HIGHLIGHTS

• First print of 2021-22 GDP out, many more to come

• Significant variations in six versions of the GDP data

• GDP growth in 2021-22 to help project Budget numbers

• Low demand continues to be a cause for concern

• GST collections on the rise, but there are caveats

• GST collections’ share in GDP sees no recovery

• Nominal growth in 2021-22 may not be enough to help GST

• Double whammy from industrial output and inflation

• No relief from wholesale prices in December 2021

• Implications of inflation for interest rates and Budget

• Manufacturing pulls down industrial output growth

• Indo-UK FTA talks begin, raising hopes on trade policy front

• Exports maintain growth with brighter outlook for 2021-22

First print of 2021-22 GDP out, many more to come

Early this month, the National Statistical Office or NSO released the advance estimates of India’s national income during 2021-22. Known as the First Advance Estimates or FAE, this is the first official indication of how the Indian economy may have fared in a year that is not yet over. This is the first of the six iterations of the official estimate of India’s gross domestic product or GDP in 2021-22 over the next three years. The FAE would be followed by the Second Advance Estimates, to be released a few weeks later on February 28, 2022. Then there would be the Provisional Estimates of the same GDP numbers at the end of May 2022, followed by the First Revised Estimates at the end January 2023, the Second Revised Estimates at the end of January 2024 and the Third Revised Estimates at the end of January 2025, which would be the final seal on what India’s GDP numbers in 2021-22 looked like. This is a long period of three years over which India’s national income numbers would be debated and discussed, depending on the nature and extent of variations. India perhaps is the only country which has as many as six versions of its GDP data released over as long a period as three years.

Significant variations in six versions of the GDP data

A three-year long schedule of data releases also paves the way for significant variations in the national income numbers. Take for instance just the GDP growth numbers. In 2016-17, the GDP growth as per the First Advance Estimates was 7.1 per cent. After five more iterations, the final GDP growth number, as per the Third Revised Estimates released in January 2020, was 8.3 per cent. This was a dramatic recovery of over one percentage point in the GDP growth number through different estimates in the space of three years. The reverse is also true. For 2018-19, the FAE in January 2019 pegged the GDP growth number at 7.2 per cent. By the end of January 2021, that number as per the Second Revised Estimates was revised down to 6.5 per cent. The Third Revised Estimates, the final iteration for 2018-19 growth, would be available at the end of January 2022, and it is likely that this would place the number at an even lower level. Similarly, the FAE for 2019-20 was initially pegged at 5 per cent GDP growth, but the First Revised Estimates for the same year already shows the growth to be at 4 per cent.

GDP growth in 2021-22 to help project Budget numbers

The NSO’s estimate of GDP growth for 2021-22, as per its FAE released on January 7, 2022, is 9.2 per cent. This data point will be revised five more times in the next three years. By the end of February 2022, the Second Advance Estimates of GDP for 2021-22 would be available, perhaps incorporating the impact of the third wave of the pandemic on the pace of economic activity. Yet, the real growth figure of 9.2 per cent growth or the nominal growth figure of about 18 per cent for 2021-22 would be an important tool to be used by the finance ministry for making its key assumptions on revenues and expenditure while preparing the Union Budget to be presented on February 1, 2022. Indeed, the practice of releasing the First Advance Estimates of national income in the first week of January began in 2017 to serve as an essential input for the Budget exercise. The NSO, however, admits that the FAE for the year is based on limited data and compiled using the benchmark-indicator method i.e. the estimates available for 2020-21 are extrapolated using relevant indicators reflecting the performance of sectors.

Low demand continues to be a cause for concern

These caveats notwithstanding, it would be important to take note of the key numbers that the FAE has released for 2021-22. After a record contraction of 7.3 per cent in 2020-21, the Indian economy is set to grow by 9.2 per cent in 2021-22, even though economists fear that this estimate would have to be revised downwards to consider the impact of the ongoing third wave of the pandemic. However, there is a key concern area in the GDP numbers for 2021-22. Private final consumption expenditure, a proxy for private consumption demand, accounting for over 55 per cent of GDP, is still below the level that was reached in 2019-20. In other words, consumption demand has not yet gone beyond the level that prevailed two years ago before the pandemic. This will delay the onset of the much-needed demand revival for sustaining growth in the coming years. On the positive side, investment in the economy has begun to grow, which should augur well for growth prospects.

GST collections on the rise, but there are caveats

The collections of the goods and services tax (GST) during December touched the Rs 1.3 lakh crore mark for the third consecutive month, raising hopes that the biggest indirect tax reform in the country has at last begun paying dividends in terms of a sustained revenue buoyancy. Two data points on the buoyancy of GST collections are worth noting here. One, GST collections have crossed the Rs 1 lakh crore mark in each of the last six months beginning July 2021. Two, barring the months of May and June 2020, when the second wave of Covid-19 had adversely impacted the pace of economic activity, the monthly GST collections have stayed above the Rs 1 lakh crore mark for the last 15 months.

GST collections’ share in GDP sees no recovery

But how real is the growth in GST collections? To answer this question, it is necessary to evaluate the growth in GST collections in the context of the average monthly rate and in relation to their share in gross domestic product or GDP. For instance, the total GST collections in 2018-19, a pre-pandemic year and the first full year after the rollout of the new tax in July 2017, were estimated at Rs 11.75 lakh crore. Their share in GDP was 6.22 percent. The average monthly collection that year was Rs 0.98 lakh crore, slightly better than the monthly average collection of Rs 0.9 lakh crore in the nine months of 2017-18 after its rollout from July 1, 2017. What happened in 2019-20? Remember that 2019-20 did not experience the impact of the pandemic as the economic lockdown was enforced in the last week of March 2020. Total GST collections in 2019-20 did go up to Rs 12.2 lakh crore. The average monthly rate of collection also increased to Rs 1 lakh crore. But worryingly, the GST collections of Rs 12.2 lakh crore accounted for only 6 per cent of GDP. In terms of the share of GST collections in GDP, the new tax was failing to grow as much as the increase in the pace of economic activity. Or the GST coverage was not as wide as to capture that part of the economy, which was growing at a faster pace, or the rates had been reduced or revenue leakages had increased. Seen from that perspective, the problem got worse in 2020-21, when the economy came under the firm grip of Covid-19, contracting by 7.3 per cent. Total GST collections in 2020-21, understandably, fell to Rs 11.35 trillion and the average monthly rate of collection also declined to Rs 0.94 lakh crore. But the fall in the GST collections’ share in GDP in 2020-21 was sharper – down to 5.75 per cent.

Nominal growth in 2021-22 may not be enough to help GST

The Indian economy bounced back in 2021-22, with an estimated growth of 9.2 per cent, according to the National Statistical Office. The nominal growth in 2021-22 was expected to be about 18 per cent. The big question is whether this smart recovery will have an equally significant impact on GST collections. In the first nine months of 2021-22, total GST collections are estimated at Rs 10.68 lakh crore, with an average monthly collection of Rs 1.2 lakh crore. With the Omicron impact on the economy in the fourth quarter of 2021-22, GST collections would be affected. Even if one assumes that the average monthly collections seen in the first three quarters of 2021-22 would be maintained in the final quarter of the year, the total estimated GST collections in the full year would be Rs 14.28 lakh crore. It would represent a 25 per cent increase over 2020-21 and a 17 per cent increase over the collections of Rs 12.2 lakh crore in the pre-pandemic year of 2019-20. But the GST collections’ share in GDP in 2021-22 would not show a similar increase – it would be only about 6.1 percent. The ratio of GST collections to GDP gives an important indicator for measuring how tax revenues have kept pace with the economy’s growth and possibly points to the gaps in the GST’s coverage or leakages in the system. Hence, a more appropriate assessment of the GST collections provides a mixed picture and celebrations over their buoyancy should await a closer evaluation.

Double whammy from industrial output and inflation

The Indian economy in January had to absorb the impact of three adverse developments. Industrial growth in November 2021 decelerated to 1.4 per cent, a nine-month low, retail inflation in December 2021 surged to 5.59 per cent, a five-month high, and wholesale inflation in December 2021 continued to stay in double digits. The three data sets are important also because they, along with the First Advance Estimates on GDP growth for 2021-22, would become inputs for the preparation of the Union Budget for 2022-23. The rise in the Consumer Price Index (CPI) by 5.59 per cent in December is to be seen against the much lower acceleration in the CPI by 4.91 per cent in November 2021. More worrying was the trajectory of the core inflation, which stayed above 6 per cent for December. Core inflation excludes changes in food and fuel prices, which are usually more volatile and seasonal. Hence, core inflation gives a more accurate picture of the state of inflation in the economy. Therefore, when core inflation rises, managers of the economy are more worried. More importantly the rise in the overall retail inflation in December was driven by food, beverages, clothing and footwear. Now that international crude oil prices have risen sharply in the first few weeks of January, the overall retail inflation in January is expected to see a further spike.

No relief from wholesale prices in December 2021

The annual rate of inflation, based on the movement in the Wholesale Price Index, reached an uncomfortably high level of 13.56 per cent in December 2021. A year ago, the wholesale inflation rate was just 1.95 per cent. The high rate of inflation was attributed to a rise in prices of mineral oils, basic metals, crude oil, petroleum products, natural gas, chemicals, chemical products, food products, textiles, paper and paper products. No easy and early respite from an inflationary spiral is likely.

Implications of inflation for interest rates and Budget

For Finance Minister, Nirmala Sitharaman, the rise in inflation would be a headache. The higher inflation would also influence the Monetary Policy Committee of the Reserve Bank of India, which would meet in the first week of February to look at what the central bank’s monetary policy stance needs to be in the coming months and whether the time is ripe for an increase in interest rates to rein in inflation. If indeed there is a signal from the RBI on an interest rate increase, the government’s fiscal arithmetic would have to be reworked. Already about 45 per cent of the Centre’s net revenues are accounted for by interest payments. With a higher interest rate and the need to service growing government debt, the Centre’s interest burden next year could go up further, usurping a much higher share of its total revenues in 2022-23. This could reduce the government’s flexibility in allocating higher funds for its expenditure programmes.

Manufacturing pulls down industrial output growth

Industrial output in November 2021 was only 1.4 per cent, compared to 4 per cent in the previous month. The worrying signs are that manufacturing, which has the highest weight of 77 per cent in the Index of Industrial Production, showed a growth rate of only 0.9 per cent. Even though mining and electricity reported growth numbers of 5 per cent and 2.1 per cent, respectively, these along with that of manufacturing were below the pre-Covid level of February 2020. Capital goods and consumer durable goods sector contracted by 3.7 per cent and 5.6 per cent, respectively, in November 2021. The IIP numbers confirmed fears of poor investment and consumer demand creating headwinds for industrial recovery in the economy. For the April-November 2021 period, the cumulative industrial growth was still a healthy 17.4 per cent, which reflected the low base effect as industrial output in the same period of 2020 had contracted by 15.3 per cent.

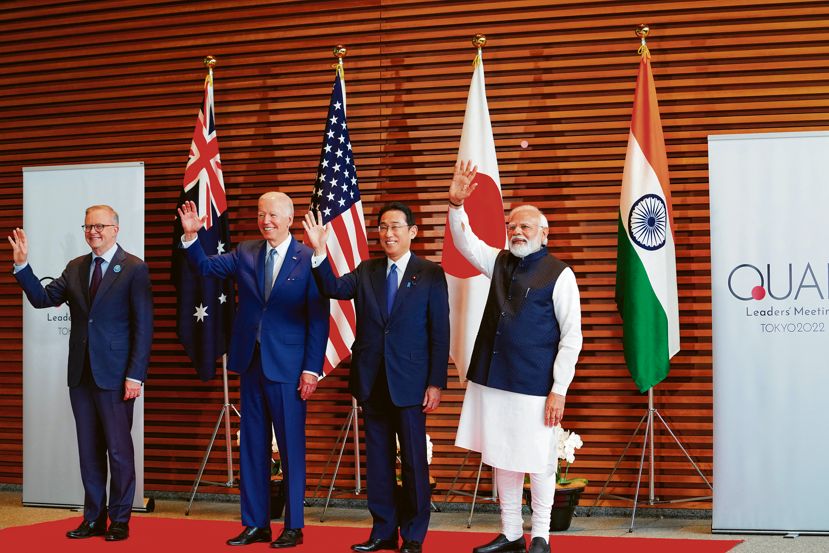

Indo-UK FTA talks begin, raising hopes on trade policy front

In what seems to be a change in its approach towards international free trade arrangements, India began negotiations with the United Kingdom in January for a free trade agreement or FTA with each other. The expectation is that the proposed FTA would help double bilateral trade between India and the UK by 2030. At present, Indo-UK bilateral trade in goods is estimated at $12 billion, with the balance hugely in favour of India. The commerce ministry expects the FTA to give a big push to Indian exports in labour-intensive sectors like leather, textiles, jewellery and processed agri-products. This is among the few bilateral free trade agreement talks that the Indian government has begun, a clear sign that the country was now open to more such engagements with international trade through bilateral or regional arrangements. Since India’s last-minute pull-out from the talks on the Regional Comprehensive Economic Partnership consisting of ASEAN countries and China, India has remained a little ambivalent towards its approach to such trading arrangements.

Exports maintain growth with brighter outlook for 2021-22

India’s exports of merchandise goods at $37.81 billion in December 2021 continued to maintain robust growth, recording a rise of about 40 per cent. The rise was on account of healthy performance of sectors such as engineering goods, petroleum products, gems and jewellery, organic and inorganic chemicals, drugs and pharmaceuticals. This augured well for India’s overall exports performance. The cumulative exports during April-December 2021 were estimated at $301 billion. At this rate, the annual goal of achieving exports of over $400 billion during the current year is all set to be achieved. On the imports front as well, the buoyancy continued, showing a rise in the demand for industrial goods – a sign of a pick-up in economic activity. India’s merchandise imports in December 2021 were estimated at $59.48 billion, a rise of 38.5 per cent over those in the same month of 2020. Consequently, India’s trade deficit in December 2021 rose to $21.68 billion, compared to $12.62 billion in the same month a year ago. An important point to be noted in India’s foreign trade in December 2021 is that its core exports (excluding petroleum and gems & jewellery) rose by 30 per cent to $28.92 billion, while imports without petroleum products and gems & jewellery rose by 34 per cent to $35.47 billion. This suggested that the growth in exports and imports was broad-based and not just linked to the petroleum and gold jewellery sector.

The previous issues of Indian Economy Review are available here: LINK

Supported by

………………………………………………………………………………………………

(The views expressed are personal)

………………………………………………………………………………………………