H I G H L I G H T S

- Political Developments

- Economic Developments

- Bilateral Developments

IA) Political Developments: Pan-Regional and Global Issues

Regional and International Developments

∙ The visit by the US secretary of state Antony Blinken to Saudi Arabia on June 8-9 included a call on Saudi PM and Crown Prince Mohammed bin Salman described as “open and candid”. It was also utilised for a US-GCC dialogue that Blinken and Saudi Foreign Minister Faisal bin Farhan co-hosted on combating the Islamic State militant group. (Comment: The first-ever visit by Mr Blinken to Saudi Arabia that followed US NSA’s dash to the Kingdom a month earlier, seems to indicate a concerted, albeit belated, bid by Washington to mend its ties with Riyadh after China brokered a reconciliation between Saudi-Arabia and Iran. According to the US media reports, the American diplomatic push also prioritised the normalisation of ties between Saudi Arabia and Israel. While Riyadh has been reticent, the US media has hinted that as quid pro quo it had put up stiff conditions including a settlement of te Israel-Palestine dispute, the US security guarantees, state-of-the-art weaponry and civilian nuclear technology including uranium enrichment. Some observers believe that each of these preconditioned may be an uphill task for the Biden administration given its cold vibes with the most right-wing government in Israel. Nevertheless, for President Biden, Israel-Saudi normalisation has a tantalising appeal: besides having an epochal impact on the WANA-Islamic region – and balancing the Iran-Saudi reconciliation – it could

be a huge tailwind for his re-election campaign. Further Reading: “Saudi Arabia may accept normal relations with Israel” The Economist Jun 15.)

∙ Algeria was among the five countries elected by the UN General Assembly on June 5 for a two-year non-permanent seat at the Security Council beginning next year. ∙ BRICS foreign ministers’ meeting in South Africa on Jane 1-2 evoked strong interest from several WANA countries in joining the organisation. These included Saudi Arabia and Iran (both were represented by their foreign ministers) as well as Algeria and the UAE.

∙ Arab and Islamic world reacted with abomination to the act of public burning of a copy of the Quran by an Iraqi exile in Stockholm on June 29, the day of Eid al-Adha. The reactions ranged from Morocco recalling her ambassador to the Organisation of Islamic Countries (OIC) which condemned it as a hate crime and a case of Islamophobia.

∙ The International Organisation on Migration disclosed on June 13 that it recorded 3,789 deaths in 2022 along land and sea routes in the MENA region – an 11% surge from 2021.

∙ According to the Henley Private Wealth Migration Report published on 13 June 2023, the UAE was the biggest gainer from US Dollar millionaires’ migration even as the numbers relocating to it came down from 5200 in 2022 to 4500 in 2023. Among other WANA countries which gained such HNWI in 2023 were Israel (600) and Morocco (100). On the losing side in 2023 were China (13500), India (6500), Egypt (200) and, surprisingly, Saudi Arabia (100).

∙ Most WANA countries celebrated Eid al-Adha on June 28. The event marked the first normal Haj after three years of the pandemic restrictions. More than 2.6 mn pilgrims from all corners of the world took part, making it “the largest Haj in history.” The Kingdom’s annual earnings from the Hajis and 19 mn Umrah travellers in 2023 is estimated at $12 bn. Special arrangements were made for Hajis from Yemen, Iran, Syria and Israel-Palestine.

WANA and Ukraine Conflict:

∙ The UAE President Mohammed bin Zayed (MbZ) was one of the few prominent WANA personalities to attend Russia’s Annual Economic Forum in St Petersburg this year. He was received by President Putin on June 16 who thanked him for helping in a PoWs exchange with Ukraine. MbZ reiterated “The UAE continues to support all efforts aimed at reaching a political solution through dialogue & diplomacy” and hoped to welcome one mn Russian tourists to the UAE in 2023.

∙ The abortive mutiny by Russia’s Wagner group on June 23-24 impacted the group’s wide network of military and commercial operations across the WANA region particularly in Syria,

Libya and Sudan. (Comment: The Wagner’s presence in Syria was relatively small, at between 250 and 450 personnel, or roughly a tenth of the estimated Russian military strength in the country. After the events in Russia, Syrian authorities collaborated with Russia to contain the group’s presence and many of its members were airlifted out of the country, mostly to Mali. The oilfields in eastern Syria under Evro Polis, a Wagner

linked company, are likely to be handled directly by Russia. Wagner’s presence in Libya peaked in 2020 at around 1200 and was in support of Gen Khalifa Haftar’s Libyan National Army based in Benghazi. It was reportedly paid for by the UAE. Apart from taking part in the failed assault on Tripoli, it has manned the Jufra airbase and trained foreign mercenaries. The picture of Wagner’s presence in Sudan is less clear. While Russia has maintained ties with both sides in the civil war, the Wagner group was closer to the RSF with which it has profitable gold mining operations. The US has accused it of supplying surface-to-air missiles to RSF.)

∙ On June 9 a White House spokesman said that Iran and Russia appeared to be deepening bilateral defence cooperation to “a full-scale partnership that is harmful to Ukraine, to Iran’s neighbours, and the international community.” He released declassified information alleging that Iran supplied Russia with hundreds of one-way attack drones being used in Ukraine. Additionally, they were collaborating in setting up a UAV manufacturing plant in Russia’s Alabuga Special Economic Zone expected to be fully operational early next year. On the other side, Russia has been offering Iran unprecedented defence cooperation, including on missiles, electronics, and air defence.

∙ Separately on June 19, a Russian deputy PM stated that a free trade zone agreement between the Eurasian Economic Union comprising of Armenia, Belarus, Kazakhstan, Kyrgyzstan and Russia – and Iran could be possible by the end of the year.

∙ Russia’s second-largest bank VTB said on June 15 that it would increase the number of countries to which retail clients can remit money to 25 from 11, with India and Turkey the key, new destinations.

WANA Regional Security and Terrorism

∙ China, Pakistan and Iran held their first trilateral consultation on counter-terrorism and security at the director-general level in Beijing on June 7. They had an in-depth exchange of views on regional counter-terrorism situations, joint efforts to crack down on cross-border terrorists, etc and decided to hold trilateral consultations on counter

terrorism and security regularly. Chinese media described these talks as a part of the “Global Security Initiative” propounded last year by President Xi. (Comment: The three sides face common security challenges along Pakistan’s western border stemming from

unrest in Baluchistan and Taliban rule in Afghanistan as threats to the ambitious CPEC agenda. Iran too perceives insecurity in that area from several Takfiri, Iranspeak for Sunni, terrorists, straddling the area.)

∙ In a rare incident on June 3 on the normally tranquil Israel-Egypt border, three Israeli soldiers were killed by an Egyptian security operative, who also died in retaliatory fire. Israeli PM Netanyahu called it a terrorist incident and demanded a full Egyptian explanation.

∙ In a statement that concealed as much as it revealed, Israeli external secret service Mossad claimed on June 29 that it had carried out an operation in Iran to capture the suspected leader of an Iranian plot to attack Israeli businesspeople in Cyprus and thwart the attack. While Iran denied the claim the next day, Cyprus made no comments.

∙ Following widespread attacks by Jewish settlers on Palestinian villages in the occupied West Bank on June 24, Israeli security chiefs designated these as “nationalist terrorism” that merits stepped-up countermeasures. Although PM Netanyahu condemned these attacks, security chiefs’ remarks drew anger from far-right cabinet ministers, exposing the schism in Israeli society on this issue.

∙ On June 28, a lone gunman was killed in a firefight at the US consulate General in Jeddah. According to sketchy details provided by Reuters, a Nepali private security guard also died.

Pakistan and WANA Region:

∙ There was a noticeable spurt in Pakistan’s official contacts with Iran during the month, possibly taking a cue from reconciliation between Tehran and Riyadh mediated by China, Islamabad’s mentor as well as reports of US-Iran indirect talks in Oman. The opening overture in this regard was made on May 18, when PM Shahbaz Sharif and President Ibrahim Raisi jointly inaugurated a 10-acre border market located at Mand

Pishin. They also launched an electricity transmission line to provide some of Pakistan’s remote regions with electricity from Iran.

∙ The 12th Iran-Pakistan foreign office consultations were held in Tehran on June 17-18 with trade, energy and security as the main areas of focus. These were led at Foreign Secretary/Dy FM level.

∙ Curiously, the Pakistani defence secretary led a defence delegation on a visit to Iran on the same day in a separate manner. During the visit, a memorandum of understanding on maritime cooperation was signed between the Pakistan Maritime Security Agency and Iranian border guards. This agreement aims to strengthen

relations and foster collaboration in areas such as security, joint counterterrorism measures, and regional economic connectivity.

∙ A military delegation led Iranian Navy Commander began a three-day official visit to Pakistan on June 19.

∙ On June 18, Pakistani security agencies claimed that Nawaz Ali Rind, a commander of the Baluchistan Liberation Front, was killed in a gunfight in a “neighbouring” country, meant to be Iran.

∙ Pakistani media Reports put the number of Pakistanis on the migrant boat that sunk off the Greek coast on June 14 to be around 300. The UNHCR said that a total of up to 750 people were on board.

China and WANA Region

∙ There was a perceptible surge in Saudi Arabia’s economic engagements with China during the month. An Arab-China Business Conference began in Riyadh on June 11 with the event being addressed by Saudi ministers, including those of energy and investments. Apart from energy – where the Kingdom and China are the world’s largest crude exporter and importer respectively – there were also talks on security and technical cooperation. Later, on June 26, the kingdom fielded a 24-strong delegation comprising no less than 6 ministers to the Annual Meeting of the New Champions (colloquially known as the Summer Davos) held in China’s Tianjin. With bilateral trade of $116bn in 2022, China is the kingdom’s top trading partner. (Further Reading: “Saudi Arabia sends top delegation to China’s ‘Summer Davos”, FT, June 26.)

IB) Political Developments

Turkey:

Following his successful re-election bid, Mr Recep Tayyip Erdogan, 69, took oath as Turkey’s president for the third time for a five-year term on June 3. Counting his previous stint as the executive prime minister, he completed two decades at the helm of the country. He also announced a new cabinet of ministers. Pakistani PM Shahbaz Sharif attended the Presidential oath ceremony. (Comment: Having snatched victory from the jaws of an electoral defeat was perhaps the easier part for “the Sultan” lately prone to grandstanding and ultra-nationalistic

Islamic rhetoric. Running the government with coffers depleted to propitiate the voters, the devastating earthquake, the lira in free flight and run-away inflation would be a tougher act to follow. Moreover, the major foreign policy decisions on Syria, the veto on Sweden’s entry to NATO, and ending the costly regional military engagements would all need to be taken.

The incipient term would set Erdogan’s legacy. Further Reading: “Turkey’s President Erdogan shifts towards sane economics”, The Economist, June 4.)

The month saw considerable heat but not much light on Turkey’s veto on Sweden’s application to join NATO, with Ankara unimpressed by steps taken by Stockholm to curb anti-Turkey elements, mainly Kurds, whom it regards as the “terrorists.” Thus, developments during the month such as the NATO secretary general’s Ankara visit on June 4 or Sweden’s charging of a PKK apparatchik on June 9 for financial crimes under the new tougher law or the June 26 opening of a study by the US and Swedish prosecutors on a graft complaint naming a son of President Erdogan made any difference.

The minimum wage limit was raised by 34% on June 20 to compensate for the annual inflation running at over 40%.

On June 14, Turkey’s military claimed to have “neutralised” 53 Kurdish militants in northern Syria. The action was in retaliation to an attack on a police post on the Turkish side of the border.

Sudan:

The civil war in Sudan continued unabated, albeit interrupted by 4 imperfectly implemented ceasefires on June 4, 10, 21 and 27. These were mostly mediated by the US and Saudi Arabia, which were increasingly frustrated at the antagonists disregarding the peace-making efforts. The fighting remained sporadic and indecisive although wanton in destruction and casualties. The ICRC mediated release of 125 Sudan Armed Forces personnel release on June 29 by the Rapid Support Forces. Rivals often accused each other of looting and diverting humanitarian assistance. By the end of June, 3000 civilians were estimated to have been killed in the fighting. According to the International Organization for Migration, some 2.2 mn have been forced from their homes inside the country with almost 645,000 fleeing across borders for safety. A record 25 mn people in Sudan need humanitarian aid and protection, the UN said. At a UN-organised donors’ conference in Geneva on June 19, $1.5 bn was pledged for relief in Sudan. On June 1 the US announced its first list of sanctioned companies and persons from both SAF and RSF. They were not specifically named.

Iran:

President Ebrahim Raisi paid a five-day tour of Latin America from June 12 that took him to Venezuela, Nicaragua and Cuba.

In a caveat-ridden but moderate statement on June 11, Supreme Leader Ali Khamenei said “There is nothing wrong with the agreement (with the West), but the infrastructure of our nuclear industry should not be touched.” The statement came amidst reports of indirect and undisclosed talks between the negotiators of the US and Iran in Oman even as both sides denied that any deal was imminent. Chief Iranian nuclear negotiator Ali Bagheri Kani met in Doha with the EU mediator Enrique Mora on June 21. It was a follow-up on Mr Kani’s meeting with E3 representatives the previous week in the UAE. (Further Reading: “America wants to lower tensions with Iran. Good”, The Economist, June 21.)

In a sign of growing entente, the foreign ministers of Saudi Arabia and Iran met in Tehran on June 17. The Iranian embassy in Riyadh reopened on June 6 after being closed for over 7 years.

During June 19-22, the Iranian foreign minister toured four Gulf Arab countries of Qatar, Kuwait, Oman and the UAE. He was received by the respective heads of state/government and conferred with his counterparts.

Sri Lanka announced on June 23 that it had reached a tea-for-crude barter arrangement with Iran that is expected to kick off in July 2023.

On June 29, Canada, Britain, Sweden and Ukraine announced their intention to move to the International Court of Justice to hold Iran accountable for the downing of an airliner by Iranian forces in 2020.

On June 6, Iran unveiled its first hypersonic missile named “Fattah.”

Saudi Arabia:

Venezuelan President Nicolas Maduro visited Jeddah on June 3.

The Kingdom acted with unusual alacrity in the sports arena during the month. On June 8, the Public Investment Fund (PIF) – with assets estimated at $700 bn –acquired control of the four large football clubs in the country: the Riyadh-based Al-Nassr and Al-Hilal, and the Jeddah-based Al-Ittihad and Al-Ahli. Portuguese superstar Cristiano Ronaldo joined Al Nassr in December, while this month French duo Karim Benzema and N’Golo Kante left Real Madrid and Chelsea, respectively, for Saudi champions Al-Ittihad. Many more stars are expected to arrive before the start of the Saudi Professional League (SPL) in August. On the other hand,

the international golf circuit was stunned on June 6 by the announcement of a merger of PGA and DP World Tour with Saudi-owned LIV Golf. The first two have recently been at loggerheads with LIV Golf accusing it of poaching big players in a game that is a over $100 bn industry in the US alone. The Saudi petro-dollar-induced merger is the biggest disruptor the game has seen in recent times. It was taken seriously enough for a US Senate Panel to examine its anti

trust implications. (Comment: There could be several reasons for the Saudi move into the sports and gaming sectors. It has a youthful population that the crown prince wishes to pre occupy with sports; Riyadh may seek to indulge in “sportswashing” to give itself a new and more benign image, and it may, after all, turn out to be a series of shrewd investment decisions. We will have to wait till the birdies come home. Further Reading: (i) “Meet the world’s most flirtatious sovereign-wealth fund” The Economist, June 29; (ii) “Saudi soccer league creates huge fund to sign global stars”, NYT, June 6.)

On June 19, Kingdom’s aviation startup SCOPA announced that it is to co-produce helicopters in collaboration with Airbus Industrie.

On June 21 Saudi Arabia announced an allocation of $7.8 billion worth of investments for Expo 2030, for which Riyadh has made a bid for hosting.

Israel:

The Israeli domestic political situation continued to be in flux during the month. In a case of irresistible force and immovable object, PM Benyamin Netanyahu’s ruling coalition sought to use their parliamentary majority to persist with the draft legislation on judicial overhaul ignoring the popular demonstrations against the move. To get their view, the coalition adopted salami tactics and made some facile changes. For instance, on June 29, Netanyahu said although he was still pursuing changes to the way judges are selected, the provision to grant parliament the authority to overturn Supreme Court rulings had been dropped. Similarly, on June 28, the government decided to delay a bill that provided the finance minister powers to override some central bank decisions after the governor objected to it. (Comment: Flushed with a 64-56 majority in the Knesset, the extreme right-wing ruling coalition has tried to weaponise its majority to push through some structural changes, but has faced institutional and popular pushback.)

In a significant statement, the Head of Knesset’s foreign affairs and defence committee said on June 17 that Israel could accept US-Iran nuclear understanding. Similarly, Israel’s national security adviser said on June 30 that Israel was not close to attacking Iran’s nuclear facilities.

This came amidst reports of indirect talks in Oman as well as PM Netanyahu accusing the IAEA of caving into Iranian tactics.

The month saw several developments in the Israeli defence sector. The annual report of the Stockholm-based SIPRI, released on June 12 estimated Israel to have 90 nuclear weapons. The Israeli defence ministry disclosed on June 13 that country’s defence exports reached a record figure of $12.556 bn last year. Without naming specific clients, the ministry said 24% of defence exports were to Abraham Accords countries, 30% to Asia-Pacific, 29% to Europe and 11% to North America. On June 9, Germany purchased Arrow-3 anti-missile system from Israel for €4bn. (Further Reading: “The war in Ukraine is boosting Israel’s arms exports”, The Economist, June 22.)

On June 17, PM Netanyahu said he’s been formally invited to visit China, although he’s not yet been invited to the US six months after taking office.

Israeli leadership took steps to contain the escalating violence in the West Bank that had vitiated atmospherics leading to the Eid al-Adha and caused massive international condemnation. The UN Security Council on June 27 “called on all parties to refrain from unilateral actions that further inflame tensions” and urged restraint to reduce tension and prevent further escalation. Israeli President Herzog talked with PA President Mahmoud Abbas. Israeli defence minister reached out to PA counterpart to offer reassurance about Israel’s intention to crack down on Jewish settler riots. Similarly, the Israeli foreign minister sought to reassure the US secretary of state.

Palestinian Issues:

Palestine Authority President Mahmoud Abbas visited China and met President Xi Jinping on June 14. Earlier, Chinese foreign minister Qin Gang shared “Chinese Wisdom” during a meeting with visiting PA counterpart Riyadh al-Malaki in Beijing on June 13. The visits were against the backdrop of escalating violence in the West Bank and Gaza and the Chinese publicly made an offer to facilitate a settlement of the Israel-Palestine dispute.

The Israel-Palestinian violence acquired more vicious overtones during the month. The violence peaked on June 19 with Israeli troops launching a protracted operation against the Palestinian militants holed up in Jenin in the West Bank using drones and helicopter gunships. Reports indicated 5 militants being killed and 90 others wounded. Eight Israeli soldiers were also wounded during the operation. The next day, Palestinian gunmen killed 4 Israeli settlers

before being hunted down and killed. This led to an angry settler mob pillaging several Palestinian villages in an unprecedented manner. The ferocious Israeli response and the settler mob attacks were widely condemned by the Arab-Islamic world and the West. UNHCR said on June 19 in a statement that the violence in the occupied West Bank risked “spiralling out of control.” (Comment: The steady ascendence in violent incidents in the Palestinian territories has several impetuses. Firstly, a more assertive right-wing Israeli government has in-your-face agenda about increasing settlements which is mirrored by the rise of Palestinian militancy. Secondly, the rivalry between the various Palestinian militant groups jockeying to occupy the power vacuum in West Bank plays out. Thirdly, the dire socio-economic conditions in the Palestinian camp have festered teeming youth seething with rage – ready to act as cannon fodder.)

The UAE:

On June 1, the UAE finance ministry issued a new regulation introducing a 9% corporate tax above taxable income of $100,000. The tax did not apply to the qualifying entities in its free zones which would continue to be subject to zero tax regime. (Comment: The UAE, which attracted businesses and residency by offering a tax haven regime, has had to gradually join the global mainstream for several reasons. This is the second major tax after 5% VAT was introduced in 2018 and coupled with the rising value of the dirham (linked to the dollar) would pinch investors and tourists alike. The move appeared necessitated by a new global minimum corporate tax regime signed by 136 economies including the UAE, to ensure big companies pay a minimum of 15% and make tax avoidance harder. The tax level is the lowest in the GCC, apart from Bahrain which does not impose a general corporate tax. The step indicates authorities’ confidence in the UAE’s continued business attractiveness beyond tax haven status as well as the need to diversify the non-oil revenue stream. The UAE still does not levy any personal income tax.)

A London court issued a freeze order on all the assets of Dubai-based NRI businessman Prateek Gupta following a case by Swiss commodity trader Trafigura of “systematic fraud” against him alleging that none of the 1104 containers had high-grade nickel worth totalling $625 mn as claimed.

Syria:

There were some international diplomatic moves on Syria during the month under review. On June 30, the UN General Assembly approved by 83-11-62 vote a resolution setting up an independent body to look into 130,000 missing persons in Syria during 11 years of civil war.

Earlier, on June 23, the first convoy of UN relief trucks since the earthquake crossed over from the government side to the rebel-held Idlib enclave in northwest Syria. Following the conclusion of the 20th Astana talks on Syria between Russia, Iran and Turkey in Kazakhstan, the host proposed that as Syria had rejoined the Arab fold, the Astana process should conclude. Russia was non-committal on the proposed termination. On June 12, Netherlands and Canada announced that they had approached the International Court of Justice at the Hague for a case against the Syrian government alleging torture since 2011.

At an EU-hosted conference in Brussels on June 15, International donors pledged $6.13 bn to help Syria cope with the aftermath of an earthquake in February compounding the plight of a poverty-stricken population caught up in conflict since 2011. The European Union pledged 3.8 bn euros in grants, of which 2.1 bn would come from the European Commission and 1.7 bn from the member states. According to the UNHCR, the civil war since 2011 has caused over 14 mn Syrians to flee their homes, including about 6.8 mn displaced in their own country, where almost the entire population lives below the poverty line. About 5.5 million Syrian refugees live as refugees in Turkey, Lebanon, Jordan, Iraq and Egypt. However, the pledges were preceded by World Food Programme announcing on June 13 that it has been forced to reduce the rations to eligible Syrian by half due to a funding shortage.

22 US troops were injured in Syria on June 12 in a helicopter mishap.

The agriculture minister claimed on June 5 that thanks to boosted domestic harvest, Syria would import half as much wheat in 2023 as the previous year.

Iraq:

Qatari Emir Sheikh Tamim bin Hamad Al-Thani visited Baghdad on June 15. During the visit, Iraq and Qatar signed memorandums of understanding (MOUs) with Qatar’s private companies for projects in the fields of energy, electricity and construction totalling around $9.5 bn.

Following a US waiver on economic sanctions against Iran, Iraq paid $2.76 bn on June 10 to Iran for a part of the debts owed for the supply of gas and electricity.

Iraqi police seized 250,000 Captagon pills from a school building in Ramadi near the Syrian border on June 28. These recreational narcotics were suspected to have been smuggled from Syria.

Egypt:

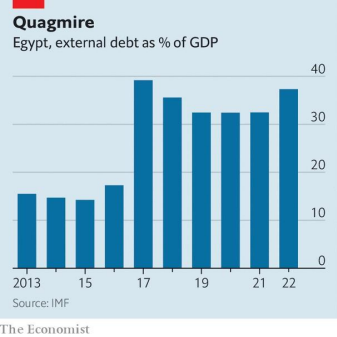

In a speech at a financial summit in Paris on June 22, Egyptian President Abdel Fattah al-Sisi pleaded with the country’s development partners for a greater understanding of the country’s economic pressures as it pursued ambitious infrastructure plans while trying to manage its debt burden. He cited the Covid-19 pandemic and the Ukraine war as having caused economic challenges. The country’s external borrowing has quadrupled during the past 8 years. (Further Reading: “Egyptians are disgruntled with President Abdel-Fattah al-Sisi”, The Economist Jun 15.)

Tunisia:

A meeting of the EU-Tunisia Council, held in Tunis on June 11, was dominated by a phenomenal surge in the illegal migration to European Union, mostly from Tunisia, across the Mediterranean Sea. Italy alone has received 53,000 migrants by boat so far this year, more than double for the same period last year. The session was attended by the EU Troika (PMs of Italy and Netherlands and EC President) and President Kais Saied of Tunisia. The EU offered Tunisia some 900 mn euros ($967m) to support its economy, plus an immediate 150 mn

euros ($161m) in budget support once a “necessary agreement is found” to staunch the flow of refugees to Europe. Italian PM Meloni, who earlier visited Tunisia for a bilateral visit on June 6, urged the International Monetary Fund (IMF) and other countries to help Tunisia. (Comment: Tunisia, with an economy in dire straits and the IMF terms regarded by President Saied as “a threat to civil peace”, could ill-afford to turn down the EU financial offer. Moreover, it also was in sync with President Saied’s public narrative about Sub-Saharan migrants swamping the Tunisia society. Further Reading: “EU offers Tunisia over €1bn to stem migration”, FT, June 11.)

Kuwait:

The elections for 50-member National Assembly were held on June 6 with 207 candidates, the lowest number since 1996. As political parties are banned in Kuwait, the candidates stand as individuals. The electoral college comprised about 750,000 out of a population of about one million. The new national assembly was also dominated by well-known opposition figures. The emir reappointed Sheikh Ahmad Nawaf Al-Ahmad Al-Sabah as the prime minister and the new cabinet was announced on June 18. It had a new oil minister, but the finance minister was reappointed. (Comment: The new cabinet has five members from the royal family, a relatively high number. It also marked the return of deputy premier and defence minister Sheikh Ahmad Al-Fahad Al-Ahmed Al-Sabah, a polarising figure. He left government 12 years ago amid abuse of power and corruption accusations and was convicted of forging a case against a fellow royal to accuse him of staging a coup d’état. Given the populist opposition holding sway in the house and a royal family seemingly equally determined to hold its fort, there was a sense of deja vous. This could further protract political sclerosis and hold back badly needed fiscal reforms – particularly in the upstream investments and personal debt sectors.)

Lebanon:

On June 12, the parliament failed for the 12th time to elect a president of the country to fill the post lying vacant since October 2022. Under the country’s sectarian system, the president has to be a Maronite Christian to be elected by a two-thirds majority, but none of the two candidates could get even a simple majority. (Comment: The deadlock showed the limits of the recent Iran-Saudi reconciliation, as Hezbollah and allies thwarted the Christian+Sunni block.)

Yemen:

Among the growing signs of thaw relations were the first direct Yemen Airways Haj flights with some prominent al-Houthi officials on board. The two sides also exchanged bodies of their dead soldiers across the land border.

Libya:

On June 6, a “6+6 committee” drawn from Libya’s two rival legislative bodies – the Tobruk based House of Representatives and the Tripoli-based High Council of State– agreed on draft laws for presidential and parliamentary elections, inching forward in the country’s current political crisis. While welcoming progress, UN envoy Abdoulaye Bathily warned the UN Security Council on June 19 that “key issues remain strongly contested,” blocking the road to “a final settlement” and harbouring the potential to spark a new crisis in the divided country.

Qatar:

On June 19, Qatar and the United Arab Emirates’ respective embassies reopened to resume work after the two Gulf states agreed to restore diplomatic ties after being severed in 2017.

Morocco:

Moroccan foreign minister said on June 23 that hosting of a summit of Abraham Accord countries between Israel and Arab states was being postponed “till after the summer.” (Comment: The proposed Summit posed several contextual issues such as Israel’s demurral to acknowledge Western Sahara as an integral part of Morocco, rising strife in the West Bank and civil war in Sudan. Besides, as American diplomacy seemed to be hard at work to bring normalisation between Israel and Saudi Arabia, it would be desirable to wait till this was accomplished.)

Algeria:

On June 22, Algeria’s former Prime Minister Noureddine Bedoui and former Health Minister Abdelmalek Boudiaf were sentenced to five years in prison on corruption-related charges.

II) Economic Developments

Oil & Gas Related Developments:

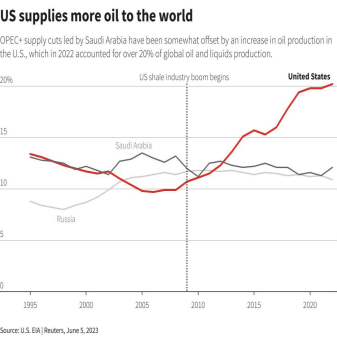

The month under review had several surprises in store. Firstly, at the OPEC+ in-person meeting in Vienna on June 2-3, no member followed Saudi Arabia, which declared its intention to reduce production by 1 mbpd from 1.7.23, in announcing the production cuts. Secondly,

although oil prices gained during June 2023 (the first month to do so in 2023), they posted a fourth consecutive quarterly decline. This was remarkable as the month saw the Wagner mutiny, continued stoppage of Iraqi exports via Turkey, and the US intention to replenish its strategic reserves by 12mb this year. On the other side, the anticipated rise in Chinese offtake did not happen, production from the US, Russia and Iran continued to compensate for Saudi decline. (Further Reading: “Against expectations, oil and gas remain cheap” The Economist, June 19; and “Opec+ is not on board with Saudi Arabia’s ‘whatever it takes’ message” FT, June 6.)

The US governments Energy Information Administration released the following estimates of the OPEC members’ total and per capita oil revenues during 2021-24 summarised in the following two tables:

NB: Apart from the 13 OPEC members listed above, the following 10 are OPEC+ members:

Russia, Mexico, Kazakhstan, Oman, Azerbaijan, Malaysia, Sudan, Bahrain, Brunei and South Sudan.

At its June 4 meeting, the OPEC+ set in place a process to overhaul production quotas for the majority of its members. This cleared the way for OPEC giving larger production quotas to its Gulf members at the expense of African nations which have underinvested in the upstream oil sector and have consistently failed to fulfil their production/export quotas. For instance, in May 2023, Saudi Arabia, the UAE and Kuwait’s share of total OPEC production was over 10% higher than it was 15 years ago at 55%, while Nigeria and Angola’s total share over the same period shrunk by over 3% to below 9%. The shake-up is likely to become more extreme in the next few years as Middle Eastern state oil majors ramp up investments while production

falls in African nations that have struggled to attract foreign investment. (Further Reading: “OPEC+ oil quota reform increases Gulf’s dominance”, Reuters, June 27.)

On June 27, Saudi Aramco expressed optimism about sound demand in H2/23 due to robust demand in China and India. On June 24, the company signed an $11 bn contract with Total Energies for a new petrochemicals complex in Saudi Arabia. On the same day, Italy’s engineering group Maire Tecnimont won two contracts valued at about $2 bn related to a petrochemical expansion of the SATORP refinery in Jubail, Saudi Arabia, a joint venture between Saudi Aramco and TotalEnergies.

Iran claimed that it boosted its crude output to above 3 mbpd in May 2023, the highest since the US economic sanctions were imposed in 2018. Other analysts put the production figure in the same ballpark, from 2.87 mbpd (IEA) to 3.05 mbpd (SVB International) while Kpler put the Iranian exports during the month at 1.5 mbpd, also the highest since 2018.

The settlement of overland crude pipeline issues between Iraq and Turkey following the arbitration could not be reached during discussions on June 19 in Baghdad. Turkey halted Iraq’s 450,000 bpd of northern exports through the Iraq-Turkey pipeline on March 25. The stoppage has already deprived the Kurdistan Autonomous Region of over $2.2 bn in earnings and further constricted the global oil market. On June 18, Iraq invited bids for the exploration and development of 11 gas blocks.

On June 20, QatarEnergy and China National Petroleum Corporation (CNPC) signed a 27-year agreement, under which China will purchase 4 mn MT of LNG a year. CNPC will also take an equity stake in the eastern expansion of Qatar’s North Field LNG project. This was the second such megadeal signed recently by QatarEnergy with a Chinese state energy company.

According to a report by BDO consultancy, Israel‘s gas reserves grew from 780 bcm in 2012 to 1,087 bcm at the end of 2022, while 119 bcm was extracted over the same period. The report attributed this growth to increased drilling and exploration activities in the Eastern Mediterranean Sea.

On June 21, Oman allocated land to a consortium led by French energy company Engie for a $7 b project to produce green ammonia for export to Asian buyers. Other partners in this venture include South Korean companies such as steelmaker Posco, several power companies, Samsung and Thailand’s NOC PTTEP. It will comprise 5 gigawatts of new wind and solar,

batteries, an electrolyzer producing 200,000 tons of hydrogen each year, and dedicated hydrogen pipelines to bring the gas to an ammonia production plant near the port of Duqm. Following the feasibility studies on wind and solar potential a final investment decision is expected by 2027. The site is planned to be operational by 2030, with the first cargo of green ammonia slated for the mid-2030s.

Following economy-related developments took place in WANA countries:

∙ Several missions of the International Monetary Fund submitted their reports on some WANA countries. These included Saudi Arabia (June 7; the report warned that oil production cuts could lower the GDP growth in 2023 to 2.1% in the median case, in the worst case the GDP could contract. The Kingdom’s economy grew by 8.7% in 2022 on high oil revenues); Kuwait (June 5; following 8.2% GDP growth in 2022, it is expected to slump to 0.1% in 2023); Yemen (June 7; it made no economic projection but noted, “Despite cautious optimism about the ongoing peace process, the economic and humanitarian crisis in Yemen continues. Currently, 17 mn people are estimated to face acute food insecurity, while a high-level UN pledging event raised only $1.2 bn of the $4.3 bn needed to address this crisis. Despite the recent decline in global food and fuel prices, domestic prices remain high, with food inflation averaging 45% in 2022. It added, “Attacks on oil export facilities in October 2022 have deprived the government of most of its revenues in foreign currency, equivalent to about half of total revenues. This, combined with a rise in global oil prices, widened the fiscal deficit to 2.5% of GDP in 2022. Without a resumption of oil exports, the deficit is expected to widen further in 2023, despite cuts in much-needed expenditures.”) and the UAE (June 26; GDP growth estimated at 6.9% in 2022, is projected to grow at 3.6% in 2023) (Further Reading: “After years of talks, indebted Arab states and the IMF are at an impasse”, The Economist, June 27.)

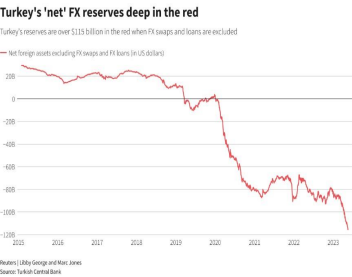

∙ The post-election macro-economic situation of Turkey was under the spotlight for signs of a shift away from the flawed “Erdoganomics”, which sought to treat high inflation with low bank rates. In the event, appointments of competent technocrats (such as the governor of the Turkish central bank, TCB, and minister of economy) only partially mitigated the doubts about a new beginning. Indeed, although in its first MPC meeting under the new dispensation on June 20, the TCB decided to raise the bank rate by 6.5% to 15%, it still underwhelmed the market despite the TCB to promise further measures.

Turkey’s economic indicators worsened perceptibly during the month with the market sentiments apprehensive about the new dispensation sticking with the old economic dogmas. Thus, despite some improvement, the central bank’s net reserves stood on June 15 at (-) $3.17 bn having lost $30.5 bn since the 2022 end due to voter-pleasing profligacy. The Turkish lira hit a new low of 26.05 against the US dollar on June 26.

∙ Official data released on June 29 put unemployment among Saudi citizens at 8.5% in Q1/23 as compared to 8% in the preceding quarter. The Saudi ministry of investment signed a $5.6 bn deal with Chinese electric car maker Human Horizons to collaborate on the development, manufacture and sale of vehicles. The deal was signed on the first day of an Arab-China business conference in Riyadh. Chinese FDI into Arab markets stood at $23 bn in 2021, of which $3.5 bn was in Saudi Arabia. Bloomberg reported on June 1 that Saudi Aramco representatives met on the previous two days in Ankara with executives of 80 Turkish contracting companies to discuss the $50 bn worth of potential projects through 2025.

∙ In a detailed piece on June 19 on Dubai’s economic prospects, Reuters sounded cautiously optimistic that the poster child of hedonistic economic growth would avoid the boom-to-bust cycle this time as it enters post-covid recovery. It has adopted a 10- year economic plan known as D33 aiming to double the GDP and make Dubai one of the top four global financial centres by 2033. Its prosperity mainly banks upon tourism and real estate – both have shaken off the Covid-19 blues. Tourist numbers in 2023 are almost back to levels of 2019, and the average property prices rose 12.8% in Q1/23 with Indians, British and Russians being the biggest buyers. According to the 2022 FT ‘fDi Markets’ report, published in May 2023, Dubai attracted an estimated $12.8 bn in FDI, far exceeding the inflow to Saudi Arabia ($8 bn). However, S&P has estimated Dubai’s public sector debt will stay elevated at about 100% of GDP due to high non-financial liabilities of the government-related entities (GREs). While Dubai has set up a Debt Management Office in 2022 and has a strategy to list the GREs to stabilise them, it remains in the FATF grey list and is vulnerable to regional geopolitics, the global oil economy and economic slowdown. It could draw some comfort from the LinkedIn survey published on June 23 declaring Doha and Dubai to be the world’s topmost competitive job markets. (Further Reading: “Dubai chases long-term growth as property booms, seeks to blunt debt risk” Reuters, June 19.)

∙ The status of Israel’s high-tech, fastest-growing sector during the last decade, accounting for 14% of jobs and almost a fifth of GDP was widely debated during the month. Preliminary data released on June 28 revealed that fundraising by Israeli technology firms slumped 65% in Q2/23 compared to the same period last year, as political turmoil in the country exacerbated a global slowdown in the sector. Firms raised a total of $1.78 bn in the second quarter, roughly the same as the first quarter, but down 65% from over $5 bn in the same period last year. The industry leaders, central bank governor and country’s innovation agency raised alarm over a funding draught, and migration of talent and capital. They alleged that it was primarily due to the judicial and banking overhaul resulting in socio-political turmoil. PM Netanyahu, on the other hand, cited June 18 announcement by Intel to invest $25 bn in a new

semiconductor plant in Israel – the country’s largest foreign investment ever. On June 18, the Israeli finance ministry unveiled plans to build a 254-km fibre-optic cable between the Mediterranean and the Red Sea, creating a continuous link between Europe and countries in the Gulf and Asia.

∙ Egypt’s core inflation rose to 40.3% in May 2023. The parliament approved the country’s 3 tr Egyptian pound annual budget for the next financial year beginning on July 1 on June 12. It provides for revenues of EP2.142 tr pounds and expects a fiscal deficit of EP824.44 bn, or 6.96% of the GDP. It allocated allocating EP127.7 bn ($4.14 bn) for its food subsidies. Egypt, with 105 million people, is one of the world’s biggest importers of wheat estimating the requirement of 8.25 MT next year. It optimistically estimates real GDP growth of 4.1% and an average inflation rate of 16%. Suez Canal’s annual revenue hits a record $9.4 bn during the financial year ending on June 30 with 25,887 ships having transited.

∙ Iraq‘s parliament on June 12 approved a 2023 budget with a record outlay of $153 bn on a higher public wage bill and development projects to improve services and rebuild infrastructure ruined by neglect and war. Despite robust oil revenues, it has a fiscal deficit of a record $49.5 bn, more than double the last budget deficit in 2021. It is based on an oil price of $70 per barrel and projects oil exports at 3.5 mbpd, including 400,000 bpd from the semi-autonomous Kurdistan region, which would be better regulated. It adds more than half a million new public sector workers. The same budgetary provisions would apply for two subsequent years, viz. 2024 and 2025. (Further Reading: “Analysis: Iraq’s new budget may hamper more than it helps” Al

Jazeera, 26/6.)

∙ On June 15 Bahrain gave a “golden licence” to each of the five firms investing in a total of $1.4 bn. This facility is for projects which create more than 500 local jobs or pledged to invest more than $50 mn during their first five years. Its benefits include prioritised allocation of land, infrastructure and services, easier access to government services and support from government development funds.

III) Bilateral Developments

∙ Prime Minister Shri Narendra Modi paid a state visit to Egypt on June 24-25. He met President Abdel Fatah al-Sisi who decorated him with the “Order of the Nile”, the country’s highest citation. They discussed strengthening ties in areas including trade, food security and defence. PM Modi also met with Egyptian PM Mostafa Madbouli and the “India Unit” of ministers formed to follow up on President al-Sisi’s State visit to India in January this year. He visited the 1100-year-old al-Hakim Mosque in Cairo

recently renovated by the Daudi Bohra community of Shia Muslims from India. (Comment: This was the first visit in nearly two decades by an Indian PM to Egypt, the most populous Arab country and marked 75 years of diplomatic relations between the two countries. Despite bilateral proximity on political issues, As far as India’s economic outreach is concerned, Egypt has largely been in an umbral zone of the Gulf’s oil-rich monarchies. However, the current strong headwinds faced by the Egyptian economy limit the visit’s monetisation potential, at least in the short run. Further Reading: “Squaring the circle at the India-Egypt summit” Mahesh Sachdev, The Hindu, June 24.)

∙ PM Modi had a teleconversation with the Saudi Crown Prince and PM Mohammed bin Salman (MbS) on June 8. While Shri Modi thanked MbS for excellent support during the evacuation of Indians from Sudan, Saudi Crown Prince said that he was looking forward to his visit to India.

∙ A UAE delegation led by Dr Thani bin Ahmed al-Zeyoudi, Minister of State for Foreign Trade visited India on June 11-12 to participate in the first Meeting of the Joint Committee (JC) of the India-UAE CEPA, which completed its first Anniversary of implementation. The bilateral trade grew at around 16.5% and touched a record of $84.84 bn during FY 2022-23. India’s exports to the UAE grew by 12%, reaching $31.6 bn. The two countries had agreed to set a target of $100 bn of trade in non-petroleum

products by 2030 from the USD 48 billion at present. Separately it was revealed on June 12 that the FDI from the UAE to India jumped over three-fold to $3.35 bn in FY23 from $1.03 bn in FY22. Thus, the UAE became the fourth largest source of FDI to India from the seventh earlier.

∙ National Security Advisor Ajit Doval visited Oman on June 26. He called on Sultan Haitham bin Tarik and discussed ways to bolster security ties between the two sides and cooperation in technology, military matters and mining. He separately met foreign minister Sayyid Badr Hamad Al-Busaidi and Gen Sultan Mohammed Al-Nu’amani, minister of the royal office.

∙ Iraqi deputy prime minister for energy affairs, and minister of oil Hayan Abdul Ghani Abdul Zahra Al Sawad met Shri H.S. Puri, minister for petroleum and natural gas in New Delhi on June 20 to discuss expanding bilateral economic relations, esp. in the oil sector. The visiting dignitary was received by vice president Shri Jagdeep Dhankar. He also met Indian ministers of commerce & industry and health & family welfare. (Comment: While the visit of the Iraqi oil minister was to co-chair the 18th bilateral joint commission, it took place against the backdrop of shrinking demand for Iraqi crude (traditionally India’s first source) due to competitive supplies from Russia. With bilateral trade at $37.08 bn in FY23, India was Iraq’s second-largest market but had the dubious distinction of having a very skewed trade profile: direct imports from India

were less than a tenth of Iraqi exports, mostly oil, to India: $2,697 mn vs. $34,386 mn. It is hard to see how this situation can be sustained without Iraq increasing the offtake of Indian goods and services.)

∙ On June 2, Admiral R. Hari Kumar, Chief of Naval Staff interacted with the 55 cadets of the Royal Saudi Naval Force and five Directing Staff of King Fahd Naval Academy, Saudi Arabia, undergoing sea training at Southern Naval Command, Kochi. Separately, the first edition of the India, France and UAE Maritime Partnership Exercise were held on June 7-8 in the Gulf of Oman.

∙ Speaking at a G20 event on energy transition in Delhi, executive director of the International Energy Agency (IEA) Fatih Birol said on June 14 that India has attracted global attention for its initiatives in a variety of sectors such as solar, coal, hydrogen and biofuels. “In the last five years, India was the largest contributor to the global solar capacity,” he said, He disclosed that a global energy transition to clearer sources was well underway. Of the total $2.7 trn worth of investments in the global energy sector, a majority ($1.7 trn) was for clean energy sources, with the rest committed to fossil fuels, Birol said. Of the total number of power plants opened globally in 2022, 80% were in the renewable sector. For the first time, investments attracted by the solar power sector have crossed those of oil production. He, however, disclosed that 90% of the investment in renewable energy continues to take place in the OECD countries and China. In its outlook report released on June 14, IEA predicted that about three-quarters of the global oil demand growth during 2022-28 will come from Asia, with India surpassing China as the main driver of growth by 2027. This is mainly because of the rapid electrification of cars and buses in China. “I very much hope India will move closer in terms of electrification” he added.

∙ Vortexa, a private energy cargo tracker, claimed on June 3 that India’s import of cheap Russian oil during May 2023 averaged 1.96 mbpd. It was more than the combined amount bought from Iraq (0.83 mbpd) Saudi Arabia (0.56 mbpd), the UAE (0.2 mbpd) and the US (0.14 mbpd). Russia now makes up for nearly 42% of all crude India imported in May. This is the highest share for an individual country in recent years. According to the Indian data, India paid around $70 per barrel in May for Russian crude on a delivered basis, which was 7% cheaper than the Indian crude basket and 17% less expensive than Saudi Arabian crude. However, a report by commodity market intelligence firm Kpler on July 2 claimed that India imported roughly 2.1 million barrels per day of Russian crude in June, down 2% from 2.15 million barrels per day in May. (Comment: Due to several reasons, India’s splurge of Russian crude can be plateauing. These include shrinking discounts, technical issues e.g., the need to blend the Ural crude and the competition with China.)

∙ India, the 8-times winner of the South Asian Football Federation (SAFF) cup, had to settle for a 1-1 draw with Kuwait in the last group match played in Delhi on June 27. The two contenders met again for the final on July 4. The match ended in a 1-1 draw, but India won it 5-4 on a penalty shootout basis. Earlier, a match with Lebanon on June 15, too, ended in a goalless draw.