report on March 31 noted that Turkey’s contemporary military footprint abroad was the highest since the Ottoman Empire, with Turkish forces present in Northern Cyprus, Azerbaijan, Syria, Iraq and Somalia.

Sudan:

On March 8, the UN Security Council passed resolution No. 2724 on the situation in Sudan with 14 votes in favour and Russia abstaining. It had the following operational paragraphs:

“1. Calls for an immediate cessation of hostilities during the month of Ramadan, and for all parties to the conflict to seek a sustainable resolution to the conflict through dialogue;

2. Calls on all parties to ensure the removal of any obstructions and enable full, rapid, safe, and unhindered humanitarian access, including cross-border and cross-line, and comply with their obligations under international humanitarian law, including to protect civilians and civilian objects, and their commitments under the Declaration of Commitment to Protect the Civilians of Sudan (“Jeddah Declaration”);

3. Encourages the Secretary-General’s Personal Envoy on Sudan Ramtane Lamamra to use his good offices with the parties and the neighbouring States, complementing and coordinating regional peace efforts;

4. Decides to remain actively seized of the matter.”

On March 12, the Sudan Armed Force (SAF) regained control of the National TV and Radio headquarters in the Khartoum from Rapid Support Force (RSF). It was the first flush of the SAF fortunes after a string of debacles in the hands of RSF.

During the month, the UN sources continued to portray a grim picture of the humanitarian situation in war-torn Sudan blaming international inattention and inaction. According to a statement on March 20 by the UN Office for the Coordination for Humanitarian Affairs, Sudan’s civil war, which began on April 15 2023, had created one of the ‘worst humanitarian disasters in recent memory.’ More than 8 mn Sudanese have been displaced. More than 18 mn Sudanese are facing acute food insecurity – 10 million more than at this time last year – while 730,000 Sudanese children are believed to be suffering from severe malnutrition. “The statement warned” A famine was eminent in large parts of the country and “almost five million people could slip into catastrophic food insecurity in some parts of the country in the coming months”.

Syria:

Israel’s unacknowledged air and missile attacks on targets in Syria intensified during the month under review. On March 29, Israel carried out its most deadly air strike since Oct 7 when it attacked Aleppo province killing 33 Syrians and six Hezbollah fighters.

On March 30, a car bomb blast during night crowded marketing hours in Ramadhan at the anti-government enclave of Azaz near the Turkish border killed at least seven people and injured thirty.

Iraq:

The head of the International Atomic Energy Agency (IAEA)visited Iraq to help the country develop a peaceful nuclear programme. He was received by Iraq’s Prime Minister Mohammed Shia Sudani in Baghdad on Monday as part of a visit. It was agreed that an Iraqi technical group would visit IAEA Hqtrs soon to “set out a road map for the Iraqi peaceful nuclear programme.” During Saddam Hussein’s era, Iraq actively pursued a nuclear weapons programme that had three nuclear reactors one of which was destroyed by Israel in 1981 and the other two during Operation Desert Storm launched by the US to liberate Kuwait in 1991.

Saudi Arabia:

On March 25 the Islamic Trade Finance Corporation (ITFC) signed an agreement to provide $1.4 bn to the Bangladesh Petroleum Corporation to develop the country’s energy infrastructure and ensure its energy security.

In a boost to Saudi Arabia’s ambition to be an artificial intelligence (AI) hub, on March 4 Amazon Web Services announced that it will invest $5.3 bn to launch data centres in the Kingdom in 2026. Separately, Bloomberg revealed on March 25 that Saudi Arabia’s Public Investment Fund (PIF) was talking with a big venture capital company to partner on a $40 bn fund to target the AI sector.

On March 20, the Saudi cabinet on Tuesday approved an agreement to establish a regional office for the International Monetary Fund in Riyadh.

By March end, Saudi Arabia emerged as the sole bidder to host the 2034 FIFA World Cup. The formal decision to award the games to the Kingdom was to be announced later by the FIFA Council.

The UAE:

In a significant shift away from the hostility that has long defined relations between Shi’ite Muslim Hezbollah and the Sunni Muslim UAE, a senior official from the Lebanese militia visited the UAE. The visit was to facilitate the release of more than a dozen Lebanese nationals detained there.

In an exclusive on March 19, Reuters reported that the United Arab Emirates was quietly urging the European Union to start talks on a trade pact separate from the GCC. The EU and GCC started trade talks in 1990 but these were formally suspended in 2008. According to the report, The UAE has also urged the UK to engage in a bilateral process for a trade pact.

Bloomberg mentioned on March 11 that Abu Dhabi had formed a new artificial intelligence-focused firm called MGX targeting $100 bn assets under management in this emerging sector.

According to Bloomberg on March 25, LuLu, an NRI Group, which operates one of the Middle East’s largest hypermarket chains, was considering an IPO worth $2 bn, one of the biggest in the Gulf this year.

On March 19, the UK referred the UAE-led takeover of the Telegraph newspaper for a lengthy review. (Comment: The move will effectively kill the deal because a law banning foreign governments from owning newspapers is due to come into force in the coming months.)

Reuters reported on March 29, citing unnamed sources that the UAE has discussed the idea of state-owned Emirates Nuclear Energy Company (ENEC) becoming a minority investor in European nuclear power assets. ENEC currently operates the Arab world’s first nuclear power complex. It has ambitions of becoming an international nuclear energy company holding minority stakes in the nuclear power infrastructure of other nations, without managing or operating them.

Tunisia:

On March 19, Tunisia and Libya closed a major border crossing at Ras Jedir due to armed clashes, between the “outlaws” and the Libyan internal security units sent to enforce governance in this wild west zone known for smuggling and trafficking. Ras Jedir, 170 kms west of Tripoli, is the main crossing point between the two North African countries.

On March 27, Tunisia’s parliament barred a state-run Qatari fund for Development from opening a branch in Tunis despite a carrot of $150 mn expansion in immediate financing and to pave the way for additional support. Although the Tunisian economy has been in serious trouble, President Kais Saied and his supporters are deeply suspicious of Qatar’s pro-Islamist policy.

Libya:

On March 10, three key Libyan leaders issued a joint statement announcing their agreement on the “necessity” of forming a new unified government that would supervise long-delayed elections. They also agreed to form a technical committee to “look into controversial points”. They also called on the U.N. Mission in Libya and the international community to support their proposals. The leaders are the head of the Presidential Council, the head of the High State Council, who are both based in Tripoli, and the speaker of the House of Representatives in Benghazi.

II) Economic Developments

Oil & Gas Related Developments:

Global Issues:

March saw a continuing ascent of the oil prices even a great deal of turbulence in the market largely due to the continuing Red Sea disruptions and the emergence of early signs of industrial recovery in China, the world’s largest consumer and importer, after five months of tepidity. The Brent futures for June delivery closed on March 29 at $87.00/barrel, having gained approximately 4.0% during the month under review. The supply-side constraints such as the OPEC+ decision (March 8) to continue with 2.2 mbpd production cuts till mid-2024 and the new transportation and banking restrictions on Russian oil exports also pushed the prices higher. Relevant to note that oil prices grew by a robust 14% during Q1/24, reviving the speculation about the commodity rising to $100 a barrel all over again. The CEO of Vitol, an oil trader, said on March 20 that the diversion of the maritime trade from the Red Sea route to a much longer route around the Cape of Good Hope itself contributed to nearly 100,000 bpd of oil.

In a commentary on March 13, IEA flipped its longstanding view against new investments in upstream petroleum capacity enhancement a corollary to its confident projection of the global oil demand peaking by 2030. Its new position was nuanced differently: “The global dependence on oil was decreasing but remained deep-rooted and supply disruptions could still lead to significant economic harm and have a substantial negative impact on people’s lives.” It went on to add “There is a high degree of uncertainty around how quickly demand will fall, leaving oil companies facing difficult and commercially risky decisions around upstream investment,” OPEC agreed with IEA commentary but said the IEA’s calls for no new investments in oil and natural gas have “contributed significantly to this uncertainty, which has the potential to lead to major energy chaos, not the desired energy security.” On March 18, the CEO of Saudi Aramco, the world’s largest oil company, also waded into the Peak Demand controversy. He told the CERAWeek conference in Houston that the global oil demand would not peak for some time so policymakers need to ensure sufficient investment in oil and gas to meet consumption and abandon the fantasy of phasing out fossil fuels.

In its monthly oil report released on March 14, the IEA made a 110,000 barrels per day (bpd) upward revision of global oil demand from its previous forecast due to the rising fuel needs of ships rerouted away from the Red Sea amid attacks by Yemen’s Houthi rebels and a brighter US economic outlook. It now expects world oil demand to increase by 1.3 mbpd in 2024, sharply lower than in 2023 when it reached 2.3 mbpd. Total global demand is forecast to reach 103.2 mbpd in 2024 compared with 101.8 mbpd last year. (Comment: The IEA bulletin made three additional interesting points (i) China’s oil demand growth is expected to slow from 1.7 mbpd in 2023 to 620,000 bpd in 2024 contributing nearly all to the global decline of growth in demand. While the IEA report does not mention India, S&P Global expects our oil demand to grow by 206,000 bpd in 2024. (ii) As for 2024, non-OPEC+ oil supply growth will eclipse the oil demand expansion by some margin. Led by the United States, Guyana, Brazil and Canada, non-OPEC+ production is forecast to rise by 1.6 mbpd in 2024, while the global demand is to rise by 1.3 mbpd. Thus, non-OPEC+ oil supply growth will eclipse the oil demand expansion by some margin. In comparison, in 2023 the position was opposite the corresponding numbers being 2 mbpd and 2.4 mbpd respectively. (iii) Despite the US sanctions, IEA expects Iran to increase production by a further 280 kbpd this year.)

Country Specific Developments:

In tandem with the OPEC+ decision of March 3, Saudi Arabia also announced that it would continue with the voluntary 1 mbpd production cut till June 30 2024. On March 10, Saudi Aramco hiked its dividend for 2023 by 30% to $97.8 bn. This was despite a sharp drop in its profits by 24.7% to $121.3 bn. As Saudi Aramco is 82.2% owned by the government, high dividend contributes to the state revenue. On March 20 Saudi Aramco told the CERAWeek conference in Houston that the company plans to increase gas output by 60% by 2030. Aramco recently halted plans to expand oil output capacity and is focused on developing unconventional gas fields similar to U.S. shale fields in the kingdom. The company has also said it is looking at opportunities to invest in LNG projects abroad.

On March 27, Iraq signed a 5-year agreement with Iran for supply of up to 50 mcm/day of Iranian gas to meet the needs of Iraqi power stations. (Comment: Given Baghdad’s uneasy perch with each of the US and Iran, the deal would have probably required a waiver by Washington which has imposed strict sanctions on Iranian export of hydrocarbons.) Iraq said in March it would reduce its crude exports to 3.3 mbpd in the coming months to compensate for having exceeded its OPEC+ quota since January, a pledge that would cut shipments by 130,000 bpd from last month. The Iraq-Turkey oil pipeline (ITP) has been dysfunctional since March 2023 when a Pais-based international resolved that transit of Kurdish oil through the pipeline was illegal as the Iraqi federal government’s prior approval was not obtained. The International Chamber of Commerce ordered Ankara in 2023 to pay $1.5bn in damages to Baghdad after the KRG sent oil directly to Turkey from 2014 to 2018. Thus the ITP, which once handled about 0.4 mbpd, is stuck in legal and financial limbo between the governments of Iraq, Turkey and Kurdistan as well as the producing oil companies.

Reuters reported on March 12 citing unnamed sources that Iran and Venezuela were trying to patch together a techno-economic oil alliance that began to fray last year after the South American country fell behind on oil swaps that had boosted crude exports and helped stem domestic fuel shortages. This was prompted by the possible return of U.S. sanctions on Venezuela’s oil industry in April and the revival of oil-related ties with Iran became critical to keeping Caracas’ lagging energy sector afloat.

Bloomberg reported on March 28 that following greater US vigil on the sanctioned Russian oil trade, the waters off Oman are emerging as a hot spot for ship-to-ship transfers of Russian oil heading to India.

Libya replaced its oil minister on March 28 after an official investigation alleged violations including “circumventing the law and wasting public money.” The replacement named was a senior executive in the national oil company. While this move raised hopes for driving deals and reviving Libya’s beleaguered energy sector, a fragmented political picture was still a strong deterrent for the oil investors.

On March 31 QatarEnergy signed four agreements to charter 19 LNG carriers from Asian ship operators as it prepares to ramp up output significantly by 2028.

Israeli gas producer NewMed stated on March 13 that a $2 bn offer by UAE’s ADNOC and BP to buy a 50% stake in the company has been put on hold due to “uncertainty in the region.”

Following economy-related developments took place in WANA countries:

SWF Institute (SWFI) report gave the ranking by total assets of Top-100 Sovereign Wealth Funds across the globe. The following table contains the relevant extract for WANA-based SWFs:

Rank | Profile | Total Assets in USD Mn | Country |

1 | Norway Government Pension Fund Global | 1,648,082 | Norway |

2 | China Investment Corporation | 1,350,000 | China |

3 | SAFE Investment Company | 1,090,000 | Asia |

4 | Abu Dhabi Investment Authority (ADIA) | 993,000 | The UAE |

5 | Public Investment Fund (PIF) | 925,000 | Saudi Arabia |

6 | Kuwait Investment Authority (KIA) | 923,450 | Kuwait |

8 | Qatar Investment Authority (QIA) | 526,050 | Qatar |

12 | Investment Corporation of Dubai | 341,067 | The UAE |

13 | Turkey Wealth Fund | 279,261 | Turkey |

14 | Abu Dhabi Developmental Holding Company | 190,000 | The UAE |

16 | National Development Fund of Iran | 156,500 | Iran |

18 | Mubadala Investment Company | 138,981 | The UAE |

21 | Emirates Investment Authority | 87,000 | The UAE |

30 | Oman Investment Authority | 46,345 | Oman |

33 | Libyan Investment Authority | 38,800 | Libya |

45 | Mumtalakat Holding | 17,642 | Bahrain |

50 | Sovereign Fund of Egypt | 12,000 | Egypt |

83 | Mohammed VI Investment Fund | 1,600 | Morocco |

92 | Israeli Citizens Fund | 1,010 | Israel |

96. | Palestine Investment Fund | 957 | PA |

(Comments: (i) The Top-100 SWF list has 17 entries from the WANA region; (ii) Of these, AUM of the Top three SWF, viz. ADIA, PIF and KIA are approaching the $1 tn mark; (iii) Some GCC countries have multiple large state or state-linked investors; For instance, Mubadala, MGX, etc (Abu Dhabi), Kingdom Holdings (Saudi Arabia). Further, much of the GCC private capital can eventually be traced to proxies investing on behalf of Royal family members and originates from the hydrocarbon sector. (iv) In most of the GCC states, their SWFs are managed either directly by the royal families or by their confidants. Western asset managers occupy their operational rung. (v) Typically, most of the investments either go to the high visibility western groups or are used domestically. (vi) The list seems to be incomplete as it excludes imported SWF holders such as Japan, the US securities and even the nascent NIIF of India which has assets above the threshold for Top-100.)

Saudi Arabia transferred an 8% stake in Aramco worth roughly $163.6 bn to the country’s Public Investment Fund (PIF) on March 7. The move was intended to boost PIF’s capacity to finance the kingdom’s ambitious economic reform agenda known as Vision 2030. (Comment: This transfer of Aramco stakes to PIF would entitle it to also receive nearly $20 bn annually in oil company’s dividend. With a corpus of nearly $925 bn, PIF is engaged in funding across a huge swathe of sectors ranging from golf to artificial intelligence. Its diffused and episodical focus on massive injection of funds, mostly in Saudi infrastructure, has often led to sub-optimal returns. Further Reading: “Saudi Arabia’s investment fund has been set an impossible task” The Economist, March 14.)

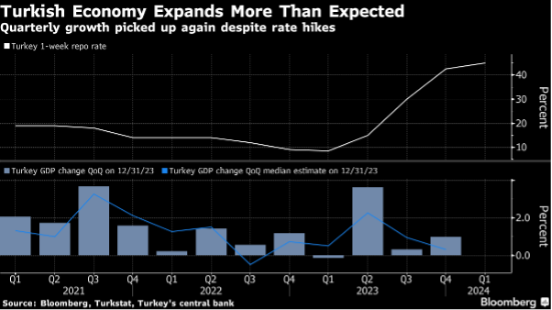

Turkish economy had a mixed performance during the month. Annual inflation climbed further to 70% in February 2024, forcing the central bank to raise the bank rate by 500 points on March 21 to a whopping 50%. On the other hand, the Q/Q GDP growth rate picked up to nearly 1% in Q4/23. Fitch moved the credit rating one notch higher to B+ with a positive outlook, as the government returned to orthodox economic policy thereby reducing financial stability risks and balance-of-payments pressures.

Among the mega-investment bids abroad by the UAE firms during March were a $5 bn real estate development plan for the Hungarian capital Budapest and a takeover of 80% stakes in Zambia’s Lubambe Copper Mine, one of the largest in the country. On March 7, the Dubai Emirate decided to impose a 20% annual tax on foreign banks operating there. Those operating in designated economic zones of Dubai were exempt from this tax.

On March 20, Fitch Ratings upgraded Qatar to AA, its third-highest rating, on the back of revenues expected from its expanded gas fields and the expected decline in its debt-to-GDP ratio. (Comment: The rating upgrade raised some eyebrows as Qatar’s economy is hugely dependent on the export of LNG, a commodity with a sharp fall in price this year to nearly all-time lows. Moreover, Qatar needs a massive boost in spending for creating the new LNG infrastructure before it starts higher export revenues.)

Egyptian economy came out of a long-suspended animation during the month as Cairo finally gave up resisting the IMF’s “pro-reform” conditions for financial assistance. On March 6, the Egyptian pound was floated to the parity of 50 to a US Dollar (losing 38% of its official value) and the bank rate was boosted by 600 bps. On the same day, IMF announced an expanded $8 bn loan facility (from an earlier $3 bn) and the deal was finally executed on March 30. On March 8, Moody’s Ratings raised Egypt’s credit outlook to positive, and the Egyptian stocks resumed a world-beating stock rally in the aftermath. Subsequently, the World Bank announced a bailout package of $6 bn on March 18. The European Union, too, announced a package of assistance worth $8 bn linked to measures being taken to check cross-Mediterranean illegal migration to the EU’s southern shores. All this coupled with an earlier UAE Ras el-Hekma land deal of $35 bn on Feb 23, meant a global injection of over $50 bn into the Egyptian economy during the last 5 weeks. However, the annual inflation came out to be 35.7% in February. (Comment: This huge dollop of funds, nearly a tenth of Egypt’s GDP, seemed differently motivated. While the US and the EU seemed interested in rewarding el-Sisi for a positive role during the Gaza conflict, the Gulf regimes were likely to be motivated by a desire to get Egyptian assets on the cheap, the need to avoid socio-economic dissatisfaction getting out of control and to retain Egypt as a bulwark against Iran. On a different note, through this economic withdrawal, the el-Sisi government did not concede to the IMF pressure to privatise state economic assets, particularly those belonging to the military establishment.)

Kuwait Investment Authority (KIA), the country’s SWF with an AUM of $923 bn had a double-digit growth during 11 months to Feb 2024. More than 50% of the KIA’s investments are in the US, and last year’s surge in the S&P 500 as well as the Nasdaq 100 helped boost returns.

III) Bilateral Developments

- The Advent of Ramadhan and the announcement of the Indian general elections reduced the bilateral political interaction between India and the WANA countries.

- On March 6, Reuters cited a report by the Global Private Capital Association (GPCA) disclosing that India has emerged as a key beneficiary of private investment from the Middle East in the last three years as diplomatic pacts facilitated deals and investors sought to tap into its growing market potential. Accordingly, of the total inflow of $83 bn from the Middle East to Asia since 2020, India accounted for 58% of all investments outpacing China and Southeast Asia.

- Following the death of an Indian and injury to seven others in Galilee due to IDF-Hezbollah shelling on March 5, the Indian embassy in Tel Aviv issued cautioning Indians in Israel about their safety.

- India has expressed deep shock at the loss of lives in Northern Gaza during the delivery of humanitarian assistance. An official statement issued by the Ministry of External Affairs on Mar 1 2024, stated: “We are deeply shocked at the loss of lives in Northern Gaza yesterday during the delivery of humanitarian assistance. Such loss of civilian lives and the larger humanitarian situation in Gaza continue to be a cause for extreme concern. We reiterate our call for safe and timely delivery of humanitarian aid and assistance.”

- On March 16, the Indian navy freed MV Ruen, a ship captured by Somali pirates 17 crew members held hostages were released and 35 Somali pirates were made to surrender and brought back to India on March 23 to face trial. The hijacking of the Malta-registered Ruen last year was the first successful takeover of a vessel by Somali pirates since 2017. It was being used by the pirates as a mother ship to coordinate their activities. Further, on March 30 IN rescued an Iranian fishing vessel rescuing 23 sailors, all Pakistanis, from Somali pirates.

- On March 6, Reuters published details of an interview with Haitham Al Ghais, OPEC’s secretary general concerning crude trade between OPEC countries and India, the world’s third largest consumer and importer. OPEC expects Indian crude demand to more than double by 2045 to 11.7 mbpd. The SG said “OPEC Middle East producers remain ideal suppliers to the Indian market, given their proximity. It is a perfect supplier-consumer fit, and cost-efficient for all parties,” Al Ghais added he sees a greater role for OPEC members in India’s development beyond oil. “We expect levels to rise further in the coming decades as India’s economic development continues,” Al Ghais said, adding that “many” national oil companies from OPEC members plan to invest in India’s refining sector. India plans to expand its refining capacity to 9 mbpd by 2030, from 5.02 mbpd currently. OPEC supplied 54% of India’s imported oil in January, according to industry sources. The month was peppered with reports about a hiatus of supplies of Russian crude to India due to stricter US sanctions and shrinking discounts offered. On March 23, the government allowed UAE’s ADNOC to export oil from its Strategic Petroleum Reserves from India.

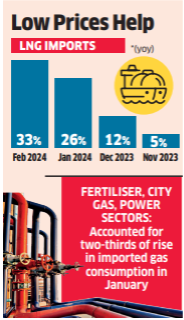

- Natural Gas imports by India surged during FY24, taking advantage of the precipitous decline in its prices. For the first 11 months of this financial year, LNG imports cost $12 bn, lower than $15.9 bn last year, even though volumes were up 18% this year. Domestic consumption was also aided by an 11% year-on-year expansion in local production of gas in February and nearly 6% in the April-February period. LNG is currently available for about $8.5 per mmbtu in the Asian spot market. It averaged $10 in the three months through February, about half of $21 in the year-ago period.

- Larsen and Toubro announced on March 14 that it had won a Rs 5000 crore onshore gas pipeline contract in West Asia.

- On March 21, The UAE-based healthcare provider Aster DM completed its internal process to de-segregate its GCC business from that of India in a bid to leverage faster growth in India.

The previous issues of West Asia & North Africa Digest are available here: LINK