IA) Political Developments: Pan-Regional and Global Issues

Regional and

International Developments

- The

flux and fog about the United States (US) mediated rapprochement between

Israel and Saudi Arabia persisted during the month with the stakeholders

making periodic remarks swinging between the difficulties and early

conclusion of the process. Thus, Reuters reported in an exclusive on Sept

29 that Saudi Arabia is determined to secure a military pact requiring the

US to defend it in return for opening ties with Israel and will not hold

up a deal even if Israel does not offer major concessions to Palestinians

in their bid for statehood. There was no comment on this report from the

three sides. US President Joe Biden and Israeli PM Benyamin Netanyahu met

on Sept 20 on the sidelines of the UNGA session in New York and pledged to

work for Israel’s normalisation with Saudi Arabia. This was their first

meeting since Netanyahu’s return to power nearly 9 months ago. The next

day, the Israeli foreign minister said that a framework of the grand

bargain could be possible by early 2024. In a Fox TV interview on Sept 20,

Saudi Crown Prince and PM Mohammed bin Salman said that his country was

moving steadily closer to normalising relations with Israel. But he also

warned that if Iran gets a nuclear weapon, “we have to get one.”

However, taking a more pragmatic view were the US secretary of state

(“Normalisation remains difficult”, Sept 15) and the US NSA (“Still work

to do”, Sept 15).

- In

his speech to the annual session of the United Nations General Assembly

(UNGA) on Sept 21, Palestine Authority (PA) President Mahmoud Abbas

emphasised that Middle East peace will not be achievable until the

Palestinians are granted full rights. A Saudi delegation led by their

Amman-based non-resident ambassador to PA paid a high-profile visit to

Ramallah on Sept 24-26 during which he described a decades-old Arab

“land-for-peace” offer on Tuesday as a pillar of any normalisation of ties

with Israel, an apparent attempt to signal that Riyadh has not abandoned

the Palestinian cause. Earlier, BBC disclosed that in their separate

discussions with the American diplomatic delegation in Amman and the Saudi

NSA in Riyadh during the first week of September, PA NSA had following

specific demands for backing the normalisation: (i) Transferring parts of

the West Bank currently under full Israeli control (known as Area C under

the 1990s Oslo peace accords) to the PA; (ii) A “complete

cessation” of Israeli settlement growth in the West Bank; (iii)

Resuming Saudi financial support to the PA, which was stopped completely

three years ago, to the tune of around $200 mn per year; (iv) Re-opening

the US consulate in occupied East Jerusalem – the diplomatic mission to

the Palestinians – that was shut down by President Donald Trump; (v)

Resuming US-brokered negotiations between Israel and the Palestinians from

where they stopped under then-Secretary of State John Kerry in 2014.

- On

Sept 26, an Israeli minister became the first publicly known official of

his country to land in Saudi Arabia to attend a UN tourism conference.

- The

second round of trilateral negotiations on the $4.2bn Grand Ethiopian

Renaissance Dam (GERD), between Ethiopia, Sudan and Egypt – three Nile

riparian states – ended in Addis Ababa on Sept 25 without reaching any

conclusion. Ethiopia reiterated its commitment to continue negotiating in

good faith. Earlier on Sept 10, Ethiopia’s Prime Minister Abiy Ahmed

announced the successful completion of the fourth and final filling of the

GERD.

- The UN Human Rights Commission disclosed on Sept 19 that over 2,500 migrants had perished or were missing while trying to cross the Mediterranean Sea to the southern European coast since the beginning of 2023. According to the same source, 186,000 succeeded in making the crossing.

WANA and Ukraine Conflict:

- Turkish President Recep Tayyip Erdogan met Russian President

Vladimir Putin in Sochi on Sept 4. Turkish President could not achieve his

main objective of persuading Russia to reinstate the grain export deal as

his Russian counterpart refused to do so because the West had failed to

remove obstacles created by sanctions on its own grain and fertiliser

exports. It also complained that too little of the Ukrainian grain freed

by the Black Sea deal was getting to the poorest countries. As a sop of

sorts to Turkey and African consumers, two days later Moscow announced

that Turkey had agreed in principle to handle 1 mn tons of grain that

Russia plans to send to Africa at a discounted price with financial

support from Qatar.

- On

Sept 19 the US issued fresh Iran-related sanctions on Tuesday, targeting

seven individuals and four entities in Iran, Russia, China and Turkey in

connection with Tehran’s drone and military aircraft development. Earlier,

on Sept 6 several news media outfits reported that the representatives of

the US, the UK and the EU had visited the UAE to jointly press the gulf

country to halt shipments to Russia of proscribed goods, such as advanced

computer chips, electronic components and other so-called dual-use

products. The US AI hardware producers, such as Nvidia and AMD, had

disclosed that the US government had imposed curbs on chips designed to

speed up machine-learning tasks for customers in the Middle East. However,

the Department of Commerce stated that the US “has not blocked chip

sales to the Middle East” but declined to comment on whether it had

imposed new requirements on specific US companies. A UAE official said the

country “strictly abides by UN sanctions and has clear and robust

processes in place to deal with sanctioned entities”. (Comment:

The UAE’s freewheeling and well-globalised economy could be a useful

conduit for procuring such advanced IT hardware for other usual suspects

as well. Relevant to note that sanctions on Russia were not imposed by the

US but by the US-led West. Further Reading: “Abu Dhabi throws a surprise

challenger into the AI race”, The Economist 21/9.)

WANA Regional Security and Terrorism

- Israel ended the week-long ban on imports into Gaza on Sept

10. It was imposed on Sept 4 following allegedly finding 16 tons of

ammonium nitrate explosive precursor hidden in goods imported from Turkey.

Israel also banned entry of workers from Gaza following the escalation of

tensions on the common border. 18,000 Gazans work in Israel.

- Five Israeli Arabs were killed in a shooting in their

community on Sept 27. 180 persons have died in such fratricidal shootings

since the beginning of 2023.

- On Sept 21, Israeli forces killed five Palestinians during a

raid on Jenin refugee camp, a West Bank militancy hotspot.

- Ongoing sporadic fighting among two Palestinian factions in

Ein el-Hilweh camp (in Lebanon) flared up again on Sept 7 and 13 leaving

15 dead.

- US Centcom announced the capture of two operatives of the

Islami State in Syria on Sept 25 and 30 respectively.

- On Sept 29, the Netherlands announced that 120 more Dutch

soldiers would be deployed in Iraq from the beginning of 2024, in addition

to 145 soldiers already positioned there under the NATO alliance

mission.

Pakistan and WANA Region:

- On Sept 28, Pakistan’s Interim Commerce Minister Gohar Ejaz

and Gulf Cooperation Council (GCC) Secretary General Jassem Mohamed

Albudaiwi concluded the final round of negotiations for a free trade agreement

(FTA) at the GCC headquarters in Riyadh. A preliminary deal on the FTA was

signed. In a joint statement the two parties “looked forward to the

expeditious signing, ratification, and implementation of the agreement.” (Comment:

If taken to the logical conclusion, this would be the first FTA signed by

the GCC as a group. India, too, has been negotiating for such an FTA with

the GCC since last year.)

China and WANA Region:

- President Bashar al-Assad of Syria visited China to

attend the inaugural ceremony of the Asian Games on Sept 23 at Hangzhou.

He met Chinese President Xi on Sept 22 who called for the lifting of the

Western sanctions on Syria. The two sides also decided to upgrade their

bilateral ties to a “strategic partnership.” (Comments: Although an

enhanced bilateral relationship serves the interests of both countries as

they face Western attempts at economic ostracisation, there were intrinsic

limits to growth. Chinese companies do not wish to run the gauntlet of

Western sanctions to rebuild Syria, which still has major security and

economic challenges. Perhaps for this reason, China did not announce any

large package of assistance to Syria after the visit.)

- On Sept 18 President of the Chinese e-commerce giant Alibaba

Group Holding Ltd met President Tayyip Erdogan of Turkey on the

sidelines of the UNGA session in New York. He informed that Alibaba had

invested $1.4 bn in Turkey through its local unit, and it plans to invest

$2 bn in facilities such as a data and logistics centre in Ankara and an export

operation centre at Istanbul Airport. On Sept 15, the Energy Minister said

that Turkey was closing in on an agreement with China for the construction

of its second nuclear power plant, following the first, still under

construction by Russia.

- On Sept. 8 the UAE Sovereign Wealth Fund Mubadala

opened an office in Beijing.

WANA and Football-related Issues:

- In a TV interview on Sept 22, Saudi Crown Prince and PM

Mohammed bin Salman (MbS) said he “did not care” about allegations about

“sportswashing” and that he will continue funding sport if it adds to the

country’s gross domestic product (GDP). This came amidst media reports

claiming that Saudi club al-Ittihad had offered Liverpool football club a

record $270 mn for Mohammed Saleh, an Egyptian player. According to these

reports, Liverpool had rebuffed the offer.

GCC:

- On Sept 20, US Secretary of State Anthony Blinken had a

meeting with the Foreign Ministers of the Gulf Cooperation Council in New

York on the sidelines of the UNGA session. Their joint statement urged

Iran to cooperate fully with the IAEA.

Natural/Anthropogenic Disasters

- On Sept 8 at 22.11 hrs local time, a powerful earthquake of

magnitude 6.8 struck Al-Haouz, the epicentre, and Taroudant provinces of Morocco’s

High Atlas Mountains region, 71km southwest of Marrakesh. This calamity

led to the death of 2,946 people and injuries to 5,674. While the affected

area was sparsely populated its difficult terrain impeded the relief work.

On Sep 20, the Moroccan government announced an $11.7 post-earthquake

recovery plan over the next 42 months.

- On the night of Sept 10-11, heavy rains due to Storm Daniel

caused the collapse of the two dams at Derna and Mansur, inundating much

of Derna city on the Mediterranean coast in eastern Libya.

The estimates of deaths and devastation varied from 6,000 to 20,000.

Derna city had a population of nearly 100,000. The disaster was attributed

to the lack of an early warning system and poor maintenance of the two

dams built over three decades ago. (Further Reading: “The lethal negligence of

politicians in Morocco and Libya” The Economist, 13/9.)

IB) Political Developments

Iran:

In an interview aired by CNN on Sept 24, President Ibrahim

Raisi predicted that the normalisation deals between Israel and the Arab states

shall fail.

The protracted and indirect deal between Iran and the US

involving an exchange of mutually held prisoners and approximately $6 bn of

Iranian funds frozen in South Korea was implemented during the month with Oman,

Switzerland and Qatar playing as intermediaries. On Sept 18, five of the

imprisoned nationals were exchanged between the two countries at Doha. The

Iranian funds were also deposited in Qatari banks, with the amount being spent

on mutually agreed humanitarian purposes. The deal came to be criticised by the

hardliners on both sides and the White House had to issue a statement on Sept

13 pointing out that the funds released belonged to Iran in the first place. (Comment:

Though the deal implemented represented higher modus vivendi between the two

long-estranged countries, most observers do not believe this to mark a bilateral

transformation. The US and Iran have strongly entrenched mutually antagonist

positions on nuclear, WMD, oil and other sanction and regional geopolitical

issues, which are not affected by this side issue. Further Reading: “Iran’s $6bn hostage deal is part of

a broader diplomatic strategy” The Economist, Sept 18.)

There was no let-up in development on Iran’s nuclear issue

during the month under review. On Sept 4, the IAEA reported no progress on the

issue of Iran expanding its stock of weapon-grade enriched uranium.

Further Iranian decision to bar several inspectors was condemned by the IAEA Chief

on Sept 16. On Sept 14, E3 countries decided to retain their existing sanctions

on ballistic missiles and nuclear programmes of Iran. On Sept 18, E3 and

the US issued a statement urging Iran to reverse the ban on some of the IAEA

inspectors. On Sept 22, US Secretary of State Anthony Blinken described Iran as

“not a responsible actor” concerning its nuclear programme.

On Sept 21, the Iranian parliament passed a bill increasing

the prison term up to 10 years in jail for wearing an “inappropriate dress.”

The bill needs to be endorsed by the Guardians’ Council before becoming law. (Comment:

The bill was passed soon after the first anniversary of Mehsa Amini’s death in

Gasht-e-Irshad custody on Sept 16 and was marked more outside Iran than inside.

This showed that the months of public protests on the Hijab issue had hardened

the conservative rulers of Iran.)

Russian defence minister visited Iran on Sept 19-20. In a

statement, he said that his visit has taken the bilateral ties to a new level.

Iran claimed two strategic accomplishments during the month:

On Sept 27, it successfully launched the Noor-3 satellite; On Sept 22 it

paraded the Mohajer-10 drone with a 2000 km range (claimed to be the longest

range for a drone) and capacity to carry a load of 300 kgs while staying afloat

for 24 hours at one stretch.

On Sept 8, the US authorities seized 980,000 barrels of

Iranian crude worth over $90 mn from super-tanker Suez Rajan for violating the

unilateral sanctions on Iranian crude exports.

The Saudi ambassador-designate arrived in Iran on Sept 5,

thus ending a seven-year hiatus in diplomatic ties. This was preceded by the

decision of the Saudi clubs to play their Champions League games in Iran.

Turkey:

President Recep Tayyip Erdogan kept a hectic diplomatic

profile during the month. He visited Azerbaijan (Sept 25) during the

Nogorno-Karabakh crisis and made it a point to visit the Nakhchivan exclave

proposed as a corridor via Armenia joining Turkey with Azerbaijan. On the

sidelines of the UNGA session, he met (19/9) Israeli PM Netanyahu in New York.

This was their first meeting and indicated the thawing of bilateral ties after

a long spell of acrimony. The day after Erdogan claimed that both sides would

soon take steps towards offshore drilling for oil and gas. He participated in

the G20 Summit held in New Delhi (Sept 9-10) and met Egyptian President el-Sisi

on the sidelines. On his return, he opposed the idea of India Middle East

Europe Economic Corridor, saying, “There is no corridor without Turkey.” On

Sept 26, he said that Turkey would back Sweden’s bid to join NATO if the US

kept her promise to supply Turkey with F-16 fighters.

The foreign ministers of Greece and Turkey met in Ankara on

Sept 5 indicating a revival of contacts between neighbours across the Aegean

Sea often marred with dispute over territory and Cyprus.

Turkish Central Bank raised its rate by 5% to 30% to fight

the annual inflation which was 59% in August.

Saudi Arabia:

On Sept 25, Saudi Energy Minister Prince Abdulaziz bin Salman

told the IAEA’s Annual General Conference “The kingdom has recently

decided to rescind its Small Quantities Protocol and to move to the

implementation of a full-scope Comprehensive Safeguards Agreement,”

Although Saudi Arabia’s first nuclear reactor is yet to reach criticality,

media reports have suggested that the Kingdom is contemplating a Chinese

proposal to build a nuclear power plant.

The Wall Street Journal (WSJ) reported on Sept 10 that the

United States and Saudi Arabia were in talks to secure the mining of cobalt,

lithium and other metals required in electric car batteries, laptops and

smartphones. According to the WSJ report, a state-backed Saudi venture would

buy stakes in mining assets worth $15 bn in African countries such as the Democratic

Republic of Congo, Guinea and Namibia.

On Sept 4, Huawei announced the opening of a cloud data

centre in Saudi Arabia as a part of its plan to invest $400 mn in that country

over the next five years.

Israel

On Sept 12, the Israeli Supreme Court began hearing the

arguments on the constitutional validity of the controversial bills passed by

the Knesset earlier this year to curb the judiciary’s

prerogatives.

Israeli Defence Minister accused Iran of setting up an

airport capable of handling mid-size aircraft in southern Lebanon 20 kms from

the Israeli border. (Comment: The said airport is more likely to

accommodate large drones – some of them weaponised – built from Iranian

blueprints. The drones launched from the site could be used for both internal

and external operational activities. Apart from Iran’s formidable drone

armoury, Hezbollah has also been investing heavily in drone technology.)

On Sept 4, Israel finally opened its Bahrain embassy in

Manama. Papua New Guinea opened its embassy in Jerusalem on Sept 5, becoming

the fifth country to do so. On Sept 21, the Democratic Republic of Congo (DRC)

announced that it too shall open its embassy in Jerusalem; Israel is to open

its embassy in Kinshasha.

On Sept 27, the US admitted Israel to its list of countries

whose citizens can enter without a visa.

Sudan:

Sudan Armed Forces (SAF) Chief Gen Abdel Fattah al-Burhan

sought to gain international acceptance by visiting South Sudan and the UNGA.

In his address to the UNGA, he warned the UN that months of war in his country

could spill over into Sudan’s army chief warned the United Nations that months

of war in his country could spill over into the region, and he called for

international pressure to be placed on the paramilitary forces he is fighting,

including their designation as “terrorists”. the region. He also called for

international pressure on the Rapid Support Forces (RSF) he is fighting,

including their designation as “terrorists”. In an interview with al-Jazeera in

New York he promised that soon after the ceasefire, a comprehensive political

process towards restoring peace and preparing for elections after a short

transitional period would be initiated. On his return leg from New York, he

visited Qatar and was received by Emir Sheikh Tamim.

An army drone killed over 40 people in Khartoum on Sept 10.

Earlier on Sept 6 over 32 civilians were killed in SAF shelling in the Ombada

neighbourhood in western Omdurman. Relevant to add that the SAF-RSF conflict

which began on April 15 this year, has so far caused 5,000 deaths and displaced

5 mn people as refugees including nearly a million have fled to neighbouring

countries.

On Sept 6, the Sudanese government led by Gen al-Burhan

formally dissolved the RSF.

On Sept 6, the US imposed sanctions on two generals of the

RSF.

The UAE:

In a sign of a continuing boom in real estate, CBRE

consultancy announced on Sept 12 that the average apartment prices in Dubai

have risen by 20% y/y in August 2023.

On Sept 14, Dubai police seized 86 mn Captagon pills

weighing 13 tons hidden in a furniture consignment. The recreational narcotics

pills were worth nearly $1 bn in the open market. It was believed to be one of

the largest seizures in the world.

After Nigeria permitted the repatriation of its profits,

Emirates Airline resumed flights to West African countries on Sept 11.

Syria:

The armed clashes between US-backed Self Defence Forces

(SDF), a Kurdish militia effective against ISIS, and Arab tribes continued

during the first week of September despite the US officials visiting Deir

el-Zor to defuse tensions. Dozens of people are estimated to have been killed.

Ultimately on Sept 7, the SDF chief promised to meet some of the Arab tribes’

demands.

Israel attacked several targets in Hama, Tartous and other

coastal areas on Sept 13.

Iraq:

Iraq’s Federal Supreme Court ruled this month that a

bilateral agreement regulating navigation in the Khor Abdullah waterway between

Iraq and Kuwait was unconstitutional. The court said the law ratifying the

accord should have been approved by two-thirds of parliament. Kuwait’s prime

minister described the Iraqi court ruling as containing “historical

fallacies” and called on Iraq to take “concrete, decisive and urgent

measures” to address it. Reacting to the problem in a carefully worded

statement on Sept 26, Iraqi PM Mohammed Shia Al-Sudani said the country wants a

solution that does not conflict either with its constitution or with

international law. He emphasised that Iraq respected the sovereignty and

territorial integrity of Kuwait and was committed to all its bilateral

agreements with countries and to the resolutions of the UN Security Council., a

statement from the prime minister’s media office said on Tuesday. (Comment:

Although the UN-demarcated Kuwait-Iraq land border In 1993 after Iraq’s

invasion of Kuwait was undone, it did not cover their maritime boundaries. This

was left for the two countries to resolve. A maritime border agreement between

the two nations was reached in 2012 and ratified by each of their legislative

bodies in 2013. Ten years on, Iraq’s Federal Supreme Court has scratched the

old wound of Saddam Hussein’s invasion of Kuwait. The court seems to have a

penchant for such disruption, already witnessed in its ruling over various

issues on Kurdish autonomy.)

On Sept 19, PM al-Sudani met US Secretary of State Anthony

Blinken on the sidelines of the UNGA session in New York. Blinken conveyed an

invitation from President Biden for a visit to the White House “soon.”

There were several developments concerning relations between

the Iraqi central government and the Kurdish Regional Government (KRG). On Sept

18, the Iraqi government announced an increase of its annual financial support

to KRG to $1.6 bn. On Sept 12, Iraq started relocating anti-Iranian Kurdish

fighters away from the bilateral border, meeting an Iranian demand. On Sept 3,

Iraqi security forces were deployed in Kirkuk after four persons were killed in

protest against an Iraqi Federal Supreme Court decision to delay a building

handover by the Iraqi army to KDP. On Sept 27, a wedding fire killed over 100

persons in Mosul.

On Sept 14, a US Treasury official urged the Iraqi

government to act to curb illegal transfers of US dollars to Iran by private

Iraqi banks.

On Sept 26, Iraq announced that an 18 km railway line

linking Basrah in Iraq with Shalamja in Iran would be completed in 18 months.

This would be the first train link between the two countries and would mainly

facilitate travel by the Iranian pilgrims to the Shite holy sites in Iraq.

Libya:

Renegade general Khalifa Haftar, whose forces dominate

eastern Libya, has held talks with Russian President Vladimir Putin and Defence

Minister Sergei Shoigu in Moscow on Sept 28. It was the first meeting

between the two men since 2019. (Comment: Their talks are likely to have

centred on the future of hundreds of Wagner personnel remaining stationed in

the areas under Haftar’s control.)

Egypt:

On Sept 25, the National Elections Authority announced that

the vote to elect the new President of the Republic will be held on December

10-12. While a handful of politicians have already announced their bids to run

for the country’s highest post, observers expect President Abdel Fattah el-Sisi

to sail through the elections.

On Sept 22 U.S. prosecutors charged Senator Bob Menendez,

Chairman of the Senate Foreign Relations Committee and his wife with taking

bribes from three New Jersey businessmen in exchange, inter alia, to benefit

the government of Egypt.

On Sept 5, Egyptian President Abdel-Fattah El-Sisi warned

that a surging population is leaving the country of more than 104 million

people with an increasingly unaffordable burden. The number of Egyptians has

almost quadrupled since 1960 and, if unchecked, could nearly double again by

2050.

Egypt’s General Authority for Supply Commodities (GASC) bought

about 480,000 metric tonnes of Russian wheat on Sept 5.

Yemen:

On Saudi invitation, an al-Houthi delegation visited Riyadh

for discussions on the resolution of issues related to the 8-year-old Yemeni

civil war. They left on Sept 19 after five days of talks that made some

progress on the main sticking points, including a timeline for foreign troops

exiting Yemen and a mechanism for paying public wages. The other focus points

of these talks were a full reopening of Houthi-controlled ports and Sanaa airport

and post-war construction. An agreement between al-Houthis and Saudi Arabia

would pave the way for the United Nations to restart a broader political peace

process. On Sept 20, the Saudi defence ministry reaffirmed Riyadh’s commitment

to promote the dialogue in Yemen. However, an al-Houthi drone attack on Sept 25

led to the death of 4 Bahraini soldiers, putting the future of the Yemeni civil

war, which has been under a relatively peaceful cease-fire for nearly a year

now, in jeopardy.

Yemenia, the only airline servicing Sanaa airport for

civilian flights only to Amman, announced on Sept 30 that it was closing down

its operations due to the al-Houthi government refusing to release its

accumulated funds of $80 mn.

Bahrain:

On Sept 13, Bahrain’s Prime Minister and Crown Prince Salman

bin Hamad al-Khalifa and US Secretary of State Antony Blinken signed the

Comprehensive Security Integration and Prosperity Agreement (C-SIPA), a “new

framework to promote cooperation across a range of areas, from defence and

security to science, technology and trade.” (Comment: C-SIPA, a new

construct in the US diplomacy, is intended to reassure the traditional allies

of a deeper and wider American engagement for their security and economic

interests. The need for C-SIPA has arisen to allay the suspicions about

Washington’s reliability as a defence guarantor in the wake of subterranean

contacts with Iran and as China looms large over the Gulf. C-SIPA is the

closest Washington can offer as a formal defence treaty would require the pains

of Congressional approval. C-SIPA template could be offered to Saudi Arabia to

fulfil Riyadh’s requirement for a more formal defence pact as one of the

conditions for rapprochement with Israel.)

Tunisia:

On Sept 29, Rached Ghannouchi, 82, a prominent opposition

leader in Tunisia and the former speaker of the country’s parliament, began a

three-day hunger strike to protest against his incarceration. He has been

imprisoned since last April on charges of incitement and plotting against state

security.

II) Economic Developments

(a) Oil & Gas Related Developments:

Global Developments:

Oil prices ended the month with Brent crude trading at

$95.31 a barrel, up 29% during Q3/23. This was despite higher production by

Nigeria (up 110,000 bpd) and Iran whose production was estimated at 3.15 mbpd,

the highest since 2018. Although Reuters estimated the OPEC September output at

27.73 mbpd, up by 120,000 bpd as compared to the previous month, it was still

lower than the collective OPEC ceiling by 700,000 bpd. On Sept 26, the

International Energy Agency (IEA) put the global consumption in June 2023 at

103 mbpd, a new record. In an article published in the Financial Times on Sept

12, the IEA Chief predicted that the peak fossil fuel demand “will happen this

decade.” The OPEC Secretariat countered this projection as “not fact-based” and

its monthly bulletin published on the same day stuck to its oil demand growth

projection. At a global conference on Sept 18, CEOs of both Saudi Aramco and

Exxon-Mobil pushed back against the forecast of peak oil by 2030. On Sept 21

Morgan Stanley opined that the global oil market could remain undersupplied for

several quarters but prices above $100/barrel seemed a bit stretched. It,

nevertheless, raised its forecast for oil to average at $95/barrel during Q4/23

-up significantly from $82.5/barrel predicted earlier. Oil rose past the

$90/barrel mark on Sept 5, for the first time since Nov 2022. Following their

phone call on Sept 6, the Russian President and Saudi Crown Prince declared

that their recent production cuts (by 300,000 b/d and 1mbpd respectively) had

ensured stability in the global oil market. Later on Sept 18, the Saudi energy

minister also echoed the same rationale for production cuts. The President of

Cyprus hosted the prime ministers of Israel and Greece on Sept 7 in Nicosia to

discuss deepening energy infrastructure cooperation in getting Israeli offshore

gas to Western Europe.

Country Specific Developments:

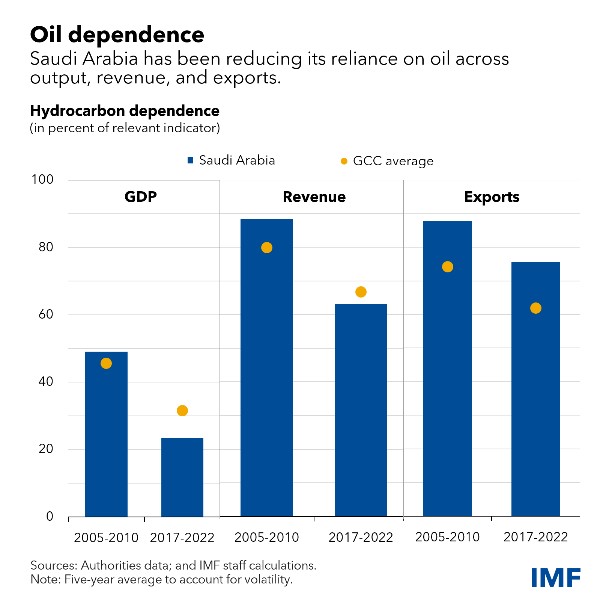

An IMF paper published on Sept 28 detailed the ongoing

diversification of the Saudi economy anchored on the implementation of

reforms to reduce oil dependence, diversify income sources, and enhance

competitiveness. (Comment: As the graphic illustrates, Saudi oil dependence

has come down in the past decade, it is partly due to oil prices being

relatively lower and production curbs.)

Saudi Arabia, the world’s biggest oil producer, is finally

moving to enter the booming natural gas market. While oil is still a vital part

of the Saudi economy, gas is becoming a major part of its investment plans.

Saudi Aramco aims to spend $110 bn developing the Jafurah gas field that will

help double output by 2030 and make the kingdom a gas exporter for the first

time. On Sept 30, it also agreed to buy a stake in MidOcean Energy, marking its

first investment in liquefied natural gas. MidOcean is in the process of

acquiring interests in four Australian LNG projects and is also part of a consortium

to buy Sydney-based Origin Energy Ltd. On Sept 15 Saudi Aramco purchased Esmax,

one of the major natural gas companies in Chile. While the price of the deal

was not disclosed, in 2022 Esmax had a revenue of $2.5 bn and a profit of $57.7

mn. (Comment: The Saudi strategic shift towards natural gas is an

integral part of its diversification away from crude – a fuel widely expected

to have a consumption peak sooner than later.) WSJ reported on Sept 1 that

Saudi Aramco was considering selling $50 bn worth of shares.

On Sept 15, the Turkish minister of energy said that the

Turkey – Iraq pipeline would soon be “technically” ready to resume operations. (Comment:

Turkey suspended the operation of the pipeline on March 25 this year in the

wake of an arbitration panel ruling involving a dispute between the Iraqi

Federal Government and Kurdistan Regional Government. In normal times, it

carries over 400,000 bpd of Iraqi crude to a port on Turkey’s Mediterranean

coast.)

On Sept 6 Adnoc decided to proceed with the Habshan Carbon

Capture project aimed at sequestering 1.5 mn tons of CO2 annually. It will

triple Adnoc’s carbon capture capacity to 2.3 mn tons per year. ADNOC said in

January it would allocate $15 bn to decarbonisation projects by 2030. (Comment:

The UAE is to host the UN COP28 climate summit to be presided over by ADNOC

CEO, in December 2023. Being on the mat by several NGOs for a contradiction

between one of the largest fossil fuel producing company CEO chairing a global

climate summit, the UAE is under pressure to show its sincerity.)

Bloomberg reported on Sept 26 that two new refineries in

Oman (at Duqm capacity of 230,000 bpd) and Bahrain (at Sitra, capacity of

~70,000 bpd) would both produce diesel for export. Together they would

correspondingly reduce the crude export from these two countries by over

300,000 bpd.

Following economy-related developments took place in WANA

countries:

- The signs started emerging during the month that the Saudi

economy was running out of steam mainly because of the lower oil revenues

caused by the double whammy of lower oil prices and production cuts.

According to an IMF paper released on Oct 1, the annual GDP growth, which

recorded G20’s highest at 8.7% in 2022, was expected to rise in 2023 by

only 0.03%. Similarly, after the first budgetary surplus in a decade in

2022, the kingdom was expected to return to deficits of -2% in 2023 and

-1.9% in 2024. The finance ministry planned to raise $11 bn from

syndicated loans, Bloomberg mentioned on Sept 15. Luxury EV company Lucid,

heavily financed by Saudi Arabia, opened its first international factory

in Jeddah on Sept 27 with an initial annual capacity of 5,000 units. The

kingdom had contracted to buy up to 100,000 vehicles from the company over

10 years.

- Turkish depositors converted most of their $127.6 bn funds

back to dollars by August 2023 by withdrawing from state

depreciation-protected accounts as Ankara begins winding down the scheme

launched in 2021. The World Bank announced on Sept 7 that it was planning

to double its exposure to Turkey during the coming 3 years to $35

bn. (Further Reading: “Turkey sets out a tough

economic path in policy turnaround”, Reuters, Sept 6.)

- The central banks of Egypt and the UAE agreed

on Sept 28 to up to Dh 5 bn in a swap deal meant to help Cairo navigate

through a serious forex crisis. Abu Dhabi’s Chimera Partners launched

Lunate, an alternative investor fund with assets under management worth

$50 bn. The public debt of Dubai Emirate was expected to go down by $7.9

bn by the end of 2023.

- On Sept 3, Kuwait’s new finance minister projected

that after 8.2% growth in 2022, the emirate’s GDP was to grow only by 0.1%

in 2023.

III) Bilateral Developments

- Following the conclusion of the G20 Summit, Saudi

Crown Prince and PM Mohammed bin Salman (MbS) paid a day’s official

bilateral visit to India on Sept 11. He co-chaired, with PM Shri Narendra

Modi, the first session of the India-Saudi Strategic Partnership Council

created in 2019. It was accompanied by the signing of 8 MoUs. An

India-Saudi Investment Forum was also organised later with over 500

companies participating, considerable G2B and B2B interaction and the

signing of several MoUs. (Comment: Although the joint statement

issued after the visit mentioned several bilateral economic issues, it was

sparse on specific decisions. For instance, on the long-pending

Saudi decision to participate in the $50 bn West Coast Refinery, the can

was kicked further down the road. There was no mention of either MbS’ 2019

commitment to invest $100 bn in India or the Saudi support for

India’s bid for permanent membership of the UN Security Council even as PM

Modi described Saudi Arabia as “one of the most important strategic

partners of India.” MbS noted that the ties between the two countries have

always been free of any differences. Among the possible reasons for Saudi

lukewarmth could be China’s growing influence over Riyadh, perception of

India’s growing proximity towards the UAE, sharp decline in Indian

purchase of Saudi crude over cheaper Russian supplies, slowing Saudi economy

and other commitments, etc.)

- On Sept 10, on the sidelines of the G20 New Delhi Summit,

leaders of India, Saudi Arabia, the US and some other countries

signed a preliminary MoU to launch the India-Middle East-Europe Economic

Corridor (IMEEC). (Comment: While the project is expected to

streamline the flow of goods and energy, it is also geopolitically

significant as it links Israel with the Gulf countries and is expected to

counter China’s BRI. Its economic viability and competitiveness

remain to be established.)

- PM Modi launched Global Biofuel Alliance on the

sidelines of the G20 Summit on Sept 10.

- On Sept 25, India permitted the export of 75,000 tons of

non-basmati rice to the UAE. Economic Times reported on Sept 26

that ADIA, Abu Dhabi’s SWF, was looking at investing ~$600 mn in RIL’s

retail business. On Sept 28, IHC, another of Abu Dhabi’s SWF, decided to

sell its investments in two companies of the Adani Group.

- On the sidelines of the G20 Summit, PM Shri Narendra Modi

also held bilateral discussions with President Erdogan of Turkey on

Sept 10.

- INS Sumedha arrived at Alexandria (Egypt) on Sept 6 to

take part in the Ex-Bright Star -23 exercise. It was the maiden

participation by an Indian naval ship in this type of annual exercise.

- Iraq defeated India 5-4 on penalties in the semifinals of the

Thai King’s Cup played at Miang Mai on Sept 7.

- Import of Russian and Iraqi crude rebounded in

September at the expense of the supplies from Saudi Arabia.