HIGHLIGHTS

- Political Developments

- Economic Developments

- Bilateral Developments

IA) Political Developments: Pan-Regional and Global Issues

Regional and International Developments

- Repeated incidents of public burning of the Quran in Nordic countries (Sweden on 20/7, Denmark on 24/7 and 25/7) ignited – as intended – a strong reaction in many countries of the West Asia North Africa (WANA) region. The Organisation of Islamic Countries (OIC) issued a relatively measured statement on July 20 condemning this incident of Quran burning in Sweden as a provocative and despicable act. The UN Human Rights Commission also adopted a resolution on Islamophobia and Quran burning. Among the strongest reactions was in Iraq where pro-Sadr demonstrators set fire to the Swedish embassy building in Baghdad. The Iraqi government expelled the Swedish ambassador, recalled its charge d’affaires in Sweden, and suspended the working permit of Sweden’s Ericsson on Iraqi soil. (Comment: The incident in Sweden was perpetrated by an Iraqi exile and was used by maverick Shia cleric Musa Sadr to rally his supporters. Arab-Muslim masses rejected the defence of freedom of expression offered by the Nordic governments.)

- There was intense speculation during the month about the outcome of the Biden administration’s efforts for a normalisation of ties between Saudi Arabia and Israel even as the US President initially said on July 9 that such an outcome was a “long way off.” Yet, on July 28, he was quoted as saying “There’s a rapprochement may be underway.” The US NSA’s meeting with Saudi Crown Prince Mohammed bin Salman in Jeddah on July 27 further revived such speculation. In its reaction on July 31, Iran said that such a development would “harm the regional peace.” (Further Reading: (i) “America’s pursuit of Saudi-Israel rapprochement” by Mahesh Sachdev, The Hindu, August 5;(ii) “What MBS wants from Joe Biden” The Economist, July 5; (iii) “A Biden Peace Deal Between Saudi Arabia and Israel?” Thomas L. Friedman, NYT, July 28.)

- On July 18, the Wall Street Journal published a seemingly knowledgeable piece on the growing rift between Saudi Arabia and the UAE. While this drift has been evident sporadically, this was a rare insight into its evolution and likely impact. (Comment: The Kingdom and the UAE are neighbours with plenty in common, but with several differences among their ruling dynasties, geo-political orientation, oil politics and economic competition. In recent years, these differences have got personalised between Saudi Crown Prince Mohammed bin Salman, MbS, and the UAE President Mohammed bin Zayed, MbZ. They have so far kept their long-simmering frictions under wraps, but these have acquired sharp focus as Saudi Arabia replicates the non-oil economic growth model of the UAE, spurring competitive ruction. Riyadh also felt let down by the UAE leading it to the two conflicts with Yemen and Qatar and then abandoning it. Further Reading: “The Best of Frenemies: Saudi Crown Prince Clashes With U.A.E. President”, WSJ, July 18.)

WANA and Ukraine Conflict:

- Saudi Arabia announced on July 30 that it would host talks on August 5-6 about the Ukraine crisis, inviting around 30 countries including Western states, Ukraine, China and major developing countries including India but excluding Russia. The next day, a Kremlin spokesman reacted to this initiative by saying that “Russia needs to understand the aims of these talks in Saudi Arabia.” (Comment: The unexpected initiative, once again, showed the growing Saudi penchant for the global stage, at times even at the expense of the Kingdom’s existing alignments.)

- Qatari Prime Minister Sheikh Mohammed Bin Abdulrahman al-Thani visited Kyiv on July 28. He was received by President Volodymyr Zelenskiy and his Ukrainian counterpart and announced $100 mn in humanitarian assistance to the war-ravaged country.

- President Zelenskiy visited Turkey on July 8 to meet President Erdogan. They discussed several issues including the Russian refusal to extend the grain deal beyond July 17, Ukraine’s NATO membership, and the exchange of prisoners of war. In the event, President Zelenskiy left Turkey bringing with him five Azov commanders of Ukraine’s former garrison in Mariupol, forced to live in Turkey under the terms of a prisoner exchange last year. Moscow protested this “violation of the terms of POW exchange” by Turkey.

- The Financial Times reported on July 6 that Iran had helped Russia to convert an agricultural unmanned aerial vehicle factory at the Alabuga special economic zone in Tatarstan to produce reconnaissance drones being used in the Ukraine war. (Further Reading: “Russia deploys ‘Albatross’ made in Iran-backed drone factory” FT, July 6.)

WANA Regional Security and Terrorism

- The US Navy accused Iran’s Revolutionary Guards of “forcibly seizing” a Bahamas-flagged commercial ship in international waters in the Gulf on July 6. Amidst shipping tensions with Iran, the US despatched additional forces including F-16s to its bases in the Gulf. It also held joint military manoeuvres with Israel from July 10. Chancellor Olaf Scholz declared on July 12 that Germany will not be delivering Eurofighters to Saudi Arabia in the near future. On July 21 the Netherlands lifted the arms curbs to Turkey, Saudi Arabia and the UAE. On July 29, the US accused that a Russian air force plane had fired a flare at a USAF drone over Syria causing serious damage.

- The launching of two rockets from southern Lebanon toward Israel on July 6 prompted cross-border strikes by the Israeli military.

- On July 25, WHO reported a case of Middle East Respiratory Syndrome Coronavirus (MERS-CoV) in Abu Dhabi (UAE).

Pakistan and WANA Region:

- Pakistan managed two “Kaizen” rescue deposits of $2 bn by Saudi Arabia on July 11 and $1 bn by the UAE on July 12 in reserve support. The funds’ inflow paved the way for Pakistan to clinch the crucial $3 bn bailout package from the IMF. (Comment: The moot point in this episode was not if Saudi Arabia and the UAE would help Pakistan by parking their money, but in making Islamabad wait till the last minute.)

- On July 30, Pakistan approved 28 projects for multi-billion-dollar investments by the Gulf countries in sectors such as food, agriculture, IT, mines and minerals, petroleum and power sectors. It also established the Special Investment Facilitation Council (SIFC) — a hybrid civil-military forum — to fast-track economic development and debottleneck foreign-invested projects. (Comment: Approval of the projects and creation of SIFC was the easier part of the desired objective of replacing loans with FDIs. However, as CEPC experience shows – where only half of the promised Chinese aid has been delivered – Pakistan still needs to smoothen the last mile obstacle course to ensure the realisation of the projects. For this to happen, Islamabad would need to address several woes including bureaucratic snags, backtracking on its sovereign commitments, indecisiveness about geopolitical alignments, political uncertainty and insecurity. Further Reading: “CPEC to SIFC” Dawn, Aug 5.)

Afghanistan and WANA Region:

- On July 23, the Taliban rejected a claim by Iran’s foreign minister in the preceding week that the leaders of the ISIL (ISIS) armed group had been sent to Afghanistan from Iraq, Syria and Libya in recent months. (Comment: Islamic State in Khorasan Province, (ISKP or ISIS-K) – an affiliate of ISIL – has claimed responsibility for several recent attacks in Afghanistan. The exchange also indicated a growing disconnect between the two theocracies in Iran and Afghanistan.)

IB) Political Developments

Turkey:

President Recep Tayyip Erdogan toured Saudi Arabia (July 17-18), Qatar (July 18) and the UAE (July 19-20) – these being the first bilateral visits after his re-election a month ago. These visits had multiple objectives with bilateral economic resuscitation at the top of the agenda. Turkish Vice President and Finance Minister travelled to the UAE last month to discuss “economic cooperation opportunities” in preparation for the presidential visit, and they were received by the UAE President Sheikh Mohammed bin Zayed. In Jeddah, President Erdogan met Crown Prince Mohammed bin Salman (MbS). The two countries signed several memorandums of understanding in sectors including energy, real estate and direct investments including Turkey’s biggest defence export order ever involving supply and local manufacture of Akinci combat drones. In Abu Dhabi, the UAE and Turkey inked several MoUs that included an extradition accord, energy and natural resources development, space and defence cooperation estimated to be worth $50.7 bn. The specific details were indicated only for financing up to $8.5 bn of Turkey earthquake relief bonds and ADQ funding up to $3 bn in credit facilities to support Turkish exports. (Comment: President Erdogan has had a decade of terse relations with both Saudi Arabia and the UAE for several reasons including refuge to the Muslim Brotherhood and other Sunni radicals, religious-political competition, vital support to Qatar during its boycott, and Jamal Khashoggi murder that embarrassed MbS. While Erdogan began repairing Turkey’s ties with the Kingdom and the UAE in 2021, the current visit was undertaken against the backdrop of a devastating earthquake and precarious economy due to mismanagement and buying off the voters before a bruising election last month. Turkey’s budget deficit surged to $8.37 bn in June, seven times the deficit a year earlier. Annual inflation was close to 40% in June while the lira has weakened nearly 29% this year.)

On July 11, President Erdogan and the NATO Secretary General announced at the Vilnius Summit that Turkey had lifted its objection to Sweden’s membership application to join NATO, subject to some face-saving conditions such as the resumption of dialogue for Turkey to join the European Union, supply of F-16s by the US and some facile policy changes by the Swedish government to curb anti-Turkey elements on its soil. This ended the saga of Ankara blocking the NATO membership of Finland and Sweden since May 2022. (Comment: While some observers have accused Turkey of obduracy, President Erdogan cynically has weaponised the activity of some PKK and Gulenist elements to court the nationalist at home and wrest some strategic concessions from the NATO allies. While he may have, arguably, won the battle, his year-long stalling of the NATO critical expansion and his fence-sitting on the Ukraine war are likely to rankle the alliance for long.)

The EU foreign ministers said on July 20 that they were ready to re-engage with Turkey but stopped short of offering Ankara a clear resumption of membership talks. In a joint statement on July 31, Greece and Cyprus Prime Ministers welcomed moves by Turkey to boost relations with the EU, but urged caution saying that the rapprochement should be “gradual” and “reversible.” (Comment: Turkey has been a candidate to join the EU for well over two decades, but the negotiations broke down in 2016 as the bloc had reservations about the rule of law and human rights in the country – with Greece and Cyprus being the most sceptical.)

President Erdogan received Palestine Authority President Mahmoud Abbas on July 25. He received Hamas leader Ismail Haniyeh a day later. (Comment: These visits were initially organised in tandem with Israeli PM Benyamin Netanyahu’s visit to Turkey; the latter, however, cancelled his visit presumably due to pacemaker-related health issues.)

On his first foreign trip since being reappointed, Chinese Foreign Minister Wang Yi arrived in Ankara on July 26. He met his Turkish counterpart and was received by President Erdogan. Apart from the Ukraine conflict, intensifying bilateral relations and the condition of the Uigur minority in China also figured in the talks.

Sudan:

The Intergovernmental Authority on Development (IGAD), made up of eight states, Sudan included, in and around the Horn of Africa, met in the Ethiopian capital Addis Ababa on July 10 to kick-start a peace process for the conflict in Sudan. However, its initiative was rejected by the Sudanese Armed Forces (SAF) as they considered its Chair, the Kenyan President to be biased against it. This led to the Egyptian President launching a peace bid on July 13, which also did not fly. On July 15 SAF delegation arrived in Jeddah for ceasefire talks with the Rapid Support Forces (RSF) under Saudi-US aegis, but nothing more came out of it. Thus, despite multiple attempts at peacemaking, there was no let-up in fighting. The violence reached a new peak during the month with SAF and RSF slugging it out around the capital Khartoum and RSF on a rampage in the Darfur region against non-Arab tribes. On July 14, the International Criminal Court (ICC) announced a new investigation into a surge of hostilities in Sudan’s Darfur region since mid-April, including reported killings, rapes, arson, displacement and crimes affecting children. The hostilities in Sudan, which began on April 15, are estimated to have resulted in 3,000 deaths, 3 mn displaced including 700,000 forced to seek refuge in the neighbouring countries. (Further Reading: “Data from satellites suggest violence has surged in much of Sudan” The Economist July 20.)

Iran:

President Ebrahim Raisi toured three sub-Saharan African countries, viz. Kenya, Uganda and Zimbabwe from July 12. Iran’s trade with Africa is expected to increase to more than $2 bn this year. (Comment: This was the first visit to Africa by an Iranian President since 2013 and seemed part of a drive to widen Iran’s diplomatic options under which he recently visited Indonesia and Latin America.)

On July 5, Canada, Sweden, Ukraine and Britain asked the International Court of Justice (ICJ) to open proceedings against Iran over the shooting down of a Ukrainian passenger plane in 2020 that killed all 176 people on board.

In its report submitted on July 5, the Human Rights Commission’s Fact-Finding Mission on Iran asked Iran to stop executing the protestors. Undeterred, Iran resumed controversial Gast-e-Irshad patrols to enforce Hijab restrictions on women in public from July 17.

On July 8 a Sunni militant group called Jaish al-Adl attacked a police station in the mostly Sunni city of Zahedan in Iran’s restive Sistan-Baluchistan province bordering Pakistan and Afghanistan. It led to the death of two police officers and four attackers. Jaish al-Adl said that it was in retaliation for the deaths of 66 protesters killed by security forces on Sept. 30, 2022.

Saudi Arabia:

On July 25 Saudi football club al-Hilal reportedly made a record offer of €300 mn for Kylian Mbappé to Paris Saint-Germain. Apart from raising the eyebrows for the high figure, the offer reportedly did not persuade the 24-year-old international footballer who wanted to join Real Madrid. (Further Reading: “Spending spree thrusts Saudi football on to global stage” FT, July 8.)

Israel

US President Joe Biden met Israeli President Herzog at the White House on July 19. The visiting Israeli President also addressed a joint session of the US Congress the next day. (Comment: After over six months of delay, President Biden issued a formal invitation to PM Netanyahu on the eve of his meeting with his President. This indicated an unusually high level of strain in public knowledge between a democratic US President and an ultra-right Israeli PM. Further Reading: “Biden meets Israel’s president after extending an invitation to Netanyahu” FT 19/7.)

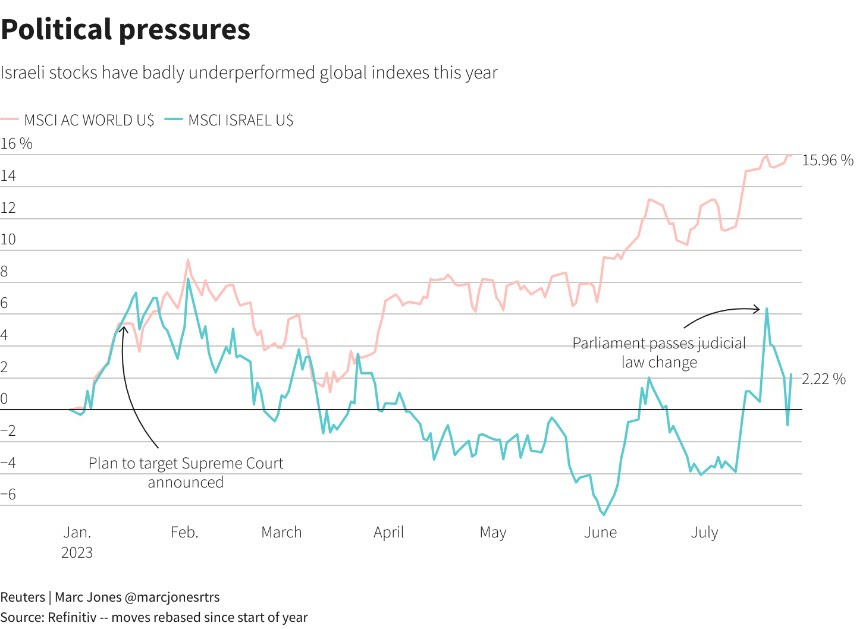

On July 24, the Israeli Knesset finally ratified the highly controversial first bill of a judicial overhaul by a 64-to-0 vote after opposition lawmakers abandoned the session in protest. The amendment limits the Supreme Court’s powers to void some government decisions if it deems them “unreasonable”. The bill was passed among the angry demonstrations and warnings by various sections of the economy that the process would hurt growth prospects, the decline in FDI and relocation of the start-ups. The passage caused a 2.5% decline in the Israeli stock market index and Shekel declined by 1% vis a vis the US dollar. The ruling coalition was, nevertheless, buoyed by the passage and promised to push other bills for the judicial overhaul. On the other hand, the full bench of 16 Supreme Court judges was set up on July 31 to consider the constitutional validity of the bill passed. (Comment: The issue of the judicial overhaul has caused unprecedented divisions in Israeli society largely between liberal youth and the committed conservatives determined to remove all impediments to the Zionist ideology. Some allege Mr Netanyahu, who stands indicted on three accounts of corruption has a vested interest in curbing the judiciary. More worrisome for the establishment was the split over this issue in the Israeli armed forces with some reservists threatening to decline orders.)

On July 3-4, the Israeli forces launched their biggest raid in 30 years on the West Bank city of Jenin (called Lions’ den) that been a hotbed of Palestinian militancy. Around 1000 troops accompanied by helicopters and drones engaged in fierce fighting with entrenched Palestinian militant groups belonging to Hamas, Islamic Jihad and Fatah resulting in at least 12 deaths, including 5 militants and one Israeli soldier. Around 100 people were injured. Israeli forces confiscated 1,000 weapons and arrested 30 suspects. (Comment: Apart from undermining the Palestine Authority, the raid also raised tensions between Israel and her Abraham Accord partners. Israel was also determined to reverse the growing entrenchment of the Palestinian militancy in hotbeds such as Jenin and Nablus townships as a sign of Hamas and Islamic Jihad, hitherto confined to Gaza, taking root in the Occupied West Bank. Curbing Palestinian militancy was the flip side of the current government’s policy of more aggressive settlement activity. Since coming to power in January 2023, Israel has advanced 12,855 settler housing units across the West Bank – the highest number since 2012.)

On July 13, the Israeli defence minister, visiting Azerbaijan bordering Iran, said that Israel and its foreign partners have foiled more than 50 Iranian-orchestrated attacks on Israelis and Jews abroad in recent years.

On July 2, Israel signed a $3 bn deal to acquire 25 more F-35 state-of-the-art US jet fighters.

Palestinian Issues:

A local incident between two militant groups, al-Fateh and Islamist group Junud al-Sham in Ein el-Hilweh Palestinian camp in Lebanon on July 29 triggered three days of fighting killing 6 persons and displacing 200 people.

Following growing concern about the collapse of the Palestine Authority (PA) due to Israeli military raids and more intense settlement activity, on July 9 Israeli PM Netanyahu promised to work to prevent this from happening. (Further Reading: “How Israel has tightened its grip on the West Bank” FT, July 7.)

The UAE:

With the approaching date next November for hosting the UNFCC’s CoP28 in Abu Dhabi, the UAE was under pressure to up its clean energy policies. On July 5, its PM announced plans to invest $54 bn in renewables over the next seven years targeting a threefold increase in the share of energy produced from renewable sources over the period and will focus on hydrogen as a source for clean power. The UAE’s new target is to cut emissions by 40% by 2030 compared with where emissions would have stood under a “business as usual” scenario. However, on July 20, Climate Action Tracker, an independent NGO, said that the UAE has set out “insufficient” plans to tackle its contribution to climate change. It pointed out “While it’s good the UAE plans to spend $54 bn on renewable energy, this is dwarfed by the national oil company’s plans to invest three times that amount on oil and gas expansion.” In its reply, the relevant UAE ministry said on July 24 “The UAE has recently updated its Nationally Determined Contributions and is fully committed to achieving its ambitious emission targets.” The UAE targets net zero by 2050.

On July 18, the UAE and the Democratic Republic of the Congo signed a $1.9bn deal with a state mining company to develop at least four mines in the African country’s turbulent east with concessions for tin, tantalum, tungsten and gold.

Syria:

Iraqi Prime Minister Mohammed Shia Al-Sudani visited Damascus on July 16 and held talks with Syrian President Bashar al-Assad focused on issues such as security, water-sharing, combatting Captagon smuggling and the possibility of reopening a Mediterranean oil export pipeline for Iraqi crude. It was the first such visit by an Iraqi premier since the outbreak of the Syrian civil war in 2011.

Army and Intelligence Chiefs of Jordan and Syria met in Amman on July 19 to discuss measures to combat the cross-border drug trade.

On July 11, a Russian veto marked the end of the Turkey-based UN humanitarian operations to support some 4 mn anti-Assad Syrians living in an exclusion zone around Idlib in northwestern Syria.

Islamic State took responsibility for the two bomb attacks on Sayeda Zainab shrine near Damascus venerated by Shia Muslims which took place during the week marking Ashura celebrations.

Reuters reported on July 7 that following a mutiny by the Wagner Group against Moscow, Syrian authorities collaborated with Russia in rounding up the Wagner militia fighters in the country who were subsequently airlifted to militia’s African bases in Libya, Mali, etc. The number of Wagner fighters in Syria was estimated at between 250 and 450 personnel or roughly 10% of the estimated Russian military strength. The fate of the oilfields, in north-eastern Syria, hitherto controlled by Evro Polis, a company linked to Wagner, remains unclear.

Syria devalued its currency, the Syrian Pound, to 9,900 to a dollar on July 18; however, the open market value of the currency continued to stay around 11,000 to a dollar.

Iraq:

On July 18, the US Secretary of State signed an unprecedented 120-day “national security waiver” to permit Iraq to pay Iran for electricity through accounts at non-Iraqi banks. The U.S. hoped that the waiver would help stop Iran’s pressuring by cutting Iranian natural gas exports to Iraq, limiting Iraq’s ability to generate power and forcing unpopular electricity cuts during Iraq’s sweltering summer. For Iran to access those funds would still require US permission and they can only be spent for humanitarian purposes. The next day, the US Treasury Department barred 14 Iraqi banks from conducting dollar transactions to crack down on the siphoning of U.S. currency to Iran. Earlier on July 11 Iraqi PM Mohammed Shia Sudani said that Iran had agreed to an Iraqi proposal to barter crude oil for Iranian gas to avoid the need for U.S. approval for payment of funds to Iran. Sudani said Iran had cut gas exports to Iraq by more than 50% as of July 1 after Baghdad failed to secure U.S. approval to disburse owed funds. (Comment: Despite being OPEC’s second-largest oil exporter, Iraq imports electricity and gas from Iran totalling between a third and 40% of its power supply. Further Reading: “Windfall oil revenue is buying illusory stability in Iraq” Al-Jazeera, 8/7.)

Lebanon:

Riad Salameh, Lebanon’s Central Bank Governor since 1993, finally demitted office on July 31 amidst swirling accusations of large-scale fraud and mismanagement evidenced by a steep rise in inflation and a 98% decline in the value of the national currency. As the Lebanese parliament failed to agree on his successor, one of his deputies was appointed as the interim governor. In 2022, Europe’s Agency for criminal justice cooperation seized nearly €120 mn of Lebanese assets in 5 European countries belonging to him and his brother.

Yemen

The UN’s years-old campaign to prevent a huge oil spill from a long-decaying oil tanker, ironically called “Safer” off the Yemeni Red Sea coast finally began on July 25 with the operation to remove more than 1 mn barrels of oil to be shifted to a rescue tanker over the next 19 days. The operation was long delayed due to funding of the needed $143 mn, of which around $22 mn was still needed. The tanker moored off Yemen, has been used for oil storage for more than 30 years, but has not been maintained since 2015 due to the Yemeni civil war. The UN officials have been warning for years that the Red Sea and Yemen’s coastline were at risk from an oil spillage from the rusting tanker which could cost $20 bn to clean up. The oil transfer was completed on August 9.

Tunisia:

On July 16, the EU and Tunisia signed a “strategic partnership” deal aimed at combating undocumented immigration and boosting the bilateral economic ties. Under the deal, signed between the EU Troika (Comprising of EC President, PMs of the Netherlands and Italy) and Tunisian President Kais Saied, the EU would allocate €100 mn to Tunisia to help it prevent illegal migration. Tunisia would be designated as a “safe third country”, meaning that everyone who passes through Tunisia can eventually be relocated back to it. A long-term loan of €900 mn was also on the table, but it would be contingent on approval of a loan from the IMF. Talks on the IMF loan have been stalled since October 2022 after President Saied rejected its terms, which included subsidy cuts and a reduction in the public wage bill. On his part, President Kais rejected allegations of Tunisia mistreating Sub-Saharan migrants flocking its coastline cities to sail across to southern Europe. The EU authorities detected nearly 66,000 illegal migration attempts in H1 of 2023 and 901 of such people had drowned by July 20.

Tunisia’s Ons Jaber was defeated 6-4, 6-4 in the Wimbledon women’s final on July 15.

Western Sahara Dispute:

On July 17, Israel recognised Morocco’s sovereignty over Western Sahara, leading to King Mohammed VI inviting Israeli PM Netanyahu for a visit to Morocco. This was followed two days later by a State Department spokesperson stating that the U.S. recognition of Morocco’s sovereignty over the territory remained unchanged. On July 20, Algeria strongly criticized Israel’s recognition of Moroccan sovereignty over the disputed territory, saying the move was a violation of international law. (Comment: Western Sahara was a Spanish colony till 1975 which was absorbed by Morocco, even as Algeria had long supported the Polisario Front fighting for its independence. The territorial dispute has continued since with African Union recognising Western Sahara’s independence while the UN Security Council equivocating about a referendum.)

Kuwait:

After nine straight years of budgetary deficits, Kuwait announced a $21 bn surplus in FY2022-23 as a boom in oil revenue and more controlled spending boosted the national economy.

Reuters reported on July 16 that Kuwait plans to establish a new sovereign fund called “Ciyada” to develop its local economy, spearhead mega projects, and attract funds from foreign investors and the private sector. Currently, the Kuwait Investment Authority (KIA) controls state investment assets worth around $800 bn. Other details about Ciyada were not revealed.

Libya:

On July 15 several of Libyan oil fields were forcibly shut by protestors demanding the release of a former Finance Minister, allegedly detained in Tripoli by the Internal Security Agency. He was released on July 17 leading to the oil production being restored.

II) Economic Developments

Oil & Gas Related Developments:

Global Developments: Oil prices that have hitherto largely defied OPEC+ production cuts, finally began their upward climb during July 2023 and ended the month with Brent crude trading above $85 a barrel, up from near $71 in late June. Saudi output fell by 860,000 bpd in July, over the previous month while total OPEC production was 840,000 bpd lower as Nigeria, Angola and Libya produced lower than their quotas. In comparison, Goldman Sachs estimated the global demand hit a record 102.8 mbpd in July and it revised up 2023 demand by about 550,000 bpd on stronger demand in India and the US, offsetting a downgrade for China’s consumption. On the other hand, the OPEC monthly bulletin issued on July 13 saw the oil demand grow by 1% 9or 0.9 mbpd) in 2023 and 2.2% in 2024. The following factors also weighed in the global oil equilibrium:

(a) On July 2 Saudi Arabia announced that it would extend its voluntary output cut of 1 mbpd to August while Russia and Algeria volunteered to lower their August output and export levels by 500,000 bpd and 20,000 bpd, respectively. If fully implemented, that would bring a combined reduction of 5.36 mbpd from August 2022 – possibly even more because several OPEC+ countries are unable to fulfil their output quotas.

(b) An official US report predicted that the country’s shale oil production will stop growing in August after reaching 9.4 mbpd. Combined with production cuts from the OPEC+ alliance, the US decline is expected to tip the world’s oil supply into deficit by the end of the year.

(c) On the other hand, China has managed to increase its oil production to 4.3 mbpd at present, having added more than 600,000 bpd of extra production during 2018-23. It is again the world’s fifth-largest oil producer, only behind the US, Saudi Arabia, Russia and Canada, and ahead of Iraq.

(d) The International Energy Agency said that the global production will increase by 5.8 mbpd between now and 2028. About a quarter of the additional supply will come from Latin America, with Argentina, Brazil and Guyana leveraging their recent oil finds. The IEA did not factor in the possibility of Venezuela coming out of its politically imposed oil production curbs.

Country Specific Developments:

Japan’s PM Fumio Kishida began a visit on July 16 to three Gulf countries (viz. Saudi Arabia, the UAE and Qatar). The visit was focused on energy tie-ups, the country being among the top three energy importers. He was accompanied by the representatives of 40 Japanese companies. Contrary to expectations no major LNG contracts were signed but the emphasis appeared to be on green hydrogen and rare earth elements.

Thanks to oil production cuts, Saudi Arabia’s oil exports declined by 40% in May 2023 y/y to 6.93 mbpd, the lowest since Oct 2021. In a statement on July 11, nevertheless, Saudi Aramco assured its Asian clients of delivering the committed supplies, albeit at higher prices. On the other hand, Saudi Arabia imported a record 193,000 bpd of fuel oil from Russia in June July 13 (Reuters) – Saudi Arabia imported record volumes of discounted Russian fuel oil in June to meet summer power generation demand and maintain crude exports despite OPEC+ production cuts.

Iraq succeeded in reviving foreign oil companies’ interest in its upstream sector with a massive $27 bn deal signed with TotalEnergie during the middle of July based on a more attractive revenue-sharing model. Instead of paying a flat rate for every barrel of oil produced after reimbursing costs, it agreed to a hybrid revenue-sharing model under which for each barrel of oil produced, 25% would go towards the Iraqi state as a royalty, while the remaining 75% would go towards reimbursing shareholders for capital and production costs and be distributed as revenues. Besides raising production at the Ratawi oil field in the Basrah basin, the deal consists of a 1 GW solar power plant, a 600 mcf/d gas processing facility, and a seawater supply project. The crude oil revenues would be plugged into the other three projects. While Iraq initially demanded a 40% share, in the end, Total took a 45% share in the project while the state-owned Basra Oil Company took 30% and QatarEnergy 25%. On July 21, Iraq agreed to supply Lebanon with 2 MT of crude annually.

On July 30, Iran’s Oil Minister said that it would pursue its rights over the Durra/Arash field if other parties shun cooperation. He was reacting to the Kuwaiti oil minister’s statement three days ago that his country will start drilling and begin production at the Durra gas field without waiting for border demarcation with Iran. On July 11, Indonesia seized an Iranian-flagged oil super-tanker MT Arman 114 suspected of transferring oil to another vessel without a permit. It was carrying $300 mn worth of crude. Iran subsequently denied that the vessel belonged to it. On July 21, Iran denied that the oil on the tanker seized by Indonesia belonged to it. Reuters reported on July 25 that a cargo of sanctioned Iranian crude oil on Supetanker Suez Rajan that was confiscated by the U.S. has sat off the Texas coast since May 30, unable to unload because commercial agents fear any vessel that takes it will be shunned by customers.

On July 11, the UAE unveiled its revised energy plan including tripling renewable energy capacity from 3.2 GW now to 14 GW by 2030 with a far greater focus on green hydrogen. The UAE climate minister separately announced on Tuesday an updated national climate pledge under the Paris Agreement on climate change to cut emissions by 40% by 2030, raising its target from 31%. On July 14, ADNOC and OMC of Austria agreed to enter negotiations to create a $20 bn chemicals giant from two of their subsidiaries.

Kuwait Petroleum Corporation announced on July 30 that its profit during the last fiscal year had surged to $8.5 bn, the highest in a decade.

Qatari minister of energy told a natural gas conference on July 11 that his country would supply about 40% of new global LNG output between now and 2029.

Partners in Israel’s Leviathan offshore gas project said on July 2 that they would invest $568 mn to build a third pipeline.

Following economy-related developments took place in WANA countries:

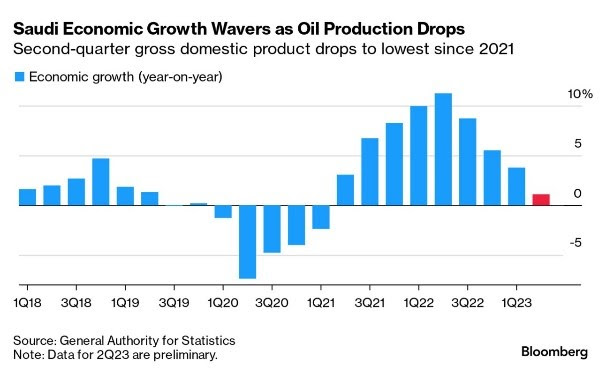

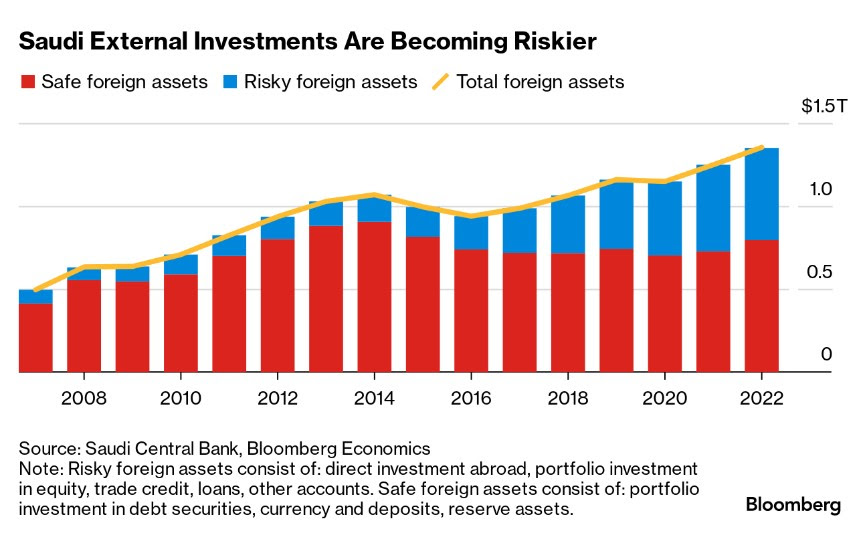

- Saudi Arabia’s economic growth declined dramatically from being the fastest in G20 in 2022 to being the slowest in the group largely due to the base effect of 2021/22, lower oil prices and curtailed production and exports. Thus the economy recorded 1.1% growth in Q2/23 – with the oil economy declining by -4.2% and the non-oil economy recording a 5.5% growth. The IMF expects the country to record a growth of 1.9% in 2023. Bloomberg estimated that if Saudi oil production cuts were to last till the end of the year, its economy would shrink by -1% in 2023. The country’s $774 bn SWF called Public Investment Fund (PIF) took a loss of $11 bn in 2022 as it dabbled into risky investments as football and golf and Western economies tethered at the edge of a recession due to the Ukraine conflict and uneven recovery from the pandemic.

- Most Gulf central banks raised their rates by 25 bps on July 26 to mirror the Federal Reserve’s move.

- On July 27, in her first press conference since taking over, the new Governor of the Turkish Central Bank pitched for a “comprehensive” monetary policy to combat high inflation running at ~40%, way ahead of the bank rate at 17.5%. The bank raised the annual forecast for inflation to 53% as the government raised fuel and other taxes on July 16 to fight the fiscal deficit that doubled y/y to $10.21 bn in the first five months of 2023 as the bills of various sops to the voters and earthquake relief measures came in. There was a stark contrast in the Turkish stock market resuming a bull run although inflation was high and Lira was plummeting. Among other good news, the tourism revenue jumped 23% in Q2/23 y/y to $12.98 bn.

- On July 3, the UAE PM announced a swathe of economic measures to sharpen the country’s competitive edge. A separate ministry of investment was to be set up to stimulate the investment environment in the UAE and to make the UAE’s legislation and procedures more investment-friendly. A Financial Stability Council would also be set up to monitor risks and deal with financial crises. According to the UNCTAD’s annual World Investment Report (WIR) release on July 5, the FDI inflow to the UAE rose by 10% to $23 bn, a new record. The UAE attracted around 60% of total FDI into the GCC bloc. FDI flows into neighbouring Saudi Arabia, the region’s biggest economy and the world’s top crude exporter, dropped almost 60% to $7.9 bn in 2022. According to the report, the UAE attracted the fourth-highest number of greenfield projects in the world last year. The UAE is also a source of investment, with $25 billion in outward investments last year, up 10% on the previous year. Dubai property market, a major source of FDI, surged: Dubai residential property prices in the year to June 30 climbed by 16.9%, their fastest in almost a decade; while average rents jumped by 22.8%. (Comment: The UAE’s performance was a contrast to the global FDI flows declining by 12% in 2022. In comparison, FDI to India grew by 10.3% to $49.4 bn and FDI to China grew by 4.5% to $189.1 bn. Indians are the biggest buyers of the Dubai properties.)

- On July 14, the UAE suspended the accreditation of Emirates Gold — which has operated in Dubai for more than 30 years — over concerns that its owners had ties to alleged money launderers. The London Bullion Market Association followed suit. The measures came amidst heightened concerns that the UAE provides a route to the market for Russian gold, subject to Western sanctions. (Further Reading: “Emirates Gold suspended from UAE and UK bullion markets”, FT, July 14.)

- On July 12, Egypt announced the sale of $1.9 bn of the state assets to local firms and Abu Dhabi wealth fund ADQ, signalling progress in reviving an economy crippled by a foreign-currency crunch and unlocking the IMF $3bn package. (Further Reading: “Egypt announces $1.9bn sale of state assets” FT, 12/7.)

- The black market value of the Iraqi Dinar declined to 1580 a US Dollar on July 26, the official rate being 1300. (Comment: This was in part due to the US ban on several Iraqi banks dealing in Dollars and partly because a more elaborate and time-consuming official procedure to get the forex pushes the stakeholders to the black market. Iraq, OPEC’s second-largest exporter, has over $113 bn in forex reserves.)

III) Bilateral Developments

- On July 15, Prime Minister Shri Narendra Modi paid a short visit to Abu Dhabi to meet the UAE President Sheikh Mohammed bin Zayed. Three MoUs (promotion of local currencies for Central Bank transactions, interlinking of payment and messaging systems and opening of an IIT campus in Abu Dhabi) were signed. The PM also met Sultan al-Jaber, President-Designate of UNFCC’s CoP28 to be held later this year in the UAE. It was PM’s fifth visit to the UAE in 8 years and was followed by the issuance of a bilateral Joint Statement and Joint Statement on Climate Change as well.

- Dr Mohammed bin Abdulkarim Al-Issa, Chief of the Jeddah-based Muslim World League, was received by President Smt. Droupadi Murmu and PM on July 12. He was also received by the NSA.

- Adm R Hari Kumar, Chief of the Naval Staff, began a three-day official visit to the Sultanate of Oman on July 31. He was received by Gen. Sultan bin Mohammed Al-Nu’amani, Minister of Royal Office, and held bilateral discussions with his counterpart.

- FICCI, MEA and the League of Arab States jointly organised the 6th India-Arab Partnership Conference in New Delhi on July 11-12.

- The government informed the parliament on July 28 that of 8330 Indians in foreign jails, 51% were in the six GCC states: UAE (1461), Saudi Arabia (1222), Qatar (696) Kuwait (446) Bahrain (277) and Oman (139). In a related development, 5 Indian women stranded in Saudi Arabia were repatriated on July 23.

- Indian Express reported on July 16 that after 10 months of incarceration in Qatar, jailed Indian Navy veterans had filed a mercy petition to the Emir of Qatar to grant them a pardon.

- As per the official data for the April-June quarter, India’s oil and gas import bill contracted by a third y/y to $35.2 bn (crude imports were $31.4 bn for 60.1 MMT at an average Brent price of 76/barrel; LNG imports were $3.8 bn for 7590 mmscm. The mmbtu cost of LNG y/y fell from $29 to $11). While crude imports fell by 1%, natural gas consumption in the country rose 2% year-on-year. During the year, India’s dependence on imports increased to 88.3% of total consumption from 86.5%. Natural gas production in the country, roughly half of the total consumption, barely changed during the quarter from a year earlier. Among the reasons for the decline in oil and gas import bills were significantly lower global prices, lower rise in consumption and discounted Russian crude.