HIGHLIGHTS

● Political Developments

● Economic Developments

● Bilateral Developments

IA) Political Developments: Pan-Regional and Global Issues

Regional and International Developments

As a follow-up to March 10 ground-breaking meeting between their respective national security advisors hosted by China, the foreign ministers of the two countries met in Beijing on April 6. The following joint statement was issued after their discussions:

“In light of the joint trilateral statement by the Kingdom of Saudi Arabia, the Islamic Republic of Iran and the People’s Republic of China, issued on March 10, 2023, on resuming relations between the Kingdom of Saudi Arabia and the Islamic Republic of Iran within the framework of coordination between the two countries on the steps needed to resume diplomatic and consular work between them, Beijing hosted discussions between Minister of Foreign Affairs of the Kingdom of Saudi Arabia Prince Faisal bin Farhan Al Saud and Minister of Foreign Affairs of the Islamic Republic of Iran Hossein Amir Abdollahian, on April 6, 2023. During the talks, the two sides stressed the importance of activating and pursuing the implementation of the Beijing Agreement, thus enhancing mutual trust and expanding cooperation, and contributing to realising security, stability and prosperity in the region. The two sides affirmed their keenness to explore ways of boosting bilateral relations and activating the security cooperation agreement between the two countries, signed on April 17, 2001, as well as the general agreement on cooperation in the fields of economy, trade, investment, technology, science, culture, sports and youth, signed on May 27, 1998. The two countries agreed to reopen their diplomatic missions within the agreed period, proceed with the necessary measures to open the embassies of the two countries in Riyadh and Tehran, and their consulates general in Jeddah and Mashhad, and continue coordination between the two sides’ technical teams to explore ways of boosting cooperation, including resuming flights, carrying out reciprocal visits of official delegations and the private sector, and facilitating the issuance of visas for nationals of the two countries, including for performing Umrah. The two sides also expressed hope that they will hold more consultative meetings and explore means of cooperation, with positive outcomes, considering the natural resources, economic potential, and many opportunities their countries have, which can help both gain mutual benefit. They also said they were ready to make every possible effort to overcome any obstacles that may hinder their cooperation. Both sides agreed to boost cooperation in order to support stability and security in the region, to mutual benefit. At the conclusion of the meeting, the two sides expressed their thanks and appreciation to China for hosting this meeting. They also thanked the Swiss government for its efforts and care for the Saudi-Iranian interests. Prince Faisal bin Farhan Al Saud, Minister of Foreign Affairs, renewed the invitation to Foreign Minister of Iran Hossein Amir Abdollahian to visit the Kingdom and hold a meeting in Riyadh. The Iranian minister welcomed the invitation and, in turn, invited Prince Faisal bin Farhan Al Saud to visit Iran and hold a meeting in Tehran, and the prince welcomed it.”

(Comment: The following aspects of the Saudi-Iranian foreign ministers’ Beijing meeting makes make the event conspicuous: (i) It took place in Ramadhan nearly a month after the NSA’s meeting and was preceded by at least two mutual phone calls. These indicated a shared determination to continue with détente and normalise it. At least on the Saudi side, it indicated the Royal family’s full support for the initiative; (ii) It took place in Beijing – even as it could have taken place in one of their capitals or within the region. This presumably indicated a willingness to keep China engaged. At the same time, there is only a passing reference to the role played by China in the Joint Statement (a bilateral document this time) and Beijing’s representation at the event was lower – from senior diplomat and polit bureau member Wang Li to foreign minister Qin Gang; (iii) The détente wavefront was expanded to include consulates, flights, the role of the private sector, visas, regional stability and security, etc. It can be surmised that while NSA’s meeting was a tentative breakthrough, the FM’s meeting indicated a longer-term positive agenda. Separately, the two countries invited each other’s head of state for a state visit.)

Apparently seeking to keep up the momentum of his country’s regional mediatory diplomacy, Chinese foreign minister Qin Gang separately phoned foreign ministers of Israel and Palestine Authority on April 17 to offer to broker peace talks among the two estranged sides. Meanwhile, the Israeli-Palestinian violence reached a new crescendo during Ramadhan with Israeli police raiding the al-Aqsa compound twice on April 5, making about 350 arrests among the stone-pelting protestors. This Israeli action was strongly criticised by several Arab and Muslim countries.

The steady normalisation of Saudi-Iranian ties had a reverse domino effect on several tense spots in the WANA region which were rooted in the Riyadh-Tehran rivalry for regional supremacy. Thus, the thaw between Kingdom and Islamic Republic had a positive impact on de-escalation in Yemen, Syria and Lebanon. It could herald greater stability in Iraq. On the other hand, it could reduce the role of some free-lancing Sunni powers, including Pakistan, which monetised these differences and insecurities. Internationally, too, China could also “encash” the gratitude of both sides for facilitating this détente through strategic projects and the sale of weapons etc – although speculations about the decline of the US role in the region were greatly exaggerated. Last but not the least, Iran’s regional isolation could attenuate making the US and Western anti-Iran nuclear position and economic sanctions awkward, if not untenable. Without lower Gulf support, Israeli actions to impede Iran’s nuclear programme would become more difficult and complicated, leading to a resort to Central Asian countries bordering Iran. (Further Reading: “Analysis: Saudi crown prince acts to realign Mideast dynamics amid concern over US support”, Reuters, April 3.)

Among the so-called Discord platform leaks of the Pentagon papers, there were some purported disclosures about the WANA countries. Of these, two merit mention: (i) A highly classified Pentagon document revealed that Russian operatives were building a closer relationship with the UAE, which hosts important US military installations. The UAE rejected the allegations, calling them “categorically false” (ii) Another document claimed that Israel’s Mossad spy service opposed PM Netanyahu’s proposed overhaul of the judiciary. This disclosure was strongly denied by Israeli PM Netanyahu.

WANA and Ukraine Conflict:

Ukrainian foreign minister Dmitro Kuleba visited Iraq on April 17 and was received by his Iraqi counterpart Fuad Hussein, who called for a ceasefire in Ukraine. Russian foreign minister Sergei Lavrov visited Iraq in February 2023.

On April 17, the Washington Post cited the recently leaked Pentagon papers to claim that the US pressure forced Egypt to abandon in early March 2023 its secret plans to supply 40,000 rockets to Russia. In a flip-flop, Cairo then approved the sale of artillery ammunition to the US “for transfer to Ukraine.”, The paper called the shift an “apparent diplomatic win” for President Joe Biden’s administration. (Further Reading: “Egypt nearly supplied rockets to Russia, agreed to arm Ukraine instead, leak shows” WP, April 17.)

There were greater signs of synergy between Iran and Russia, two economies under severe Western economic sanctions. Reuters reported on April 11 that in February and March, Russia supplied up to 30,000 tonnes of gasoline and diesel to Iran by rail. Aeroflot announced on April 11 that it had sent one of its Airbus planes to Iran for repair as its maintenance capabilities were crippled by Western sanctions.

On April 12 the US Treasury imposed sanctions on four Turkey-based entities which allegedly violated U.S. export controls to help Russia’s war effort by sending the “dual-use” goods.

WANA Regional Security and Terrorism

On April 30 President Recep Tayyip Erdogan said that Turkish intelligence forces killed Islamic State leader Abu Hussein al-Qurashi during a raid on Jandaris in northern Syria. (Comment: The assassinated militant was appointed only in Nov 2022, indicating that the shelf-life of ISIS heads is getting shorter as their nemesis catches up with them. It was unusual for Turkey, which had often been accused of being sympathetic to Syria’s Sunni rebels, including ISIS, to assassinate the ISIS leader in an exclusion zone under Ankara’s protection. Various motives, from earning brownie points from both US and Syria to an eye on Turkish elections could be attributed to the action.)

On its part, US CENTCOM forces were also active in two operations against ISIS this month in the same zone in the northern Syrian enclave controlled by anti-Assad rebels. On April 3, they killed Khalid ‘Aydd Ahmad al-Jabouri, a senior Islamic State leader in Syria in a drone attack. On April 8, the US helicopter raid in eastern Syria nabbed Hudayfah al Yemeni, an Islamic State operative and two of his accomplices.

Pakistan and WANA Region:

Long-promised financial assistance from Saudi Arabia and the United Arab Emirates was realised during the month, which in turn, fulfilled the main pre-requisite for the release of the IMF credit facility. Riyadh pledged $2 bn on April 6 and the UAE followed with $1 bn on April 14. Separately, on April 7, Saudi Fund for Development signed an agreement with Pakistan for a $240 mn loan agreement for a multi-purpose Mohamand dam in the northwest of the country.

Four Pakistani border patrol soldiers were killed in an ambush on April 1 by Baluch Liberation Army, a separatist group operating from Iran. The attack was condemned by Pakistani PM Shehbaz Sharif. Iran’s embassy in Islamabad condemned “the terrorist attack in Baluchistan state and said terrorism is a common affliction of the two friendly and neighbouring countries.”

IB) Political Developments

Sudan:

The protracted stalemate in negotiations between Sudan’s armed forces (SAF) and Rapid Support Force (RSF) over the creation of a unified command structure, as required under Dec 2022 political settlement, flared into an armed conflict on April 15. At stake were not only the hierarchy but also the vast economic paraphernalia both sides had acquired through the military rule that has been the norm in Sudan’s existence as an independent country since 1955. Both sides fought pitched battles to control the strategic assets, from military bases to administrative infrastructure. In no holds barred fighting, SAF extensively used air force leading RSF to take shelter in civilian areas. The fighting was particularly intense in the capital Khartoum, where even hospitals were not spared. The pro-democracy civilian groups, that had overthrown long-ruling military dictator Omar Hassan al-Bashir in 2019, were left mute spectators to the bloody conflict waging between SAF led by Gen Abdel Fattah al-Burhan and RSF under Gen Mohamed Hamdan Dagalo (also called Hemedti, or “my protector”). Both the antagonists have tried to curry favours with influential opinion makers such as civil society, Islamists and supporters of former ruler Gen al-Bashir who was released from jail and put in a SAF hospital “for his protection.” By the end of the month under review, the fighting had led to the death of at least 528 persons and injuries to 4600. As per the UN sources, among the several thousand that had sought refuge in neighbouring countries were 20000 to Chad, 4000 to South Sudan, 3500 to Egypt and 3000 to Central African Republic.

While the SAF-RSF clashes were rooted in long-simmering rivalry for domestic preponderance, they had foreign involvement as well. Firstly, as fighting engulfed the capital and other areas, several countries and international organisations such as the UN, Arab League, African Union and IGAD, sought to press for a ceasefire at least to evacuate the diplomatic missions’ personnel and foreigners. After several failed attempts, a three-day ceasefire was agreed on April 22 to mark the end of Ramadhan and to celebrate Eid al-Fitr. It provided a window of opportunity for the evacuation of foreigners as well as some Sudanese, either by airlift or by sea from Port Sudan. (Comment: In retrospect, the political instability and fighting in Sudan are rooted in several causes common in Sahel countries, including frayed social structure, weak political institutions and misgovernance. The incipient conflict was bad news for several reasons: firstly, as the third-largest country in Africa by area and second-largest by population in the Arab world, Sudan’s stability is important. Secondly, Sudan shares a border with eight countries, seven of which are facing their respective security fragilities which could spill over both ways. Relevant to note that for some time in the 1990s Ossama bin Laden was based in Sudan). Thirdly, Sudan has a Red Sea coast that straddles Yemen and oversees the seaborne trade through the Suez Canal. While Egypt considers itself the Big Brother of Sudan, its interference is often resented. Egypt, being ruled by an ex-army general, is regarded as close to SAF. On the other hand, RSF having contributed its troops to the Saudi-led coalition in Yemen, is deemed to have a sympathetic ear in Saudi Arabia and the UAE. RSF is also believed to be close to Gen Haftar’s Libyan National Army. There were some reports about the involvement of Russia’s Wagner Group. Further Reading: “Sudan is sliding towards civil war”, The Economist, 20/4; and “There is much danger in the Sudan crisis but also an opportunity” Abdelwahab El-Affendi Al-Jazeera 17/4.)

Iran:

Iraqi President Abdul Latif Rashid visited Iran on April 29 during which he was received by Supreme Leader Ali Khamenei and President Ebrahim Raisi.

Iranian foreign minister Hossein Amirabdollahian visited Lebanon on April 28.

On April 30 Iranian parliament voted to remove the minister of industry, mines and trade for failing to control “skyrocketing prices of automobiles and the rising costs of industrial production” and lambasted him for mismanagement. He was the first minister of Raisi Presidency to be thus removed.

On April 27, Iran seized a Marshall Islands-flagged oil tanker Advantage Sweet in the Gulf of Oman in apparent retaliation for the US action of taking control of the oil cargo aboard the Marshall Islands tanker Suez Rajan. In a step likely to exacerbate tensions, on the same day, 12 U.S. senators urged President Biden to remove policy hurdles preventing the Department of Homeland Security from seizing Iranian oil shipments.

Iranian and foreign media sources reported that Iran had acquired 24 Su-35 advanced fighters from Russia likely in exchange for the Shahed drones. (Comment: If true this would be the first major acquisition by the Iranian air force since the Islamic revolution of 1979 leading to the Western sanctions being imposed on the sale of military platforms. The induction of such state-of-the-art aircraft into the Iranian armoury is likely to significantly alter the balance of power in the region. The reports also hinted that these jets were initially destined for Egypt, which reneged on the deal under Western pressure.)

Belgium’s prime minister stated on April 27 that his country was looking into an Iranian request for a prisoner swap involving an Iranian diplomat convicted of terrorism with a Belgian aid worker in an Iranian jail.

On April 19, the US sanctioned several concerns in Iran, China and Malaysia for assisting Iranian drone manufacturing capabilities.

Relations between Iran and neighbouring Azerbaijan worsened during the month as Baku expelled 4 Iranian diplomats over “provocative actions.” Azerbaijan also decided to open an embassy in Israel, Iran’s arch enemy and host the Israeli foreign minister for a bilateral visit. Iranian and Azeri foreign ministers had a teleconversation on April 8, but apparently failed to reconcile their differences.

Israel

Despite the Netanyahu government having ordered a “pause” on the judicial “reform” package, the popular protests continued during the month under review calling for the proposals to be abandoned altogether. These even marred the celebrations of the 75th anniversary of Israel’s independence. An opinion poll on April 10 suggested that if the elections were held now, the ruling coalition would get only 46 seats instead of the 64 it got in the last election held last November. Despite various measures, including revoking the firing of the defence minister (April 10), the misgivings continued in top brass as well as Israel’s hi-tech economy, which also took a hit from the collapse of some banks in the US and Switzerland.

On the other hand, hardliners, including the Jewish settlers, also took to the streets of Israel and occupied West Bank. On April 2, the Israeli cabinet approved ultra-nationalist security minister Ben Gvir’s plan for creating a National Guard to curb Arab unrest, but held off on giving him its direct command to avoid the force becoming a sectarian “militia.”

The Israel-Palestine security situation continued to be unsettled during the month with tit-for-tat attacks at lone-wolf and collective levels. On April 7, three Israeli women in a car were shot dead in the West Bank. The same day a car driven by a Palestinian driver rammed into a crowd in Tel Aviv killing one tourist and wounding 5. Following Israeli police raids on the al-Aqsa compound on April 6 and 7, rockets were fired on Israeli targets from Gaza as well as south Lebanon. Israel attributed both to Hamas, the militant organisation ruling Gaza which also has some military presence in south Lebanon in collaboration with local militant group Hizbollah. Israeli retaliatory air raids followed on both. A car-ramming incident in Jerusalem on April 24 injured 4 persons. On April 11, Israel halted visits by Jews and non-Muslim tourists to al-Aqsa mosque until the end of Ramadhan. With the killing of two Palestinian militants near Nablus on April 11, the total number of Palestinians killed, most of them fighters in militant groups but some of them civilians, since January crossed 90. At least 19 Israelis and foreigners have also died. On April 23, a Jordanian member of parliament with diplomatic immunity was arrested at an Israeli customs checkpoint for attempting to smuggle weapons and gold into the West Bank in his vehicle. He was subsequently handed over to the Jordanian authorities for prosecution.

Israeli foreign minister visited Azerbaijan and Turkmenistan, two countries bordering Iran, on April 19 and 20 respectively.

On April 10, Israel signed a $400 mn deal to sell Spike anti-tank missiles to Greece.

According to new research published on April 11 by Microsoft and the internet watchdog Citizen Lab, spyware created by Israeli firm QuaDream has been used against journalists, opposition figures and advocacy organizations across at least 10 countries.

The UAE:

President Mohammed bin Zayed Al-Nahyan paid a visit to Egypt to meet President Abdel Fattah el-Sisi on April 12

On April 28, Sheikh Mohammed bin Rashid (MbR) Al-Maktoum, Ruler of Dubai appointed his son Sheikh Ahmed bin Mohammed bin Rashid Al-Maktoum as the second deputy ruler of the emirate. Sheikh Maktoum bin Mohammed bin Rashid al-Maktoum, one of MbR’s sons and UAE Finance Minister would continue to be the first deputy ruler.

On April 17, Italy lifted an embargo on arms sales to the UAE. It was imposed in January 2021 in the wake of Italian weapons being used in Yemen and its revocation is likely to reduce the bilateral friction.

On April 7, a UAE court dismissed the South African request for the extradition of two Gupta brothers accused of fraud and financial maleficence. The court ruled that the request did not meet the strict standards required for such legal documents. There were subsequent unconfirmed reports that the two Indian-origin brothers were seeking asylum in Cameroon and Central African Republic. In a separate case, the UAE agreed to extradite Sanjay Shah, a British national, to Denmark to face an allegation of defrauding the Danish treasury of $1.32 bn in false claims of dividend tax refunds.

17 persons were killed in a Dubai building fire accident on April 16. Among the dead were 4 Indian nationals.

Turkey:

President Recep Tayyip Erdogan launched his re-election campaign on April 11 with a manifesto pledging to slash inflation to single digits and boost growth, as he sought to extend his two decades in power in a May 14 vote for presidency and parliament. However, in an opinion poll published on that day, 42.6% of respondents said they would vote for Kemal Kilicdaroglu, his main opponent from a six-party opposition coalition, and 41.1% for Erdogan in first-round voting, with the other two presidential candidates receiving 7.2% support. Apart from populist measures and strong-arm tactics against the opposition, President Erdogan sought to sway voters by launching strategic and eye-catching projects such as the launch of first amphibious assault ship (April 10); off-shore gas generation (20/4); first nuclear power plant (27/4, “world’s largest civil nuclear project” was launched with President Putin via video link – although it would generate power only in 2024); and launch of “Kizilelma” – new ‘highly autonomous’ combat drone (29/4). Opposition candidate Kilicdaroglu, dubbed by local media as “Gandhi Kemal”, has highlighted Erdogan’s misrule in terms of voodoo economics leading to high inflation, tardy earthquake relief, bouts of muscular foreign policy, weakening of Turkey’s “Kemalist” secular legacy and centralisation of power in the executive presidency at the expense of weakened political institutions. The opposition promised to undo the Erdogan era’s excesses. (Comment: The coming elections are widely regarded as the most consequential in modern Turkey as it presents the voters with clear choices. While Erdogan’s first decade in power brought prosperity, during the second decade he moved the country towards greater authoritarianism. Most observers expect May 14 first round not to yield a clear majority winner – thus making the run-off between the top two contenders on May 28 necessary. This would then likely make it an endurance test between Erdogan, 69, (who was indisposed for 3 days on April 27-29 with an upset stomach) and Kilicdaroglu, 73. The country’s long-persecuted Kurdish minority, some 15% of the total population, could be critical in such an eventuality. Conventional political wisdom believed that in case opposition prevails, the country’s foreign policy would undergo some re-balancing with anti-west tilt being corrected. However, domestic policies, particularly the unorthodox low-interest rate regime, are likely to undergo a drastic overhaul and may take years to roll back.)

During the month there were some tentative signs of the Biden administration taking steps to improve ties with Turkey. These included notifying Congress on April 17 about the intention to sell Ankara $259 mn worth of F-16 gear and on April 19 the US Supreme Court gave the state-owned Halkbank another chance to avoid criminal charges for helping Iran evade the American sanctions.

Yemen:

The month saw the first tangible results of the process of de-escalation of the conflict waged in Yemen since March 2015. On April 9, Saudi and Omani delegations held peace talks in Sanaa with Houthi officials led by Mahdi al-Mashat, head of the al-Houthi Supreme Political Council. During the ten days beginning April 7, port restrictions were lifted and more than 869 prisoners were exchanged. While the Sanaa talks were aimed at consolidating the informal ceasefire in the short term, its long-term objectives were more ambitious. On its part, Riyadh seeks a permanent ceasefire to end its military involvement in the country’s long-running war and peace across the bilateral border in the southeast. Al-Houthis aim at an “honourable peace” and the Yemeni people aspire to “freedom and independence.” They demand a full reopening of Houthi-controlled ports and the Sanaa airport, payment of wages for public servants, rebuilding efforts and a timeline for foreign forces to exit the country. These talks, mediated by Oman are in tandem with the UN efforts for peace in the country.

(Comment: Yemeni civil war, now in its ninth year, has been described as the contemporary world’s worst humanitarian disaster with horrific data. A Saudi-led bombing campaign has killed around 9,000 civilians; between 2015 and 2020 disease and famine killed at least 131,000 more; Yemen, already one of the poorest Arab countries, currently has nearly 80% of its 30 m people rely on foreign aid, and the Houthis have carried out more than 1,000 rocket or missile attacks and flown at least 350 drones on Saudi Arabia and the UAE since the war began – bringing the hostilities to cities as far as Jeddah and Abu Dhabi. The ground fighting has been reduced to a war of attrition and the Saudi-backed Aden-based coalition government, has been ineffective and divided into various factions. Riyadh has been trying to extricate itself from its “Vietnam” for quite some time, particularly after the UAE decided to withdraw its forces from Yemen in 2019. Ending the mess in Yemen was arguably the main motivation for Riyadh to agree to reconcile with Tehran, long seen as the patron of al-Houthis. However, much water would have to go down the Baab al-Mandeb strait, before vexing issues such as the future political structure of Yemen are sorted out. With al-Houthis feeling triumphant, they may wish to extend their writ to the entire country, if not to the oil-producing areas around Marib in central Yemen. So, the near-term prognosis is for limited peace and low stability for the devastated country. Further Reading: “A prisoner swap is a symbolic step towards ending the Saudi-led war in Yemen” The Economist, April 20.)

78 persons died in a stampede in Sanaa on April 20 at a Ramadhan alms donations centre.

Syria:

The process of normalisation of ties between Bashar Al-Assad government and regional countries gathered further momentum during the month under review. Syrian foreign minister Faisal al-Mikdad visited Egypt on April 1. His visit to Saudi Arabia on April 12 resulted in an agreement to restore direct flights and resume consular services. On April 14, Saudi Arabia hosted a meeting in Jeddah of the foreign ministers of GCC states, Iraq, Jordan and Egypt to discuss the specific terms for Syria’s return to the Arab League. Saudi foreign minister Prince Faisal bin Farhan came to Damascus on April 18 and was received by President Al-Assad. Tunisia and Syria, too, agreed on April 12 to appoint ambassadors in each other’s capitals.

At a separate level, Russia hosted talks involving defence ministers and intelligence chiefs of Syria, Turkey and Russia and Iran in Moscow on April 25. The talks, held at Turkey’s suggestion, discussed strengthening security in Syria and the normalisation of ties between Ankara and Damascus. All four countries reaffirmed their desire to preserve Syria’s territorial integrity and the need to intensify efforts for the speedy return of Syrian refugees to their country.

Israel’s unacknowledged air attacks on Syria, meant to impede military involvement of Iran and pro-Iran militias continued during the month. The targets included Homs (2/4 & 29/4), Damascus (9/4 & 4/4) and Masyaf (8/4). On the other hand, Israel claimed to have shot down an unidentified aircraft (2/4) and 8 rockets (9/4) from Syria.

Iraq:

The Iraqi presidency called on Turkey on April 8 to apologize for what it said was an attack on Sulaymaniyah airport in northern Iraq, saying Ankara must cease hostilities on Iraqi soil. According to a report a drone attack took place in the vicinity when Mazloum Abdi, chief of Syrian Democratic Forces (SDF), a Kurdish militia Ankara regards as a terrorist outfit, was at the airport. He was unharmed.

Palestine Authority:

Palestine President Mahmoud Abbas visited Saudi Arabia and was received by Crown Prince Mohammed bin Salman on April 19. The visit coincides with the arrival there of a senior delegation of Hamas, ruling Gaza, headed by its politburo chief Ismail Haniyeh. (Comment: Hamas has been out of favour with Riyadh for nearly a decade due to its proximity to the region’s radical Sunni countries such as Qatar and Turkey. In 2021, Saudi Arabia arrested 69 Palestinians and Jordanians for their alleged ties with Hamas. Rehabilitation of Hamas, which is implacably opposed to Israel could be meant as a complex Saudi signal to Israeli leaders who have been hoping for a breakthrough in relations with the Kingdom. Further Reading: “The Palestinian Authority is being eclipsed by radical militants” The Economist April 11.)

Egypt:

Egyptian President Abdel Fattah al-Sisi visited Saudi Arabia on April 2 as Cairo continues to seek financial inflows to ease pressure on its currency and bolster a faltering economy. Oil-rich Saudi Arabia has long provided financial support to Egypt but recently signalled it would no longer provide such backing without strings attached. The trip also comes amid a major diplomatic realignment in the region, with moves by Saudi Arabia and Egypt to ease tensions with Syria, Iran and Turkey.

Lebanon:

On April 18, the Lebanese parliament voted to extend the terms of municipal councils and other local officials, delaying elections to avoid further political paralysis.

On April 14, Lebanon’s security forces seized an estimated 10 mn pills of Captagon, a narcotic drug being smuggled to Senegal en route to Saudi Arabia.

On April 18, US prosecutors on Tuesday charged Mohammad Bazzi, an alleged financier of Lebanon’s Hezbollah with evading the US sanctions imposed on him by exporting hundreds of millions of dollars worth of diamonds and artwork. One of the alleged co-conspirators, Sundar Nagarajan, was arrested in England for suspected terrorist financing and money laundering.

Qatar:

Qatar’s ties with each of Bahrain and the UAE moved towards normalisation during the month, more than two years after an Arab boycott of Qatar was lifted. On April 12, Qatar and Bahrain announced their intention to resume their diplomatic ties. In a separate but linked development, on April 18, Qatar and the UAE agreed to restore their diplomatic ties and reopen their embassies as soon as possible. (Comment: The revival of Doha’s ties with Manama and Abu Dhabi was spurred by Saudi Arabia’s reconciliation with Iran. These moves were likely to help revive the Gulf Cooperation Council, at least in form if not substance.)

Tunisia:

On April 18, Tunisian authorities closed down the headquarters of the main opposition Ennahdha party, a day after arresting its leader Rached Ghannouchi, who was the speaker of Tunisia’s parliament before President Kais Saied dissolved it.

Kuwait:

On April 9, Kuwait announced a new cabinet, its seventh in three years, with the previous government having resigned in January, just three months after taking office. One of the significant changes was the appointment of a new minister for finance and economic and investment affairs as the previous incumbent had run afoul of the parliament. On April 17, Kuwait’s crown prince said that although the previous parliament would be reinstated based on a Constitutional Court ruling last month, it would be dissolved and that new legislative elections would be called in the coming months.

II) Economic Developments

Oil & Gas Related Developments:

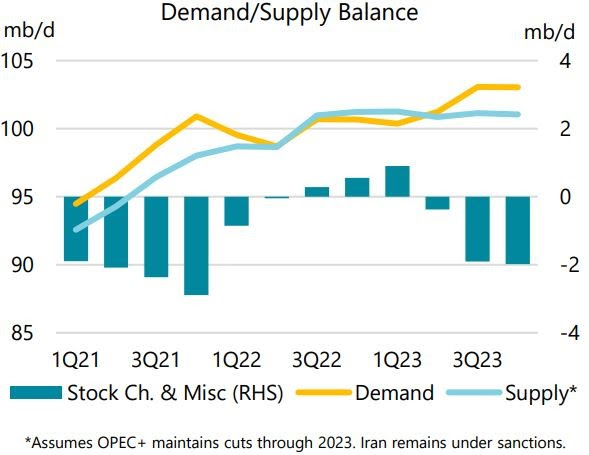

On April 2, OPEC+ announced its surprising decision to cut its collective output by 1.66 mbpd from May 1 and last until the yearend. Its statement said that the measure was aimed at regaining stability in the global oil market where crude prices have drifted downwards due to factors such as bank failures, fiscal pressures and the threat of recession outscoring the growth in Asian demand. Taken with the previous cut of 2.0 mbpd by OPEC+ since Oct 2022 and Russia’s voluntary cut of 0.5 mbpd since Feb 2023, the total supply reduction amounted to 3.66 mbpd or 3.7% of the global demand. In their respective monthly oil bulletins OPEC and IEA, issued on April 13/14, contested the OPEC+ cut. While OPEC sought to portray the move as “precautionary”, the IEA described these cuts as heightening “the risk exacerbating an oil supply deficit expected in the H2/23 that could hurt consumers and global economic recovery.”

While the crude oil prices spurted by 6% in the following week, these ended the month nearly 1% lower continuing a downward drift for the fourth month running. On April 28, the Brent crude for June delivery was quoted at $79.54/barrel.

The demand side anecdotal evidence seems to indicate that the global love affair with the internal combustion engine is hovering about an inflexion point. Thus, Bloomberg revealed on April 21 that while the US consumed a record 396 mn gallons of petrol daily in 2018, the figure had fallen to 369 mn gallons in 2022 – partly due to the pandemic, greater use of e-vehicles and work-from-home trend. A Bloomberg report on the next day mentioned that China, the world’s biggest car market and largest crude importer, was expected to have a 34% rise in e-vehicles sales in 2023 to 8.1 mn units, or nearly 30% of the total. Chinese refineries were well aware of the shift, with the newest mega plants designed to produce more petrochemicals and plastics and less gasoline. At a different level, a Bloomberg article quoted a Shell study of the performance of six new energies as saying that solar and wind energy were growing at a faster clip and they together now generate more electricity than the world’s nuclear power. BloombergNEF expects 316 GW of solar power and 110 GW of wind power to be added globally during 2023 – taken together they equal the entire power generation capacity of India. (Further Reading: “Solar and Wind Are Growing Faster Than Fledgling Nuclear and LNG Once Did” Bloomberg April 3.)

The export of crude from Iraqi-Kurdistan via an overland pipeline to Turkey’s Ceyhan port was blocked on March 23 due to the ICC verdict; it could not be resumed during the month despite the Iraqi government signing an agreement with Kurdistan Regional Government on April 4 as Turkey put conditions and sought negotiations. On April 11, Iraq file a petition with the US District Court of Columbia for “Recognizing, Confirming, and Enforcing the final award issued by the arbitral tribunal” against Turkey related to Iraqi oil exports through a pipeline to a Turkish port.

On April 4, Iraq agreed to a smaller 30% stake in TotalEnergie’s long-delayed $27 bn project to build four oil, gas and renewables projects with an initial investment of $10 billion in southern Iraq over 25 years. QatarEnergy is also likely to take part in the consortium and will have a share in the project. (Comment: The deal signed two years ago has stalled over negotiations with Iraq demanding a higher share. However, despite its high potential oil wealth, Iraqi oil production has stagnated due to various reasons such as insecurity, regulatory opacity and a downturn in the oil market. In recent years, several oil majors such as ExxonMobil, Shell and BP have scaled back or quit their operations in Iraq. Baghdad hopes that a revival of the project could help reverse the exit of oil majors from the country.)

On April 12, QatarEnergy and China’s Sinopec agreed to have the latter take a 5% stake in the eastern expansion of Qatar’s $30 bn North Field liquefied natural gas (LNG) project with a capacity of 8 mn tons per annum. While five Western oil majors have already taken similar stakes in the project last year, Sinopec is the first Asian company to do so. In Nov 2022, Sinopec and QatarEnergy signed a deal to supply 4 mn tons of LNG annually for 27 years – the longest such contract signed by Qatar.

On April 5, Saudi Arabia raised the prices of its flagship crude for Asian buyers by 30 cents to $2.80 a barrel over Oman/Dubai quotes. The Saudi oil price for Asia has been rising now for the third straight month.

Following economy-related developments took place in WANA countries:

According to the economic projections released by the International Monetary Fund (IMF) on April 13 GDP growth in the Middle East and North Africa region will slow to 3.1% in 2023, from 5.3% a year ago. In particular, the growth among MENA oil exporters will slow to 3.1% from 5.7% last year while the low-income countries in the region will lag, with growth forecast at 1.3% this year as high commodity prices, macroeconomic instability and country-specific fragilities weigh. IMF head said that the world economy is expected to grow less than 3% in 2023, down from 3.4% last year as persistently high interest rates, a series of bank failures in the US and Europe, and deepening geopolitical divisions take their toll. She added that the global annual growth is expected to remain at about 3% level for the next five years, calling it “our lowest medium-term growth forecast since 1990.” (Further Reading: “Welcome to a new era of petrodollar power” The Economist, April 9.)

With Turkey’s tottering economy as the primary concern for the voters going for elections on May 14, President Erdogan’s government continued to face headwinds. The annual inflation stood at 50.5% in March 2023. The government spending on rebuilding and aid efforts could lift the ratio of budget deficit to GDP to above 5% in 2023, up from around 1% in 2022. The economic cost of the earthquakes, estimated at $104 bn, is expected to reduce growth this year by up to 2%. In a report on April 14, JPMorgan predicted that under elevated economic volatility, Turkey’s lira could drop sharply to 30 to the dollar following the elections from its current level of around 19. (Further Reading: “Recovery from Turkey’s earthquake will take years” The Economist, April 13.)

According to IMF data, Saudi Arabia recorded GDP growth of 8.7% in 2022, the highest among G20 countries, as high oil prices boosted government revenues by 31%, leading to its first fiscal surplus in almost a decade. For 2023, however, IMF projected the growth to be significantly lower at 2.6%. Saudi economy, while decelerating from the high base effect of higher oil prices last year, continued to benefit from the tailwinds. Thus, unemployment among Saudi citizens fell to 8% in Q4/22, down from 9.9% in the previous quarter. The seasonally adjusted Saudi Purchasing Managers’ Index eased to 58.7 in March, down slightly from 59.8 in February, the highest reading in almost eight years. On April 16, a 4% stake in oil major Saudi Aramco has been transferred from state ownership to Sanabil Investments, wholly owned by the Public Investment Fund (PIF), the country’s sovereign wealth fund. On April 5, Savvy Games Group, wholly owned by Saudi Public Investment Fund (PIF), agreed to acquire Scopely, a US-based maker of mobile games, for $4.9 bn. The deal appeared to be a part of PIF’s $37.85 bn initiative aimed at making the kingdom a global hub for gaming.

On April 27, the UAE and Cambodia concluded negotiations for a Comprehensive Economic Partnership Agreement (CEPA). The UAE’s non-oil trade with Cambodia exceeded $401 mn in 2022, up 31% from the previous year, while bilateral FDI reached almost $4 mn by the end of 2020. The UAE has already signed CEPAs with India, Indonesia, Israel and Turkey, and is negotiating similar agreements with several other countries including Costa Rica, Kenya, and Ukraine. According to an FT Report, a Dubai court ordered KPMG to pay more than $231 mn to a group of investors who claim they lost money due to the firm’s poor-quality audit work on a fund managed by collapsed private equity firm Abraaj Group. Dubai property market continued to defy gravity even after a 20% jump since 2020. On April 13, a Morgan Stanley report expected the rally in Dubai’s property prices to continue this year due to cash buyers, yield-hunting investors from Russia and India and the reopening of China. The report added that Prices are likely to remain high because about 80% of property sales in Dubai are cash-based and so less impacted by interest rates. The average home price in Dubai climbed 12.8% in the 12 months through March 2023, while the average residential rent surged 26.3% over the same period. Interestingly, on April 24, a 24,500 sq foot plot of land at Dubai’s Jumeirah Bay Island was sold for Dh125 mn ($34 mn) – a record for Dubai. The owner had bought it for Dh 36.5 mn two years ago – giving him a tidy profit of 88.5 million dirhams (or 242%) without building anything. (Further Reading: “Russians have helped make Dubai’s property market red hot—again”, The Economist 7/4.)

April ended without Egypt and the IMF being able to agree on a date for the initial review under a $3 bn Extended Fund Facility loan financial package signed in Dec 2022, a sign the lender may be growing frustrated by Cairo’s lack of reforms. Under the terms of the deal Egypt was to adopt a flexible exchange rate, reduce inflation by using monetary policy instruments, especially interest rates, and open more space for the private sector by levelling the playing field with state companies. However, the progress on most of these criteria has been slow. Meanwhile, Egypt’s economy continues to deteriorate with annual headline inflation rising to 32.7% in March.

Israel’s economy grew a faster-than-expected 6.4% in 2022, although growth is expected to fall below 3% this year. In a stark warning on April 3, Israel’s Central Bank said that the ongoing political crisis could cut 2.8% from the GDP. On April 15, Moody’s rating agency revised its outlook for Israel to stable from positive, citing the government’s handling of events had made the country’s Israeli institutions less predictable. It, however, reaffirmed Israel’s sovereign credit rating at “A1.” Israeli leadership rebuffed the outlook downgrade

On April 11 Omani finance ministry disclosed that higher oil prices had enabled the country to repay 1.1 bn rials ($2.86 bn) in loans in Q1/23, bringing total public debt at the end of March to 16.6 bn rials.

On April 26. a UAE-UK private consortium announced a $37.36 mn investment in the world’s longest high-voltage direct current (HVDC) cables running more than 3,800 km between the UK and Morocco, passing Portugal, Spain and France. The cable could supply the UK with 3.6 GW of renewable electricity from a 10.5 GW facility of solar and wind farms located in Morocco, supported by 20GWh/5GW of battery storage.

III) Bilateral Developments

Prime Minister Shri Narendra Modi chaired a high-level video conference on April 21 to review the security situation in Sudan. It was also attended by EAM, NSA, Indian Ambassador to Sudan and other senior officials. It specifically focused on the safety of over 3,000 Indian citizens located in the country. PM further directed the preparation of contingency evacuation plans. Accordingly, Operation Kaveri was launched on April 24 to evacuate the stranded Indians in Sudan. The first lot of 278 Indians were picked up by INS Sumedha from Port Sudan on April 25; they were bought to Jeddah from where they were airlifted to India. The MOS(EA) Shri V. Muraleedharan was in Jeddah to oversee the evacuation process. The operation concluded on May 6 with the evacuation of 3862 Indians by 17 IAF flights and five trips by INS ships. Among the Indians stranded in Sudan were 31 Hakki Pikki tribals from Karnataka, engaged in selling herbal medicines in El-Fasher, the capital of north Darfur province. At least one Indian died in the fighting.

Raksha Mantri Shri Rajnath Singh held a bilateral meeting with Iran’s Minister of Defence and Armed Forces Logistics Brigadier General Mohammed Reza Gharaei Ashtiyani in New Delhi on April 27. The meeting was on the sidelines of the defence ministers’ conference of the members of the Shanghai Co-operation Organisation. They reviewed the bilateral defence cooperation and exchanged views on regional security issues, including peace and stability in Afghanistan. Further, the two Ministers discussed the development of the International North-South Transport corridor to ease logistics-related issues concerning Afghanistan and other countries in Central Asia.

On April 10, EAM Dr S. Jaishankar attended the Iftaar ceremony hosted by the UAE ambassador to India.

Israel’s minister of economy and trade Nir Barkat led a large business delegation to India on a four-day official visit beginning April 16. The visit was aimed at strengthening bilateral ties in common areas of interest, esp. automotive technologies and fintech. In his various interactions with the Indian media, the minister pushed for an early conclusion of a bilateral free trade agreement. In FY22, the bilateral non-defence merchandise trade stood at $7.86 bn, with the balance of trade in India’s favour.

The General Secretariat of the Organization of Islamic Cooperation (OIC) issued the following statement on April 4:

“The General Secretariat of the Organization of Islamic Cooperation (OIC) has followed with deep concern the acts of violence and vandalism targeting Muslim community in several states in India during the Ram Navami processions, including the burning of a madrasa and its library by an extremist Hindu mob in Bihar Sharif on 31 March 2023.

“The OIC General Secretariat denounces such provocative acts of violence and vandalism, which are a vivid manifestation of mounting Islamophobia and systemic targeting of the Muslim community in India. The OIC General Secretariat calls upon the Indian authorities to take firm actions against the instigators and perpetrators of such acts and to ensure the safety, security, rights, and dignity of the Muslim community in the country.”

Later the same day the official spokesman of the Indian Ministry of External Affairs tweeted the following response to the OIC Statement: “This is one more example of their communal mindset and anti-India agenda. OIC only does its reputation damage by being consistently manipulated by anti-India forces,”

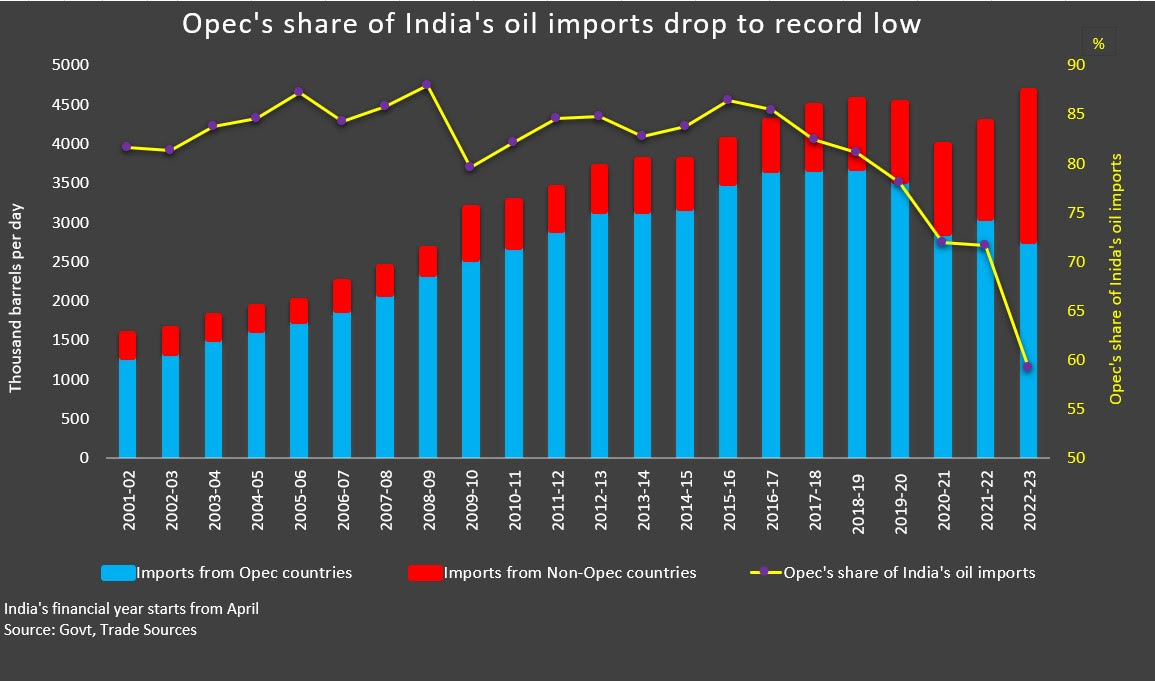

India’s oil imports in 2022/23 rose 9% from a year earlier, due to rising local fuel demand and higher exports of refined petroleum products. India shipped in about 1.6 bpd of Russian oil in 2022/23, about 23% of its overall 4.65 mbpd imports. Russia overtook Iraq for the first time to emerge as the top oil supplier to India, pushing Saudi Arabia down to No. 3. OPEC’s share of India’s oil market slid to 59% in FY23, the lowest in at least 22 years. It was 72% in FY22. Local refiners together processed about 6% more crude in 2022/23 at about 5.13 mbpd.

For the year 2022-23, the domestic consumption and imports of natural gas fell 6% and 14.1% year-on-year respectively due to high unit prices. In March 2023, the gas consumption fell to 5.12 billion cubic meters (bcm) y/y while the import of LNG slid 15.2% to 2.23 bcm. The value of gas imports, however, rose a third to $17.9 bn in FY23 from $13.5 bn in the previous year as unit prices soared. As imports fell at a steeper pace than local demand, the country’s dependence on imports for consumption dropped to 44.2% in FY23 from 48.4% in the previous year. Domestic gas production rose 1.3% in FY23. Indian buyers had almost disappeared from the spot market in the past year, with prices rising to record levels. The prices have come down during the past few weeks. With crude currently trading around $80-85 per barrel, the cost of Qatar supplies is around $11 per mmbtu. By comparison, the domestic gas price now has a ceiling of $6.5 per mmbtu. The government introduced a cap this month under a new pricing formula that also links the gas price to crude.

RBI Governor announced on April 7 that India’s inward gross remittances touched an all-time high of $107.5 bn during the calendar year 2022, thereby overshooting the World Bank projection by $7.5 bn. These accounted for nearly 3% of India’s GDP. Higher remittances and a lower current account deficit had resulted in the foreign exchange reserves rebounding from $524.5 bn on October 21 2022, to currently stand at over $600 bn. According to World Bank data, the US, with a share of 23% of total remittances, surpassed the UAE as the top source country in 2020–21. According to an RBI survey, between 2016–17 and 2020–21, the share of remittances from the five GCC countries (Saudi Arabia, UAE, Kuwait, Oman, and Qatar) dropped from 54% to 28%, while the share from the US, the UK, and Singapore increased from 26% to over 36%.