HIGHLIGHTS

- Political Developments

- Economic Developments

- Bilateral Developments

IA) Political Developments: Pan-Regional and Global Issues

Regional and International Developments

- 15th BRICS Summit in Johannesburg decided to invite 6 countries to join the organisation from 1.1.2024. These included four from the WANA region, viz. Saudi Arabia, Iran, Egypt and the UAE. Of these, Iranian President Ibrahim Raisi was himself present on the sidelines of the Summit. (Comment: With four OPEC+ members and two of the biggest three crude importers (China & India) in it, the enlarged BRICS seems loaded towards the global oil economy and the Eurasian issues. At the same time, the expansion eroded Beijing’s preponderance over the organisation as several West-leaning and capital-rich countries were now its members. While Saudi Arabia and the UAE are likely to use the BRICS platform to gain global stature, Egypt and Iran, which also joined SCO recently, are more likely to interested in finance from the China-funded New Development Bank affiliated to BRICS.)

- By coincidence two of the WANA choke points suffered short disruptions on August 23. While the Dardanelles strait connecting the Black Sea with the Mediterranean Sea had a forest fire, the Suez Canal was blocked due to a collision between two transiting ships. While both these disruptions were short-lived, they reminded of the region’s geo-political vulnerabilities.

- Recurrent incidents of public burning of the Quran and the resultant abomination in many WANA and Muslim countries led the Danmark government to propose a bill on Aug 25 banning such acts.

- On Aug 9, the Wall Street Journal reported that the US and Saudi Arabia had reached a broad agreement on the terms of normalisation with Israel over the next 9 to 12 months. However, a White House spokesperson denied that the two countries have agreed on a shared framework for negotiations. (Further Reading: “America’s pursuit of Saudi-Israel rapprochement”, Mahesh Sachdev, The Hindu, August 5.)

- On Aug 31, the US denied reports that it was blocking sales of certain chips used for Artificial Intelligence to the Middle Eastern countries. Earlier on Aug 16, FT reported that Saudi Arabia and the UAE were buying thousands of Nividia chips raising the spectre of these being transferred to third parties.

WANA and Ukraine Conflict:

- On Aug 6-7, Saudi Arabia hosted in Jeddah an intergovernmental conference of the National Security Advisors etc of over 40 countries to discuss the Ukraine Conflict. In a rare disagreement between Riyadh and Moscow, Russia was not invited to the event. Russian Deputy Foreign Minister commented that the meeting was “a reflection of the West’s attempt to continue futile, doomed efforts” to mobilise the Global South behind Ukraine’s position.

- The foreign ministers of Turkey and Ukraine met in Ankara on Aug 25 to jointly press for the revival of the grain export deal. Moscow, however, continued to demand the lifting of the Western financial sanctions to enable its own grain exports to resume normally before agreeing to the same. Meanwhile, the first ship using a newly created coastal corridor reached Istanbul port on Aug 18 without being intercepted by the Russian navy. Earlier, on Aug 13, Russian armed marines raided the Turkish-based vessel via helicopter in international waters near Istanbul only 60 km off Turkey’s northwest coast for an inspection before it was allowed to sail on to Ukraine.

- Reacting to an item in the Wall Street Journal claiming that the UAE is benefitting from the war in Ukraine, providing a refuge for Russian money, an official UAE source said on Aug 20 that the country has been careful not to violate sanctions imposed by its Western allies on Russia over the war in Ukraine. It has a robust process to deal with sanctioned people and companies and is in close contact with the US and the EU about the war’s implications for the global economy. (Comment: The official response did not rebut the specific allegations made. Further Reading: “U.A.E. Cashes In on Russia’s Economic Woes” WSJ Aug 20.)

- The death of Wagner militia’s top hierarchy, including its chief Yevgeny Viktorovich Prigozhin, in a plane crash near Moscow on August 23 had repercussions across WANA region countries such as Syria, Libya and Sudan where its forces were deployed. By the end of the month, the Russian state had moved to seize control of such assets. (Further Reading: “Wagner’s customers will have to adjust to new leadership”, The Economist Aug 31.)

WANA Regional Security and Terrorism

- On Aug 7, the US Navy announced that two of its ships with 3000 soldiers had arrived in the Red Sea on their way to deployment in the Gulf waters. On Aug 13, it warned commercial shipping to stay away from Iranian waters to avoid seizure by Iran. It also offered to deploy armed guards on the ships to prevent such eventuality. On its part, Iran announced on Aug 5 that it was boosting its navy with missiles and drones.

- The UN Middle East envoy said on Aug 22 that more than 200 Palestinians and nearly 30 Israelis had been killed so far in 2023 in the occupied West Bank and Israel. This level of violence had surpassed the entire death toll of 2022 and was the highest number of fatalities since 2005.

- On Aug 3 Islamic State confirmed the death of its leader Abu Hussein al-Husseini al-Quraishi as earlier claimed by Turkey and named Abu Hafs al-Hashimi al-Quraishi as his successor.

- The Ein el-Hilweh Palestinian camp in Lebanon, where clashes between two Palestinian militias began late last month continued to simmer during the month under review with the death toll rising to 13 by August 5. The fighting triggered Germany and some Gulf countries to issue security advisories against travelling to Lebanon. Lebanese PM tried to dispel these concerns.

Pakistan and WANA Region:

- Iranian foreign minister visited Islamabad in the first week of August. Power-starved Pakistan announced on Aug 8 that it would buy more electricity from neighbouring Iran.

- On Aug 8, Barrick Gold Corp, the world’s No.2 gold producer, said that it was open to bringing in Saudi Arabia’s public investment fund (PIF), as one of its partners in Pakistan’s Reko Diq gold and copper mine, among world’s largest untapped such projects. The company owns half the stake in the project other half being equally divided between the governments of Pakistan and Baluchistan. Islamabad has been discussing divestment of its share to the PIF.

China and WANA Region:

- In a teleconversation with his Iranian counterpart on Aug 19, Chinese foreign minister Wang Yi called for full and effective implementation of the JCPOA.

Afghanistan and WANA Region:

- On August 7, several media outlets reported that Taleban had raised a contingent of suicide bombers over Afghanistan’s water dispute with Iran over the Helmand River. (Further Reading: “Taliban Prepare Suicide Bombers in Water Dispute With Iran”, Bloomberg/Time Aug 7.)

- On August 23, the UAE’s Habtoor Group disclosed that the Taliban government had disallowed around 100 Afghan women from flying out of the country for higher education in the UAE on scholarships provided by the group.

WANA and Football-related Issues:

- Saudi Pro League kicked off on Aug 11 with 18 football clubs instead of 16 after an estimated $500 mn was spent to poach some of the world’s best players. (Further Reading: “Kicking up a $10bn sporting storm” The Economist, Aug 10.)

- Morocco was the only WANA participant in the FIFA Women’s World Cup Football tournament held in Australia-New Zealand during the month under review. The team failed to advance to the quarterfinals.

- Spain’s La Liga filed a complaint with the European Commission on Aug 13 over alleged illegal subsidies offered by Qatar to the Paris Saint Germane (PSG) football club owned by Doha.

IB) Political Developments

Iran:

In a sign of warming bilateral ties, On Aug 3 President Ebrahim Raisi invited UAE President Mohammed bin Zayed for a visit to Iran.

Iranian foreign minister Hossein Amir-Abdollahian visited Japan on Aug 7 and was received by PM Fumio Kishida. The two sides reiterated their respective positions on issues such as the JCPOA and the supply of Iranian drones to Russia.

During his visit to Tehran on Aug 8, the Russian deputy foreign minister criticised the West for putting unacceptable pressure on Iran over the revival of the nuclear deal.

A White House spokesman revealed on Aug 11 that after two years of indirect negotiations, the US and Iran had reached an understanding to unlock approximately $6 bn of Iranian funds long frozen in South Korea in tandem with the release of five US-Iranians in Iranian jails and an unspecified number of Iranians detained in the US. South Korean media reported on Aug 21 that these funds had already been transferred to Switzerland’s central bank which was to progressively convert them from South Korean Wons to US Dollars and Euros for eventual transfer to an account in Qatar that Iran could access transparently for mutually accepted purposes. On Aug 15, responding to the criticism of the deal, US Secretary of State Antony Blinken Secretary Blinken emphasised that the funds being transferred belonged to Iran and nothing about the deal changes the US’s overall approach towards Iran. By Aug 27, the five US detainees were moved from jail to house arrests within Iran. On Aug 11 the Wall Street Journal reported that Iran had slowed down its nuclear enrichment programme, which US Secretary of State Blinken welcomed, “if true.” Iran denied the report. (Comment: The fund release and prisoner swap deal was a marked step back from the Trump-era “Maximum Pressure” strategy. There were other faint signs of mutual accommodation, including the US turning a Nelson’s eye on Iranian crude exports. However, it remains to be seen if this would be a harbinger for similar de-escalation on the JCPOA revival. While Saudi-Iranian thaw and lower Israeli bellicosity could help, such efforts would face headwinds such as the US election year politics with anti-Iranian posturing in the Congress.)

Iran continued to claim various weapons manufacturing advances during the month. On Aug 31, it claimed to have foiled an Israeli plot to sabotage its missile and drone programme by supplying spurious foreign-supplied parts called “connectors” prone to explode in flight. On Aug 22, Iran claimed to have built “Mohajer” a 2000 km range drone with a 300 kg payload capable of flying for up to 24 hours. On Aug 2 Iran’s Revolutionary Guards’ navy unveiled new vessels equipped with 600-km range missiles.

On Aug 28, Iran’s foreign ministry claimed that Iraq had agreed that “armed terrorist groups” in Iraq’s Kurdistan region will be disarmed and relocated during next month.

Turkey:

There was a palpable step up in political and security interaction with Iraq. Turkish foreign minister made his first foreign trip since his appointment by visiting to Baghdad and Erbil on Aug 22 ostensibly for spadework for an Iraq visit by President Recep Tayyep Erdogan. The visit brought into open their differences over various Kurdish militias such as PKK and YPG, which Turkey regards as terrorist outfits, but Iraq and Syria do not. Six Turkish soldiers died on Aug 10 in an anti-PKK operation in northern Iraq. (Comment: As President Erdogan commenced his third term amidst the economy in a tailspin, there was a greater emphasis on transactionalism and light-footed tactical diplomacy. The earlier pretence towards a regional hegemony and Sunni Islamic nationalism were less in evidence. Further Reading: “President Erdogan wants to make nice with the West, on his terms”, The Economist, Aug 8.)

On Aug 1, Indonesia agreed to buy 12 Turkish drones in a deal worth $300 mn.

Saudi Arabia:

On Aug 18, Saudi Crown Prince and PM Mohammed bin Salman (MbS) received visiting Iranian foreign minister Hossein Amir-Abdollahian in Jeddah. The Iranian FM described the talks as “frank, beneficial and productive” and said that MbS had accepted an invitation to visit Iran.

In a detailed report on Aug 21 Human Rights Watch alleged that from March 2022 to June 2023 Saudi border guards had killed hundreds of Ethiopian migrants trying to cross the hostile land border between Yemen and the Kingdom. Saudi authorities denied the report.

Wall Street Journal reported on Aug 25 that Saudi Arabia was weighing a Chinese offer to build a nuclear power plant near the Qatar-UAE border. (Comment: These appeared to be well-timed Saudi-inspired media leaks to persuade the US to relax the terms of a similar offer as a part of the Saudi demands for a rapprochement with Israel.)

On Aug 16, Saudi Housing Ministry signed 12 housing agreements with Chinese companies with 5 of them worth more than $1.33 bn.

On Aug 8, a new council, under the direct control of the king, was established to supervise the affairs of the two holiest mosques of Islam. The new council, to replace an existing one under the ministry of religious affairs will supervise activities in both Makkah and Madinah, including religious lessons, sermons and calls to prayer.

Israel

On Aug 28, Papua New Guinea PM James Manape announced that he would visit Israel to inaugurate his country’s embassy in Jerusalem on September 5.

On Aug 21, PM Netanyahu said that the recent Palestinian attacks on the Israelis were backed by Iran. The accusation was denied by the Palestinian militant groups.

On Aug 11, PM Netanyahu announced that Israel had evacuated by a special flight over 200 of its citizens and Ethiopian Jews from two cities in the violence-prone Amhara region to Addis Ababa for their onward shifting to Israel.

On Aug 28, the Israeli finance minister, from an extreme right-wing party, reversed his decision to freeze the government funding for Arab-majority towns in the country after these towns observed strikes and demonstrations for a week.

On Aug 17, the US approved jointly developed Arrow-3 anti-air missile sale by Israel to Germany. At $3.5 bn it is hitherto the biggest weapon system sale by Israel to be completed by 2030.

On Aug 16 Intel scrapped a $5.4 bn deal to buy Israel’s Tower Semiconductors after China delayed its approval beyond the stipulated deadline.

Palestinian Issues:

On August 12, the Palestine Authority (PA) granted an agreement to the first ambassador of Saudi Arabia resident in Amman. (Comment: The measure seemed intended as reassurance to the PA that amidst the media reports about the US trying for a rapprochement between Israel and Saudi Arabia, Riyadh stood committed to Palestinian statehood. Ramallah, in the meanwhile, hoped that, unlike Abraham Accord signatories, Riyadh would go beyond mere optics in getting Israel to make real concessions, including acceptance of a two-state solution for the dispute.)

On August 11, President Mahmoud Abbas dismissed 16 of the 19 governors to various PA governorates. These included 4 governors for the governorates in the Gaza Strip, where Hamas has been in power. (Comment: PA, ruling al-Fateh and the PA President have been losing the credibility and trust of the population for misgovernance, corruption and inability to stand up to right-wing Israeli government determined to promote settlement activity and quash the Palestinian armed resistance.)

Sudan:

Sudan Armed Forces (SAF) Chief Gen Abdel Fattah al-Burhan made his first travel outside the country since the beginning of the civil war four months ago to Egypt on Aug 29 where he was received by President el-Sisi.

On Aug 29, Rapid Support Forces (RSF) Chief Gen Hemedti unveiled a 10-point peace plan titled “Sudan Reborn” calling for federalism, social justice and unified armed forces. It was promptly dismissed by the SAF Chief saying that RSF was a “traitor” organisation which could not be negotiated with. (Comment: The peace plan seems to be a cosmetic exercise to embellish the credentials of the RSF which has been widely accused of human rights violations, particularly in the Darfur region.)

The third week of the month saw intense fighting in Omdurman suburb of the capital, with considerable damage to civilian lives and property. By the end of the month under review, the UN sources put the total number of displaced persons by the civil war at 4 mn, of which nearly a million had become refugees in the neighbouring countries, particularly Chad. The number of civilian dead was conservative put at 4,000.

The UAE:

On Aug 14, the UAE agribusiness Al Dahra and the Abu Dhabi Exports Office (ADEX) signed a $500 mn deal to supply Egypt with imported milling wheat over the next five years.

Abu Dhabi emirates announced on Aug 15 the issuance of new industrial licences valued at $3.38 bn in H1/23, up 16.6% as compared to the previous year.

Bloomberg quoted Savills PLC on Aug 16 as ranking Dubai as the world’s best destination for hybrid work. In a related domain, on Aug 31, Bloomberg cited Emaar, Dubai’s biggest property developer, as showing that the Russians made up the highest component of 12% of its buyers in H1/23. (Further Reading: “Dubai and Riyadh are both riding property booms”, The Economist, Aug 17.)

Syria:

On Aug 9, President Bashar al-Assad gave his first TV interview since Syria’s membership of the Arab League was restored in May 2023. He discounted expectations for his country’s renewed ties with the Arab world yielding tangible benefits. He also ruled out an early meeting with President Recep Tayyip Erdogan until the withdrawal of Turkish troops from rebel-held northern Syria.

On Aug 16, the government doubled the public sector’s pay to partially compensate them for the cuts in state subsidies on fuel, etc. This led to widespread public anger over the high cost of living, particularly in the Druze-dominated Sweida region in the south bordering Jordan and Israel where public anti-regime demonstrations spilled over beyond the end of the month.

Islamic State claimed responsibility for an attack on a bus in Deir Ezzor province in the northeast on Aug 11 that killed 23 soldiers and wounded 10.

Clashes broke out on Aug 27 in the same Syrian Badlands in the northwest following the Kurdish-led Syrian Democratic Forces (SDF) arrest of the head of an Arab tribe for complicity in multiple crimes, including drug trafficking and failing to address the looming IS threat. This caused violent clashes between the SDF and armed Arab tribes, both constituents of the US-led coalition.

On Aug 28, Aleppo International Airport was put out of service following an Israeli air attack on an Iranian underground ammunition depot in the proximity.

A high-ranking US delegation comprising of 3 congressmen visited the Idlib exclusion zone on Aug 27 where nearly 4 mn anti-Assad Syrians are cloistered. It followed the Syrian government extending permission for limited UN aid to the zone from Aug 8.

Iraq:

On Aug 24, a Turkish drone strike killed 7 PKK members in Erbil in northern Iraq. (Further Reading: “The Kurds’ dreams of independence look farther off than ever”, The Economist; Aug 17.)

In an interview with Reuters published on Aug 16, the Iraqi Central Bank governor said that several new regulations to tighten the banking sector were being planned to discourage the illegal banking practices that have led to the US curbs on the supply of dollars to the country’s financial system. He declined to provide details. (Comment: Some of Iraq’s private banks have become conduits to siphon the foreign currencies to Iran in violation of the US economic sanctions on Tehran.)

Libya:

Israeli foreign ministry’s revelation on August 27 of a bilateral meeting between Israeli and Libyan foreign ministers in Rome in the previous week created a furore in Tripoli and the government was forced to sack the minister, who left the country for her safety. After this fiasco, Israeli PM Netanyahu ordered that in future all such secret contacts and their revelation would need his prior authorisation. (Comment: Among the very few things shared across the Libyan street is a visceral hatred of Israel and commitment to the Palestinian cause – a vestige dating back to the Qaddafi era. So, in retrospect, the sequence of events from the meeting to its revelation was diplomatically naïve and compounded the vicious cycle of blunders made all around. Worse, the episode could affect the ongoing US efforts to broker a weightier rapprochement between Israel and Saudi Arabia. Further Reading: “Why Libya’s cackhanded Israel diplomacy is bad for America, too”, The Economist Aug 30.)

French prosecutors announced on August 25 that former President Nicolas Sarkozy would be tried in 2025 over allegations he took €50 mn from late Libyan leader Muammar Gaddafi to fund one of his election campaigns.

On August 6, the Tripoli-based High State Council elected Mohammed Takala as its new leader.

On August 25, renegade general Khalifa Haftar’s Libyan National Army (LNA), based in Benghazi, launched air and ground offensive against the Chadian Front for Change and Concord (FACT) group based at Umm al-Araneb in Murzuq district in southern Libya. (Comment: Till recently, LNA and FACT were allies with the latter earning fame for killing Idris Deby, Chad’s long-term President, in a battle 3 years ago. However, the civil war in neighbouring Sudan has led to a reordering of the alliances and the LNA is now allied with the Chad government forces against the FACT group.)

Fighting between two outfits of the Tripoli-based Government of National Accord (GNA) on August 15-16 left 55 persons dead in and around the Libyan capital. The clashes ended with the Commander of 444 Brigade being released unharmed by the Special Deterrence Forces.

Lebanon:

Caretaker PM Najib Mikati said on Aug 17 that Lebanon’s failure to approve a string of crucial economic laws to pull the country back onto its feet threatened the country’s future economic stability. He pointed out four years had passed without a single draft financial reform act becoming law. He urged parliament to convene a special session that passes, in one package, long-pending plans to revamp the financial sector and restructure banks, to help overcome the crisis. (Comment: Unless the longstanding sectarian-based political fiefdoms gave way to a more transparent alternative, Lebanese politics would remain comatose without a President and with an acting PM and Central Bank Governor. Under these circumstances, the special session acting PM called for would remain a mere palliative exercise.)

The UN Security Council agreed on Aug 31 to extend the mandate of the UNIFIL deployed on the Israel-Lebanese border by one year. This was done on the very last day largely due to semantical differences between the US and France over the text of the resolution.

An audit report published on Aug 11 slammed the Lebanese Central Bank under its former governor Riad Salameh as “mired in opaque practices, bad governance and lacking in adequate risk management.” The successor temporary governor of the bank stated on Aug 17 that the liquid assets of the Central Bank were $8.6 bn.

Egypt:

On Aug 19, President Abdel Fattah el-Sisi pardoned several prisoners, including prominent Egyptian political activist Ahmed Douma.

On Aug 30, the Egyptian Nuclear regulator granted permission to establish the fourth and final unit of the Dabaa nuclear power complex with a capacity of 1200 MW, the project being built by Rosatom. (Comment: An agreement to start work on the Dabaa nuclear power plant was signed during Russian President Putin’s visit to Egypt in 2017. While the formal approval of the complex has finally been given, the financial viability and closure of the $28.75 bn project – to be 85% funded by Russia under a 22-year soft loan facility, is far from certain with the Egyptian economy in dire straits and Russia pre-occupied by Ukraine conflict and the western economic and technical sanctions in its wake.)

Yemen

With a tentative ceasefire holding between al-Houthi militia and the Saudi-led coalition government, the attention turned to deterioration in security conditions in the mostly desert provinces in the southeast where Al Qaeda in the Arab Peninsula (AQAP) remained active and resurgent. AQAP was responsible for two attacks on Aug 1 and 10 each of which killed five fighters allied to the Southern Transitional Council allied to the UAE. However, on Aug 11, AQAP released five UN security personnel after 18 months in captivity.

II) Economic Developments

Oil & Gas Related Developments:

Global Developments:

Oil prices ended the month with Brent crude trading at $86.86 a barrel, up 1.5% during August. This was the second consecutive month of an oil price rise. Among the noteworthy global oil and natural gas developments during the month were the following: (a) IEA raised world oil demand in 2023 to average around 102.2 mbpd, a record. According to the IEA, the global crude supply plunged to 100.9 mbpd in July with OPEC+ production falling 1.2 mbpd to 50.7 mbpd, a two-year low. It ascribed 70% of the 2.2 mbpd increase in demand in 2023 to additional Chinese consumption; (b) In their ministerial meeting on Aug 4, OPEC+ decided to make no changes in their policy; (c) A Reuters survey released on Aug 31 put the OPEC production at 27.56 mbpd in August 2023, up 220,000 bpd from July. That’s the first rise since February; The OPEC monthly bulletin, too, continued to flag healthy oil market fundamentals in H2/23; (d) Oil demand in the US topped pre-pandemic levels in May and June, with June consumption rising to 20.7 mbpd; (e) US Shale activity continued to decelerate, with rig count at its lowest in 17 months; (f) There continued to be some negativity about the performance of the Chinese economy and its oil demand growth, causing a bearish overhang on oil prices. China, the world’s biggest importer of crude, has also been heavily promoting EVs and renewables.

Country Specific Developments:

OPEC+ sources revealed that Saudi oil production and exports in June were 9.96 mbpd and 6.8 mbpd respectively, hitting 21-month lows. The country’s oil products exports fell 26,000 bpd from the previous month to 1.35 mbpd. On Aug 3, Saudi Arabia announced that it would extend its voluntary output cut of 1 mbpd to September. It nevertheless raised the prices for most of its crude to Asia for September. On Aug 7, Saudi Aramco declared that its net profit fell to $30.07 bn for Q2/23, down 38% y/y, amid weaker oil prices, lower production and thinner refining and chemicals margins. It nevertheless announced an additional nearly $9.87 bn dividend during Q3/23, most of which will go to the government, the first of 6 extra quarterly payouts on top of its expected $153 bn base dividend for 2022 and 2023.

On Aug 22, the Iraqi oil minister led a delegation to Ankara for negotiations aimed at reopening the crude pipeline from northern Iraq to the Mediterranean Sea. The negotiations remained deadlocked. On Aug 11 a drilling subsidiary of China National Petroleum Corp won a $194 mn EPC contract to drill wells with two rigs in Iraq’s Rumaila oilfield.

On Aug 13, an authoritative Iranian source claimed that the country’s crude exports were running over the 1.4 mbpd level envisaged in the current national budget. The oil ministry expected the production to reach 3.4 mbpd by September. On Aug 31, Reuters quoted various ship-tracking consultants to report that Iran’s oil output and exports jumped in August, with one consultant giving a production figure of 3.15 mbpd, the highest since 2018, and crude oil and condensate exports at just under 2 mbpd. On Aug 28, President Ebrahim Raisi inaugurated Phase 11 of the South Pars gas field, adjoining Qatar’s North Field, built by local contractors. When it is fully developed in the coming years, Iran will be able to tap 24 wells to add up to 56 mcm/d to its current capacity from the South Paras field running at 15 mcm/d. Iran currently produces about 1 bcm/d of natural gas and plans to raise production capacity by another 500 mcm/d by 2029. The president also announced that Iran is to renovate or revitalise five refineries in South Africa. On Aug 20, the US authorities began the discharge of 800,000 barrels of Iranian crude worth $56 mn from Suez Rajan, a tanker seized for contravening the US sanctions. Iran has threatened retaliation against any company unloading Iranian oil from the seized tanker. On Aug 3, Iran invited Kuwaiti foreign minister for discussions on the demarcation of the Dorra gas field in the light of the Saudi-Kuwaiti joint statement asserting their ownership.

On Aug 4, UAE’s ADNOC Gas reported a 24% decline in revenue for Q2/23 y/y, due to lower prices. On Aug 17 it signed a five-year nearly $500 mn deal to supply LNG to Japan Petroleum Exploration Co (Japex). The deal is valued at between $450 million to $550 mn. Japan imports approximately 25% of its crude oil from the UAE, making it ADNOC’s largest international importer of oil and gas products. On Aug 9, ADNOC Gas awarded a $3.6 bn contract to a UAE-Spanish joint venture to expand its gas processing infrastructure in the UAE.

On Aug 2, Israel’s energy minister waded into a longstanding national debate about larger exports of offshore natural gas by advocating higher volumes being made available to earn revenue and diplomatic goodwill. In 2022, Israel produced 21.29 bcm of natural gas, of which 9.21 bcm was exported to Egypt and Jordan. On Aug 28, Israel announced that it would expand its natural gas exports to Egypt which has been suffering power shortages due to excessive heat and dwindling domestic gas reserves. (Comment: Huge gas deposits, have been discovered in the past 15 years off Israel’s Mediterranean coast, but to ensure the future domestic energy security, the government has limited the exports. Israel has also lately been under pressure from the EU countries looking for alternatives for blocked Russian supplies.)

Exploratory drilling for oil and gas in Lebanon‘s offshore Block 9 began on Aug 24 following a landmark U.S.-brokered agreement last year setting a maritime border between Lebanon and Israel.

Following economy-related developments took place in WANA countries:

- Bloomberg reported on Aug 29 that Saudi Arabia’s net foreign assets declined by $16 bn in July 2023 to stand at $407 bn. Its Sovereign Wealth Fund (SWF) called Public Investment Fund (PIF) published its annual report on Aug 6 disclosing that at 2022 end, its assets were over $593.43 bn and it earned an 8% return on them. The PIF said 23% of its AUM were international investments, while 68% were local investments and the remainder were with Saudi treasury. While 17% of the assets were externally managed, the rest were under PIF’s direct supervision. On Aug 28, an IMF paper disclosed that Saudi Arabia spent almost $7,000 per capita, equivalent to about 27% of economic output, across both explicit and implicit energy subsidies. This was the highest among the G20 economies on a per capita basis.

- Turkey’s economy grew by 3.8% in Q2/23, a figure lower than anticipated leading Goldman Sachs to predict that it will probably enter recession this year. On Aug 24, the central bank raised the interest rate by 7.5% to 25%. Despite a 16.5% increase in the bank rate since the elections, the inflation was still over 55% in August, suggesting that more rate increases were likely. On Aug 20 the central bank began rolling back KKM, a $117 bn scheme that protected lira deposits from FX depreciation. It led to a steep cost to the exchequer as the Lira had depreciated by 68% against the US dollar since 2021 when the scheme was launched.

- Gulf aviation and tourism sector had a bumper year. Dubai Airport served 41.6 mn passengers in H1/23 up 49% y/y. It expected the total figure to cross 85 mn in 2023, which would still be short by 1.9% of the figure reached in 2019, before the pandemic. India was the top destination country with 6 mn passengers with Mumbai alone having 1.2 mn. Dubai welcomed 14 mn international tourists in 2022. Qatar Airways revenue went up by 45% to $21 bn in 2022, a record, thanks to the FIFA World Cup held in Qatar. However, Profit attributable to DP World in H1/23 was down 9.7% at $651 mn from a year earlier as trading activity was at low ebb.

- On Aug 2, Amazon announced plans to invest $7.2 bn through 2037 in Israel and launched its Amazon Web Services (AWS) data centres in the country.

- On Aug 4, Qatar extended a $775 mn loan to Argentina to enable it to make an IMF repayment.

- On Aug 31, the Kuwait Investment Authority (KIA) Chairman revealed that the country’s 70-year-old SWF currently has $250 bn of assets under management.

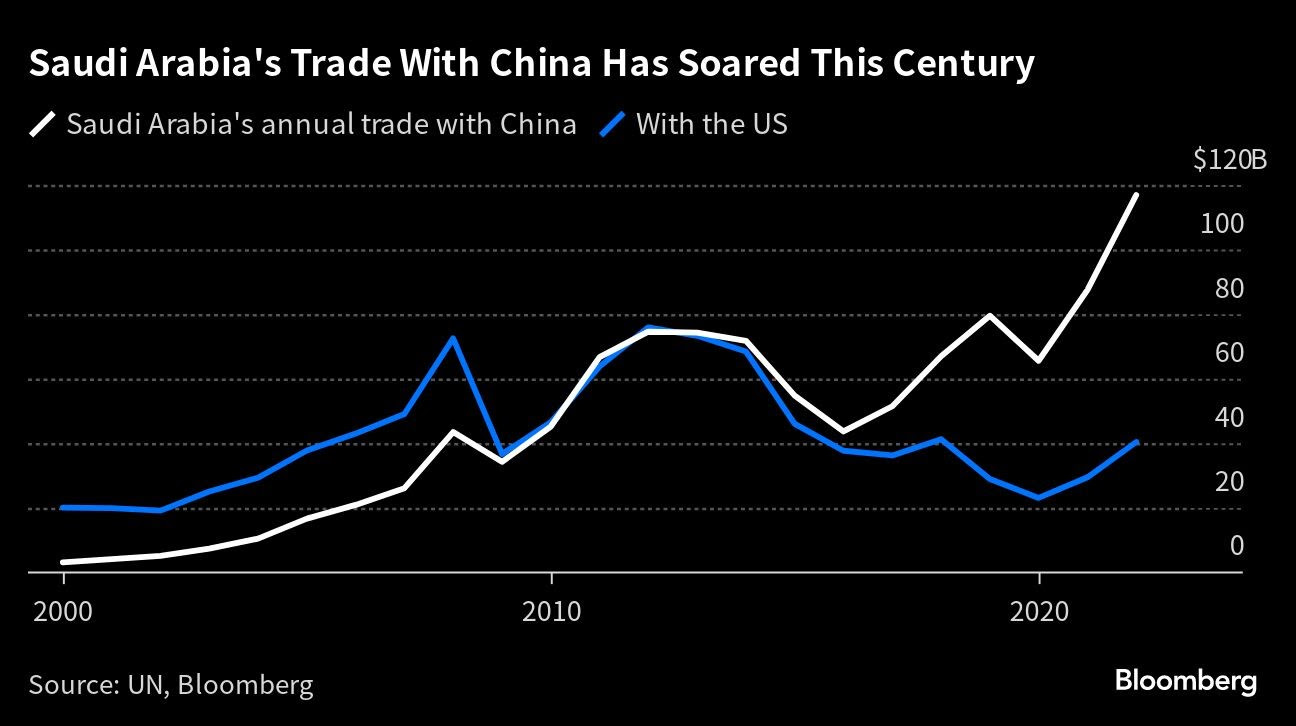

- Graphic Detail of how Saudi Arabia’s trade with China has overtaken its trade with the US. (Comment: To put in perspective, India was Saudi Arabia’s second largest trading partner in FY2023 with bilateral trade volume of $52.76 bn)

III) Bilateral Developments

- On Aug 21, the President of India, Smt. Droupadi Murmu accepted credentials from Mr Ali Achoui, Ambassador of the People’s Democratic Republic of Algeria.

- On Aug 24, Prime Minister Shri Narendra Modi issued a statement welcoming the proposed expansion of the BRICS Group to include Saudi Arabia, Egypt, the UAE and Iran from the WANA region. He met with Iranian President Ibrahim Raisi on the sidelines of the BRICS Summit in Johannesburg. The two leaders had earlier a teleconversation on Aug 18. He also had individual teleconversations on Aug 24 with President Mohammed bin Zayed of the UAE and Israeli PM Benyamin Netanyahu.

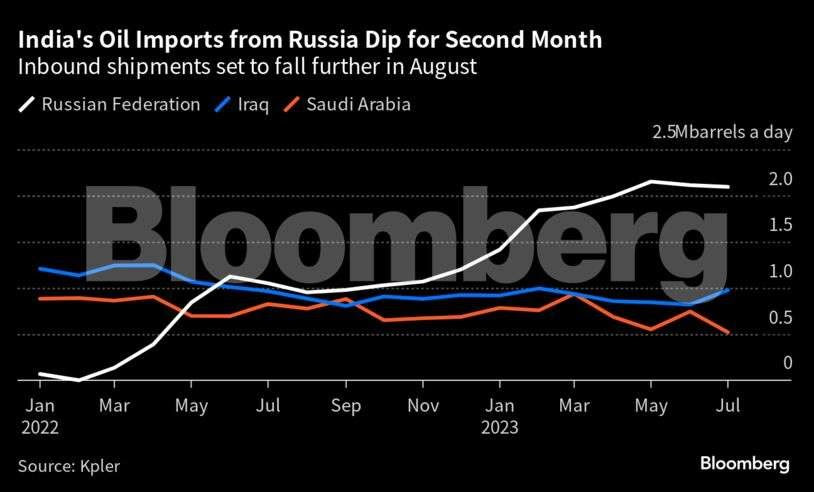

- On Aug 30, Minister of Petroleum and Natural Gas HS Puri said in a TV interview, “We are very clear in our minds that we will buy oil from wherever we can get it as long as it is delivered to our point of importation at our ports at the lowest possible price.” The preliminary estimates by Kpler of Indian crude imports in August released on 31/8 put Russian crude supplies during the month at 1.35 mbpd, down from about 1.9 mbpd in July. On the other hand, the imports from Saudi Arabia rose to 825,000 bpd from 522,000 bpd in July. The decline in Russian crude supplies was partly due to their discount having come down to less than $5/barrel vis a vis Brent and partly due to maintenance stoppages at many of the Indian refineries.

- On Aug 18, India’s Minister of State for IT, Shri Rajeev Chandrasekhar held a bilateral meeting on the sidelines of a G20 specialised event with his counterpart from Türkiye Mr Mehmet Fatih Kacir.

- A 549-strong Indian army contingent participated in “Bright Star 23” military exercises held in Egypt from Aug 31 to Sept 14. It was a first for India at this event in which 34 countries took part.

- Two Indian naval ships, viz. INS Vishakhapatnam and INS Trikand visited Port Rashid on Aug 9 to take part in bilateral exercises with the UAE naval units. A 3-member “subject matter expert delegation from the UAE Navy visited the Indian Navy’s meteorological, oceanographic and weather modelling institutions from Aug 27 to Sept 1.

- On Aug 23, Qatar Investment Authority said that it would invest $1 bn for a 1% stake in India’s Reliance Retail Ventures, the retail arm of billionaire Mukesh Ambani’s Reliance Industries Ltd.

- Dubai Ports-World announced on Aug 25 its intention to invest $510 mn by 2027 in a new container terminal at Kandla port under Hind InfraLog Pvt Ltd, its JV with the Indian government’s National Investment and Infrastructure Fund.

- Reuters reported in an exclusive on Aug 21 that the RBI was nudging local banks to ask their clients to settle the bilateral trade with the UAE using the dirham (AED) or Indian rupee (INR) to reduce the US-dollar-based transactions. The report implied that the RBI move was part of its broader aim of promoting settlement in local currencies with countries with which India has a trade deficit. Indeed, earlier during the month, Indian Oil paid ADNOC in rupees for the first time to buy 1 mn barrels of oil. Reuters also reported that the traders’ reluctance to use the INR-AED mechanism.

- Among the nine “Special Invitees” selected by India as the host for the G20 Summit in New Delhi on Sept 9-10 were Saudi Arabia, Egypt, the UAE and Oman from the WANA region.

- In yet another warning about substandard products from an Indian pharmaceutical company, on Aug 7 the World Health Organization flagged a batch of a batch of contaminated common cold syrup distributed in Iraq. The WHO said the batch of the syrup, branded “Cold Out”, was manufactured by Fourrts (India) Laboratories for Dabilife Pharma, and had a higher than acceptable limit of contaminants diethylene and ethylene glycol.

- On Aug 12 the CBI registered FIRs against four Indians asccused of committing financial frauds in Abu Dhabi and conviction by the courts there in absentia. They were hiding in India. The CBI will locally prosecute the accused and inform the UAE about the outcome through diplomatic channels.