HIGHLIGHTS

- Political Developments

- Economic Developments

- Bilateral Developments

IA) Political Developments: Pan-Regional and Global Issues

Pakistan and WANA Region:

- Islamabad continues to press Gulf monarchies to bail her out of the acute balance of payment crisis that has left the country with forex reserves barely enough for a month’s imports. It had partial success. During an official visit to Doha on Aug 24, Prime Minister Shehbaz Sharif met Emir Tamim bin Hamad Al-Thani and was promised that Qatar Investment Authority aspired “to invest $3 billion in various commercial and investment sectors” in Pakistan. No other details were provided. The next day, Aug 25, Saudi Arabia cryptically declared that it planned to invest $1 billion in Pakistan. Earlier, Pakistani paper the Express Tribune newspaper reported on Aug 6 that Army chief General Qamar Javed Bajwa had reached out to Saudi Arabia and the UAE as part of his efforts to ensure financial assistance which yielded the UAE’s decision to invest $1 bn in Pakistan. PM Sharif called up the UAE President Sheikh Mohammed bin Zayed on Aug 9 to thank him for this gesture. During the second half of the month, several Gulf leaders expressed solidarity with the flood victims in Pakistan.

- UAE President Sheikh Mohammed bin Zayed received Gen Bajwa in Abu Dhabi on Aug 16 and decorated him with the “Order of the Union”, the country’s second highest award “in recognition of his distinguished efforts in strengthening UAE-Pakistan ties and his role in consolidating bilateral cooperation between the two countries.” (Comment: The anodyne press release issued after this significant visit by Pakistani COAS and his meeting with MbZ raised more questions than answers about its real purpose.)

- On Aug 12, the trade ministers of Pakistan and Turkey signed a trade facilitation agreement in Islamabad.

WANA and Ukraine Conflict:

- During a visit to Moscow on Aug 31, Iranian Foreign Minister Hossein Amirabdollahian disclosed that he had handed over to his Russian counterpart a proposal on the Ukraine conflict by an unnamed European leader to Iran’s President Ebrahim Raisi. He provided no details.

- The first ship laden with Ukrainian grain, under the agreement facilitated by the UN and Turkey last month, reached Istanbul on Aug 2.

- The official US sources continued to maintain that Iran had supplied Russia with a large number of military drones and had trained Russian officers to use them. On Aug 29 Reuters quoted an unnamed senior US official as claiming that Russia had faced “numerous failures” with recently acquired Iranian-made drones for use in its war with Ukraine.

- More than 31,000 people from Ukraine and Russia emigrated to Israel since the beginning of the conflict on Feb 24, a 318% increase from the similar period in 2019. Most of the immigrants from Russia and Ukraine are Jews, but some may only have close relatives who are Jewish. Under Israel’s Law of Return, a person needs at least one Jewish grandparent to be entitled to immediate citizenship.

WANA and Afghanistan:

- Hundreds of Afghans stranded in the United Arab Emirates (UAE) since being evacuated from their country in the wake of the August 2021 Taliban takeover held protests on Aug 24, demanding faster and more transparent resettlement.

Pandemics and Other Natural Disasters:

- On Aug 16 Iran identified its first case of monkeypox in Ahvaz province.

- The UN sources disclosed on Aug 18 that torrential rain and floods in Sudan had killed 77 and destroyed 14,500 homes.

- Algerian government stated on Aug 18 that since the start of the month, 106 fires have broken out in the country, destroying more than 2,500 hectares (6,178 acres) of woodland and causing 37 deaths.

Regional Security and Extremism:

- On Aug 2 the U.S. State Department approved the potential sale of Terminal High Altitude Area Defense (THAAD) missile interceptors to the United Arab Emirates and Patriot missile interceptors to Saudi Arabia in separate deals estimated to be worth $2.25 bn and $3.05 bn respectively. These deals have to be approved by the US Congress before being delivered. (Comment: The US decision was an apparent follow up of President Biden’s visit to the region last month and indicated lifting of the American reluctance to supply weapon systems to the two countries, which had caused considerable heartburning among the recipients.)

- Controversial author Salman Rushdie was stabbed in the US on Aug 12 by a Shia attacker of Lebanese extraction. While the incident received considerable coverage in WANA, there was a deafening silence in condemnation of the crime. The only exception was some radicle voices in Iran which praised the attacker. In a belated official response on Aug 15, the Iranian foreign ministry rejected accusations against Iran for the attack. It added that instead, the blame lay with Rushdie and his supporters for denigrating the world’s Muslims.

- In a rare positive development on regional security on Aug 23, the global shipping industry agreed to declassify the Indian Ocean coastline off Somalia as a “high-risk area” following years of successful counter-piracy operations. It stated that no piracy attacks against merchant ships have occurred off Somalia since 2018. The declassification would be effective from the beginning of 2023.

- On Aug 14, a Palestinian gunman wounded at least eight people aboard a bus carrying Jewish worshippers in the Old City of Jerusalem. He later surrendered to Israeli security.

- On Aug 12, a Saudi terrorist suspect blew himself up in Jeddah injuring three security men and a Pakistani national.

- Qatar was busy harnessing security experts and personnel for the forthcoming FIFA World Cup. The media reports spoke of the possible deployment from Pakistan, Turkey and South Korea.

IB) Political Developments

Iran:

Although the suspended animation in indirect talks for the revival of the JCPOA was lifted early in the month, a deal could not be reached by the end of the month. On Aug 4 the EU mediated talks resumed in Geneva to iron out the differences between the US and Iran. The EU presented Iran with a “Final Text” of the document on Aug 8 and sought comments while urging Tehran not to make unrealistic demands. Iran responded to the EU text on Aug 15. In a terse statement on the same day, the US State Department emphasised that the only way to revive the 2015 Iran nuclear deal is for Tehran to abandon its extraneous demands, adding that Washington believed everything that can be negotiated had already been undertaken. On Aug 21, President Biden held virtual consultations with leaders of the UK, France and Germany regarding Iran’s response. On Aug 23, the US response was conveyed to Iran which two days later said that it was carefully reviewing the matter. There was a noticeable hardening of the positions towards the end of the month. President Raisi demanded on Aug 29 that the IAEA must conclude its pending enquiries before a deal can be reached and should not make “excessive demands.” On Aug 31, Iran sought stronger US guarantees that it would not abandon JCPOA again – a demand that Washington has already rejected. On its part, President Biden told Israeli PM Lapid on Aug 31 that the US would never allow Iran to have nuclear weapons.” A visit by Iranian Foreign minister Hossein Amirabdollahian to Moscow on Aug 31 and Tehran visit by a senior Qatari diplomat on Aug 28 seemed both linked to the JCPOA negotiations. (Comment: The last-ditch attempt by the EU negotiators to push the nuclear deal seems to ignite a brief spark of optimism. At the same time, it revealed that the positions on issues such as the US guarantees and pending IAEA investigations into radioactive traces at three undeclared sites were unreconciled. On balance, Iran would have to contemplate if it can make any more concessions, or if the time is on its side as it approaches the “nuclear breakout point.” On other hand, the incumbents in both the US and Israel face an uphill electoral battle in November which may predicate them making haste slowly on this hot-button electoral issue. Further Reading: “Stakes are High for India if Iran, US Sign Nuclear Pact” by Mahesh Sachdev, Hindustan Times, Aug 27; and “Never-ending nuclear talks with Iran are bordering on the absurd” The Economist Sep 8.

On Aug 1, the US imposed sanctions on 6 companies (4 in Hong Kong, 1 each in Singapore and the UAE) for helping to sell tens of millions of dollars in Iranian oil and petrochemical products.

On Aug 9, Russia launched an Iranian remote sensing satellite titled “Omar Khayyam.”

On Aug 24, the Iranian ambassador to Kuwait told al-Rai newspaper that the sixth round of talks between Saudi Arabia and Iran in Baghdad was delayed due to unsettled conditions in Iraq and would take place when the conditions are right.

On Aug 30, the US Navy claimed to have foiled the Iranian attempt to capture its unmanned sea drone in the Gulf international waters.

Turkey:

President Recep Tayyip Erdogan travelled to Sochi on Aug 5 for a summit with Russian President Vladimir Putin. (Comment: Despite nuanced positions on several issues of regional volatility, esp. with Ukraine and Syria, the two nationalist leaders have maintained a semblance of normalcy in their bilateral ties and deftly avoided getting into each other’s ways. On his part, President Erdogan, facing an uphill election next year, is keen to square off his domestic economic travails against the foreign policy gains.)

There was a perceptible softening of Turkey’s hitherto staunch opposition to any talks with the Syrian government. Thus on Aug 11, the Turkish foreign minister called for a reconciliation between the opposition and the al-Assad government. On Aug 19, President Erdogan went even further, saying that he did not rule out talks with Syria. On Aug 23, the Turkish foreign minister added that there were no preconditions for talks with Syria. These shifts sent a chill down the spines of anti-regime Sunni militants in the Idlib exclusion zone who have so far had a symbiotic relationship with Turkey. (Comment: Ankara’s change of heart on the Syrian conflict could be based on several factors: The need to send Syrian refugees, numbering over 3.5 mn, back before elections next year as they are unpopular with Turks and a drain on the weak national economy; acceptance of the fait accompli of Bashar al-Assad’s preponderance over most of Syria; the need for his help in containing YPG/SDF Kurdish militancy on the bilateral border without a costly military engagement; and possible gains from Syrian infrastructure reconstruction contracts. The summit with Putin could have nudged Erdogan into this shift.)

On Aug 17, Turkey and Israel decided to raise their bilateral diplomatic relations to ambassador level after four-year-long hiatus.

Turkish officials met with their Finnish and Swedish counterparts in Helsinki on Aug 26 to carry forward the Madrid MoU on the repatriation of some anti-regime persons living in these two countries.

Turkish forces were involved in fighting with Kurdish militias in Syria and Iraq during the month. Three Syrian troops were also killed in a skirmish with YPG/SDF fighters on Aug 16. Turkey claimed to have killed 9 PKK fighters in northern Iraq on Aug 26.

The UAE:

On Aug 21 the UAE said that its ambassador to Iran would return to Tehran “in coming days”, upgrading the bilateral diplomatic ties after more than six years.

On Aug 26 three former U.S. intelligence operatives who illegally worked as cyber spies for the UAE and admitted to hacking American networks reached a deal with the US State Department temporarily barring them from any arms export activities.

Against the backdrop of US House Speaker Nancy Pelosi’s Taiwan visit, a statement issued on Aug 4, the UAE Foreign Ministry said the following: “The UAE affirmed its support for China’s sovereignty and territorial integrity, as well as the importance of respecting the “One China” principle while calling for adherence to relevant UN resolutions. The UAE indicated its concern over the impact of any provocative visits on stability and international peace. The Ministry urged prioritizing diplomatic dialogue to ensure regional and international stability.” (Comment: While checking all boxes that Beijing looks for, the statement carefully avoided mentioning either the US or Nancy Pelosi’s visit to the Republic of China.)

Following the Emirates Cricket Board’s confirmation that the inaugural International League T20 (ILT20) League will be played between January 6 to February 12, 2023, the participants, including the RIL-sponsored Mumbai Indians began enlisting their players in August. The six-team franchise-style league will be played over a 34-match schedule in the UAE.

Israel

On Aug 1, Israeli forces in West Bank arrested Bassam al-Saadi, a senior militant of Gaza-based Palestinian Islamic Jihad (PIJ), which threatened retaliation. Citing this imminent threat, Israeli authorities closed the Gaza border on Aug 4 and launched air and rocket strikes on Gaza the next day that lasted 56 hours. PIJ launched over 400 rockets on Israel some of them reaching the outskirts of the capital Jerusalem, but 97% of them were claimed to be intercepted by the Iron Dome. Egyptian intervention yielded a ceasefire late on Aug 7, but not before 44 Palestinians had been killed and many more injured and property destroyed. The border crossings were reopened on Aug 8. Israel did not declare any losses. Bassam al-Saadi was indicted by an Israeli court on Aug 25 (Comment: This was the fourth clash between Israeli forces and Gaza-based militants since the Israeli withdrawal from the territory in 2005. It was noteworthy on two accounts. Firstly, Hamas, the leading Gaza militant organisation which is allied to PIJ, did not join the battle. Secondly, the political situation on both sides seems to be hardening. Israel has a caretaker government in the run-up to Nov 1 general election which may be trying to gain some popularity by acting muscular. On Palestinian Authority (PA) side, old divisions between al-Fateh on West Bank and Hamas-PIJ in Gaza are being upstaged as 88-year-old President Mahmoud Abbas cedes control. Hamas and PIJ are both trying to gain popularity at al-Fateh’s expense with West Bank’s frustrated youth. Thus, both Israel and al-Fatah which have long had a modus vivendi do not want Gaza-based militant groups to expand their turf to the West Bank. This also explains the reason for frequent forays by the Israeli forces into the militancy hotspots such as Jenin on the West Bank.)

As the EU’s final text on JCPOA was bandied around between Iran and the US this month, the Israeli government intensified its lobbying against it. Prime Minister Yair Lapid spoke with leaders of France and Germany against the Iran nuclear deal. On Aug 24, he said that the deal would hand over $100 bn to Tehran to destabilise the region.

The CEO of NSO, the Israeli company that created Pegasus cyber snooping software, resigned on Aug 21.

Iraq:

The long-simmering Inter-Shia political dispute reached a flashpoint on Aug 29-30 when armed clashes between Saraya Salam militia loyal to Imam Muqtada al-Sadr and Hashd al-Sha’abi militia belonging to Coordination Network (CN) resulted in at least 30 deaths in the Green Zone of Baghdad. The violence ceased only when al-Sadr asked his followers to leave the Green Zone “to avoid spilling Iraqi blood.” The showdown was preceded by incremental escalation from the beginning of the month when al-Sadr’s followers occupied the parliament building to prevent a CN-led coalition from forming the government. They withdrew after 4 days on Aug 3. A week later, al-Sadr asked the Iraqi Supreme Court to dissolve the parliament and order fresh elections – which the Court declined on Aug 14 citing a lack of authority in this legislative matter. Meanwhile, on Aug 12 the rival CN organised their demonstration. The deadly clashes on Aug 30 led to global consequences: the oil prices became volatile for while (Iraq being OPEC’s second-largest producer with a quota of 4.5 mbpd of which 3.4 mbpd is exported); the prices settled down after the oil production remained unaffected by the Green Zone violence. Iran announced the closure of its land border with Iraq and several airlines cancelled flights to Baghdad. On Aug 31, Iraqi Prime Minister Mustafa al-Kadhimi threatened his resignation, in case the violence was to reoccur. On Aug 31, US President Biden spoke with the Iraqi PM to discuss the situation in Iraq. On the same day, Inter-Shia clashes erupted in the southern Iraqi city of Basrah leading to 4 deaths. (Further Reading: (i) “Why India should not avert its eyes from Iraq” by Mahesh Sachdev, Hindustan Times, Sep 09; (ii)“Iraq’s political deadlock turns violent” The Economist 3/9/22.

Syria:

On Aug 10, US President Joe Biden issued a statement calling on Damascus to help repatriate Justin Tice, an American journalist and ex-marine who disappeared in Syria a decade ago. He claimed that he knew “with certainty that Tice had been held by the Syrian regime.” In a sharply worded response on Aug 17, Syrian Foreign Ministry Syria’s foreign ministry issued a statement that denied Biden’s accusation, describing it as a “baseless allegation.” It further denied that it had “kidnapped or forcibly disappeared any American citizen who entered its territory or resided in areas under its authority.” (Comment: While the US remained ostensibly opposed to any normalization with Syria, the Presidential statement seem to indicate a degree of flexibility as the civil war in the country winds down with Bashar al-Assad government prevalent.)

On Aug 23, the US forces conducted military strikes on multiple facilities of pro-Iran fighters in Syria. Their retaliation triggered an exchange of shelling for the next two days. An unconfirmed report indicated that the fighters belonged to the “Fatimiyun” group of Shia Afghans deployed by Iran in Syria. (Comment: Most of the 900 US troops in Syria are deployed in the strategic and oil-rich Deir al-Zor district bordering Turkey and Iraq and divided by the Euphrates river. Iranian forces and their allies use this area as a land corridor to Iran to bring their men and supplies. Moreover, it is also an area dominated by the Kurds forces, many of their pro-US militias such as the SDF have been instrumental in defeating Daesh. The US also has some troops deployed at Tunf on trijunction of Iraq, Jordan and Syria.)

On Aug 31, Israel attacked Aleppo airport with rockets damaging its infrastructure. (Comment: With Iraq’s domestic situation disturbed, the supplies for Iranian and pro-Iranian forces in Syria are increasingly reliant on air logistics. This has made Israeli attacks on the country’s two major airports in Damascus and Aleppo more frequent. These attacks try to disrupt the runways for extended periods.)

On Aug 19, 14 persons were killed in the shelling of a marketplace in the al-Bab area in northwest Syria controlled by pro-Turkish forces.

Sudan:

The unsettled political situation under a military-led regime continues to provoke popular unrest. On Aug 14, the military leader Gen Abdel Fattah al-Burhan inaugurated a conference in Khartoum in support of the initiative, known as “The Call of Sudan’s People” aimed at ending Sudan’s political crisis through a participative transition to the elections. The initiative has gained the support of Egypt, Saudi Arabia and the African Union, whose diplomats attended a conference on Saturday. The mainstream opposition has, however, remained unrelenting in their demand for the military’s immediate handover of power to civilians. In renewed demonstrations on Aug 31, one protestor was killed.

The first resident US ambassador arrived in Sudan on Aug 24, signaling full normalisation of bilateral relations after a hiatus lasting 25 years.

Palestine:

On Aug 15, the fiftieth anniversary of the killing of Israeli sportspersons at the Munich Olympics, President Mahmoud Abbas accused Israel of committing “fifty holocausts on the Palestinian people.” The statement was condemned by both Israel and Germany. (Further Reading: “The ageing, ailing Palestinian leader does not do much governing” The Economist, Aug 23.

Kuwait:

On Aug 2 Kuwaiti Crown Prince Sheikh Meshal al-Ahmad al-Sabah issued a decree formally dissolving parliament in a decree. Only on the previous day, he had approved a cabinet headed by a new prime minister, Emir’s son Sheikh Ahmad Nawaf al-Sabah. Subsequently, on Aug 28, the elections for the new parliament were set for September 29. The dissolution of the parliament left the country without the passage of a national budget for 2022. (Further Reading: “The world’s oldest crown prince nears the throne of Kuwait” The Economist, Aug 27.

On Aug 13, the first Kuwaiti ambassador in six years presented copies of his credentials to the Iranian foreign ministers. The ambassador was withdrawn in Jan 2016 following the sacking of the Saudi embassy in Tehran by the Iranian demonstrators protesting against the Kingdom’s execution of a Saudi Shia cleric.

Algeria:

French President Emmanuel Macron paid a three-day visit to Algeria on Aug 25-27 aimed at normalising the relations with the former French colony which have simultaneously been extensive and acerbic and have passed through a rough patch in recent months. He signed with his Algerian counterpart Abdelmadjid Tebboune a Joint Declaration state with a typical Gallic flourish said “France and Algeria have decided to open a new era … laying the foundation for a renewed partnership expressed through a concrete and constructive approach, focused on future projects and youth.” (Comment: Apart from mending official ties and engaging in PR and soft-power diplomacy, Macron’s visit had at least two hard-nosed objectives: persuading Algeria to increase its supplies of natural gas to France struggling to cope with uncertain supplies from Russia and hoping to gain popularity among nearly 4 mn ethnic Algerians living in France to stem a decline in his popularity.)

Yemen:

On Aug 2, the two sides in the civil war, the internationally recognised Yemeni government and al-Houthi militia agreed to extend their UN-facilitated ceasefire by two months. However, on Aug 8, the government Foreign Minister demanded that the al-Houthi militia permit road access to the besieged city of Taiz as agreed to in terms of the ceasefire.

On Aug 20, the UAE supported the Giants Brigade (Liwa al-Aumlaqa) militarily evicting al-Islah party allied militia from the oil-rich district of Shabwa in central Yemen. They followed it up by launching an operation against terrorist bases in neighbouring Abayan province. On Aug 23, Rashad al-Alimi, head of Yemen’s Presidential Leadership Council (PLC) “ordered” the UAE-backed separatists, formally called Southern Transitional Council (STC) to stop military operations in the country’s south. (Comment: The UAE has pursued a more nuanced agenda in Yemen as compared to Saudi Arabia. It has strongly supported Yemeni outfits, such as the Southern Transitional Council (STC) and the Giants Brigade, working for the restoration of an independent south Yemen and for the purging of political Islam in that area. While both STC and Islah Islamist Party (supported by Saudi Arabia) are nominally members of the PLC, their intrinsic contradictions keep them at each other’s throats and their sponsors on the edge.)

Egypt:

In a cabinet reshuffle on Aug 14, President al-Sisi sworn in 13 new ministers

A church fire in Giza on the outskirts of Cairo on Aug 14 killed 41 people.

On Aug 23, Egypt signed a G2G deal with Russia to import 240,000 tons of wheat.

Saudi Arabia:

President of Uzbekistan Shavkat Mirziyoyev began a state visit to Saudi Arabia on Aug 17 which led to the signing of 10 agreements involving Saudi investment of SR45 bn in the Central Asian country.

Lebanon:

On Aug 31 Lebanese President Michel Aoun returned the amended bank secrecy bill to the parliament asking for reconsideration to tighten the document’s provisions. (Comment: The passage of the bill is a crucial pre-condition for the IMF bailout the country’s economy desperately needs.)

On Aug 29, the Lebanese had a piece of rare good news when its national team qualified for the Basketball World Cup by defeating India 95-63 in Bengaluru.

Libya:

On Aug 27 armed clashes in the capital Tripoli between the militias loyal to the two rival prime ministers resulted in the death of 12 and injury to 87.

Morocco:

Rabat recalled its ambassador from Tunis over an invitation to the Sahraoui Democratic Arab Republic (SADR) for the eighth Tokyo International Conference on African Development (TICAD8). Tunisia also took the reciprocal measure. The conference concluded with a virtual address by the Japanese PM committing $30 bn during the next three years as development assistance to Africa.

II) Economic Developments

Oil & Gas Related Developments:

- Oil prices fell by 13% during August ending the month with Brent for Oct delivery at $95.89/barrel. Bloomberg declared on that day that the oil price was headed for its longest slump since 2020. Moody’s Analytics forecast on Aug 15 that the oil price could drop to $70/b by the 2024 end. Among the factors depressing the oil price were the prospects of lower economic growth in China and some of the OECD countries, continued lockdowns in China, Iran’s return to the oil market, the Ukraine war forcing a drastic shift to renewables in EU countries and steady rise in global oil production, etc.

- In an unusually sharp criticism, the UN Secretary-General on Aug 3 slammed the “grotesque greed” of the oil and gas companies and their financial backers and urged governments globally to “tax these excessive profits” to support the most vulnerable people. Relevant to note that Exxon Mobil Corp, Chevron Corp, Royal Dutch Shell and TotalEnergies combined earned nearly $51 bn in Q2/22, almost double the corresponding figure in the year before. BP’s Q2 profit also jumped to a 14-year high of $8.45 bn. On Aug 14, Saudi Aramco, the world’s largest listed company, reported its highest quarterly profit since the company went public in 2019, boosted by higher oil prices and refining margins. Net profit for Q2/22 was $48.39 bn, up 90% from a year earlier. It declared a Q2 dividend of $18.8 bn, in line with its target. Aramco’s average total hydrocarbon production was 13.6 mbpd of oil equivalent in Q2 and the capital expenditure increased by 25% to $9.4 bn.

- In their ministerial meeting on Aug 3, the OPEC+ group decided to raise their output target by 100,000 b/d for September. The move was based on their Joint Technical Committee’s report projecting a slightly smaller surplus this year. It trimmed its forecast for a surplus in the oil market this year by 200,000 bpd to 800,000 bpd. However, Reuters quoted unnamed experts as saying that the group underproduced its collective production target in July by 2.9 mbpd. (Comment: This being the first producers’ meeting since President Biden’s visit to Saudi Arabia, Riyadh felt the political need to raise the collective production limit a tad bit. Some other oil-watchers believed that Saudi Arabia and the UAE were saving their oil firepower to tackle any winter supply crisis.)

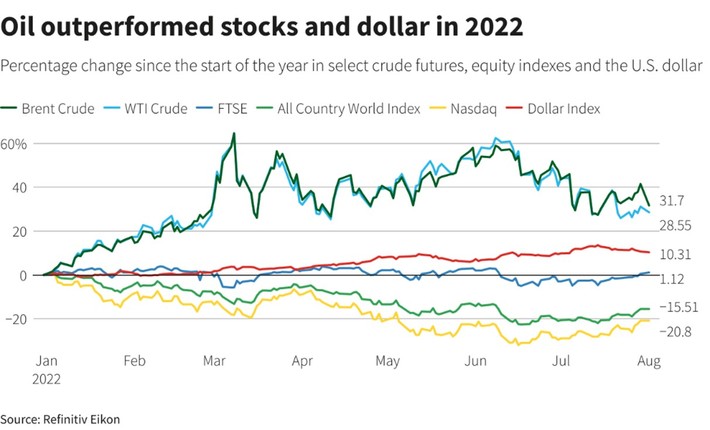

- In a report on Aug 1, Reuters pointed out that so far during 2022, despite their recent fall the two major crude futures contract indices (Brent and WTI), have outperformed global stocks and the US Dollar. The oil indices were up about 30% so far this year, while the All Country World Index (ACWI) was down about 15% and the U.S. dollar index measuring the value of the greenback against a basket of other major currencies was up by about 10%. The Graphic below has details:

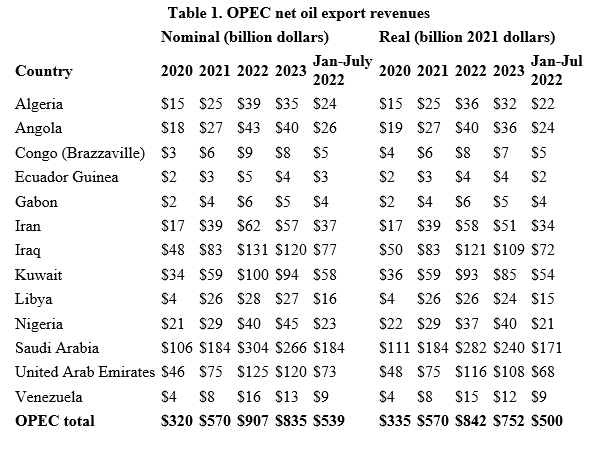

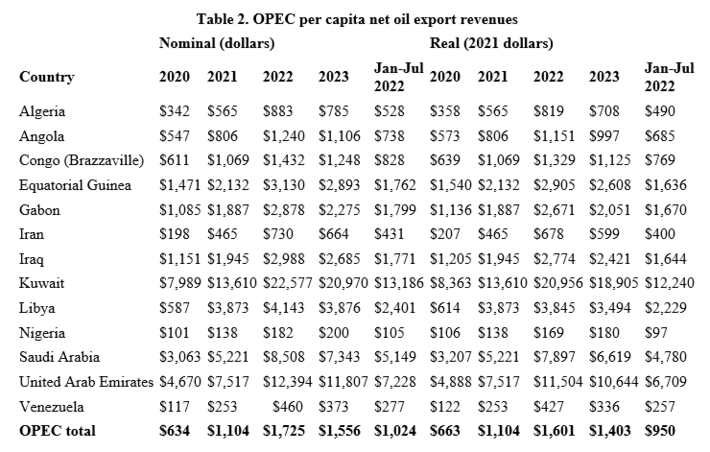

- On Aug 21, the US Energy Information Administration published its Short-Term Energy Outlook (STEO). It predicted that OPEC’s total liquids production will average 34.0 million b/d in 2022 and will further increase to 34.5 million b/d in 2023 as compared to 31.7 mbpd in 2021. It summarised the oil revenues and revenue per capita of the 13 OPEC member states in the following two tables:

- On Aug 11, both OPEC and the IEA released their respective and contrasting assessment of the global oil demand. The OPEC monthly bulletin lowered the demand increase to 3.1 mbpd (up 3.2%), citing factors such as the economic impact of Russia’s invasion of Ukraine, high inflation and the efforts to contain the coronavirus pandemic. IEA, on other hand, raised its forecast by 380,000 bpd to 2.1 mbpd citing a record surge in natural gas and electricity prices, incentivising gas-to-oil switching in some countries. The issue received a new lease of life in the last week of August with the Saudi oil minister saying that OPEC was ready to cut output to curb volatility and disconnect of the market with the situation on the ground.

- A steep rise in natural gas prices prompted several marginal producers in the WANA region to devise ways to boost their production and exports of this valuable commodity. Thus, the UAE’s ADNOC awarded in early August $2 bn worth of drilling contracts to develop the Hail and Ghasha sour gas projects as part of its push to achieve gas self-sufficiency, and after that to look to export the surplus. Egypt, too, decided on Aug 11 to ration power supply, to save natural gas for exports to take advantage of a 10-fold differential between prices at home and abroad. The scrimmage for natural gas also prompted Lebanon’s Hezbollah chief to reiterate his warning to escalate the matter if Israel usurps Lebanese rights to offshore gas in the Krish gas field in the eastern Mediterranean sea. (Further Reading: “Mediterranean gas sends sparks flying between Lebanon and Israel” The Economist, Aug 21.

- On Aug 12, PetroChina was reported to have threatened to pull up stakes in the southern Iraqi governorate of Maysan after another round of protests outside the oil company’s headquarters demanding improved services and infrastructure.

Following economy-related developments took place in WANA countries:

- Turkey’s economic performance continued to churn out extreme headlines. The annual inflation rate, which was 79.6% in July climbed to 80.21% in August 2022, a 24-year high. Despite this, on Aug 18, the country’s central bank decided to cut the main interest rate by 100 bps to 13%. This pushed its real interest rate (Inflation – bank rate) to minus 67%, among the lowest in the world. However, there were positive economic developments too: On Aug 31, the Turkish Statistical Institute declared that the national GDP had grown in Q2/22 at 7.6% y/y as compared to 7.3% in the previous quarter. The central bank’s foreign reserves – badly depleted from nine months of supporting the lira – nearly tripled since early July to $15.7 bn on a net basis. The inflows of some $5 bn from Russia as well as various currency swap arrangements with friendly countries have enabled Turkey to overcome the forex crisis. The number of foreign tourists in July was up over 50% y/y, exceeding the pre-covid number, buoyed by devalued Lira which lost 44% in 2021 and an increase in Russian tourists who were denied access to much of the West. The commercial banks’ profits surged 400% in H1 y/y. On Aug 12, Moody’s lowered Turkey’s sovereign credit rating by one notch to “B3”, citing rising balance of payment pressures and risks of further declines in its forex reserves.

- IMF projected that Saudi Arabia’s economy would grow by 7.6% in 2022, one of the fastest growth rates in the world, helped by strong oil demand and 4.2% expected growth in the kingdom’s non-oil sector. In 2023, IMF expected the real GDP to expand by 3.7% and non-oil GDP to grow by 3.8%. The kingdom is likely to have a fiscal surplus of 5.5% of GDP this year, it’s first since 2013, equivalent to around $56.21 bn. Saudi Arabia recorded a budget surplus of nearly $21 bn in Q2/22, an almost 50% rise from a year earlier. Revenue in Q2 was SR 370.37 bn, over two-thirds of which came from oil revenue which surged by 89% y/y. On Aug 2, the Saudi cabinet decided to set up the Saudi Investment Promotion Agency (SIPA). On Aug 10, the Saudi Egyptian Investment Co (SEIC), owned by Saudi Public Investment Fund, bought minority stakes in four Egyptian companies for $1.3 bn. On Aug 29, a Saudi company Alfanar signed a memorandum of understanding to build a $3.5 bn green hydrogen project in Egypt. (Further Reading: IMF Document: Saudi Arabia: 2022 Article IV Consultation-Press Release; and Staff Report.

- The UAE’s non-oil trade hit 1.058 tn dirhams ($288 bn) in H1/22, up 17% from a year earlier. The non-oil trade for half-year topped 1 trillion dirhams for the first time. Interestingly, only Dh180 bn (17%) of the non-oil trade were UAE exports, Dh580 (55%) were imports and nearly Dh300 bn (28%) were re-exports. The CEO of $167 investment conglomerate International Holding Co said in an interview on Aug 10 that he expected to increase its takeover activity, including in India and Turkey, as global market turbulence has created “a buyers’ market.” Its high-profile recent deals include a Dh7.3 bn investment in three of India’s Gautam Adani companies in May this year. Around $19.8 bn worth of diamonds have been traded through the UAE in the first half of 2022, the Dubai Multi Commodities Centre (DMCC) said on Aug 29, a 24.7% increase year-on-year. DMCC has been leveraging its proximity to Africa and Russia, where many diamonds are mined, and India, where 90% of the world’s diamonds are polished. Although DP World made a record profit of record $721 m during H1/22, boosted by elevated shipping rates, it, however, cautioned that its profits, revenue and container growth rates are likely to moderate in the rest of the year.

- Inflation in July registered at 13.6% in Egypt and 5.2% in Israel. On Aug 22, the Bank of Israel raised its bank rate by 75 bps, the biggest rise in 20 years, to curb inflation. On Aug 10, Kuwait’s Central Bank also raised its interest rate by 25 bps.

- The Governor of Egypt’s Central Bank resigned on Aug 17 without any reasons being assigned.

- On Aug 9, Iran claimed to have made its first import order worth $10 mn using cryptocurrency, a move that could enable Tehran to circumvent the U.S. financial sanctions that have crippled the economy. In 2021, 4.5% of global bitcoin mining reportedly took place in Iran, partly leveraging cheap electricity.

- On Aug 31, QatarEnergy announced that it would build the world’s largest “blue” ammonia plant, with an outlay of $1.06 bn to produce 1.2 MT/y. It is expected to come online in Q1/2026.

- On Aug 21, Iraq’s foreign exchange reserves crossed the $80 bn mark.

III) Bilateral Developments

- Indian Minister of Ports, Shipping & Waterways Shri Sarbananda Sonowal paid a 4-day official visit to Iran and the UAE from August 18. Shri Sonowal visited the Shahid Beheshti Port of Chabahar in southeastern Iran and UAE including Jebel Ali Port. The minister handed over six mobile harbour cranes to the Indian Ports Global Chabahar Free Trade Zone (IPGCFTZ), a special purpose vehicle formed for this project of “national importance.” He later travelled to Tehran for meetings with Mohammad Mokhber, Iranian Vice President and Rostam Ghasemi his counterpart. A Memorandum of Understanding on mutual recognition of Certificates of the Seafarers was also signed. During the day’s tour of the UAE, Shri Sonowal visited Jabel Jabel Ali Port, had bilateral meetings and conferred with some investors. (Comment: The Chahbahar port project was initially conceived to overcome the logistical obstacles caused by Pakistan in India’s trade with Afghanistan and the Central Asian countries. However, a Taleban takeover of Afghanistan upended that objective. Lately, the Ukraine war has provided a new foil to the project as a trans-shipment point for goods from Russia to India and beyond. Moreover, the prospect of lifting the economic sanctions on Iran has also added to its potential value.)

- On August 5, the third anniversary of the abrogation of article 370 in Jammu and Kashmir, the General Secretariat of the Organisation of Islamic Countries issued the following statement:

- OIC General Secretariat reiterates the call for the implementation of United Nations Security Council resolutions on Jammu and Kashmir August 5, 2022 marks the third anniversary of the illegal and unilateral actions taken in the Indian Illegally Occupied Jammu and Kashmir, which were followed by additional unlawful measures including illegal demographic changes. Such illegal actions can neither alter the disputed status of Jammu and Kashmir nor prejudice the legitimate right to self-determination of the Kashmiri people. Recalling the resolutions of the Islamic Summit and Council of Foreign Ministers on Jammu and Kashmir, the General Secretariat reaffirms the OIC’s solidarity with the Kashmiri people in the realization of their inalienable right to self-determination. It calls for the respect of their fundamental freedoms and basic human rights and for the reversal of all illegal and unilateral measures taken on or after 5 August 2019. The General Secretariat reiterates its call on the international community to take concrete steps for the resolution of the Jammu and Kashmir dispute in accordance with the relevant UN Security Council resolutions. OIC General Secretariat reiterates the call for the implementation of United Nations Security Council resolutions on Jammu and Kashmir Date: 05/08/2022.

- In response on the same day, the Indian Ministry of External Affairs issued the following Press Release: Official Spokesperson’s response to media queries regarding OIC General Secretariat’s Press Release on Jammu & Kashmir In response to media queries regarding OIC General Secretariat’s Press Release on Jammu & Kashmir, the Official Spokesperson, Shri Arindam Bagchi said: “The statement issued by the General Secretariat of the Organization of Islamic Cooperation (OIC) on Jammu and Kashmir today reeks of bigotry. The Union Territory of Jammu and Kashmir is and will remain an integral and inalienable part of India. As a result of long-awaited changes three years ago, it today reaps the benefits of socio-economic growth and development. The OIC General Secretariat, however, continues to issue statements on Jammu and Kashmir at the behest of a serial violator of human rights and notorious promoter of cross-border, regional and international terrorism. Such statements only expose the OIC as an organization devoted to a communal agenda being pursued through terrorism.” New Delhi August 05, 2022.

- Thanks to higher oil prices and larger quantities of crude imported by India, India’s trade deficit with several WANA oil exporters surged sharply during Q2/22. This made Iraq, Saudi Arabia and the UAE as India’s 2nd, 3rd and 5th largest sources of trade deficit during the period.

- According to Vortexa, India’s overall crude oil imports fell to 4,049,167 bpd in August, 13% lower than in July and 15% lower than in June. Saudi Arabia had a 20.8% market share in India in August, followed by Iraq (20.6%) and Russia (18.2%). Thus, Saudi Arabia overtook both Iraq and Russia during the month to emerge as India’s top supplier, a position Iraq had occupied for over a year. In particular, supplies from Russia shrank in August to 738,024 bpd 18% lower than in July and 24.5% less than in June.

- Al-Najaf IV, joint military exercises between India and Omani armed forces concluded on Aug 13.

- According to Equidem, a London-based labour rights campaigner, Qatari authorities deported an unspecified number of workers from India, Nepal, Bangladesh, Egypt and the Philippines for causing public disorder while protesting on Aug 14 against the non-payment of their salaries for up to seven months by a private contractor.

- On Aug 25 Indian cooperative Krishak Bharati Cooperative (KRIBHCO) signed a long-term deal to import one million tonnes of phosphatic fertilisers from Saudi Arabia. KRIBHCO will also invest in the new phosphate project of Saudi miner, Ma’aden.

- On Aug 31, Ashok Leyland, the flagship brand of the Hinduja Group, won orders for 1,400 school buses in the UAE. It is the only manufacturer of commercial vehicles in the UAE with a plant in Raas al-Khaimah.

The previous issues of West Asia & North Africa Digest are available here: LINK

………………………………………………………………………………………………

(The views expressed are personal)

………………………………………………………………………………………………