Brazil President Visits India

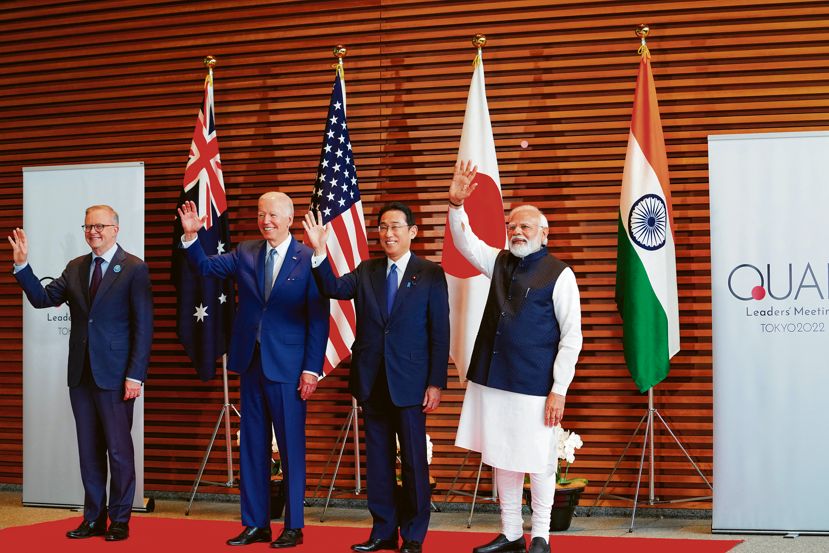

Brazil President Jair Bolsonaro visited India 24-27 January as Chief Guest on Republic Day. This was the third time a Brazilian President had been India’s Chief Guest, after F H Cardoso in 1996 and Lula da Silva in 2004. This was also PM Modi’s third meeting with Bolsonaro in four months, after the G20 summit in Osaka in October and the BRICS summit in Brazil in November last year. It said much for a relationship that seemed to be languishing. Apart from the symbolic significance, the Strategic Partnership sealed in 2006 was consolidated with a high-level understanding, perhaps even ideological affinity, between the leaderships. Brazilian ultra-conservative Foreign Minister Ernesto Araújo referred to the appreciation by the present Brazilian dispensation of the nationalism and sense of ‘identity’ being developed in India, which he considered important for a nation’s progress. (see India section for further details on the visit).

Brazil’s relationship with India has strategic dimensions: membership in BRICS and other multilateral organisations and a campaign for permanent membership of the UN Security Council for a greater say in global affairs. Brazil is a leading member of the South American market bloc (MERCOSUR), with which India has a preferential tariff agreement dating back over a decade, which needs to be expanded. The current regime is in the mood to liberalise trade. It is also moving towards membership of the OECD (see below) and may well give up its developing country status. Both countries have, however yet to attain the critical velocity required to elevate the relationship to a higher orbit. Meanwhile China has become Brazil’s largest trading partner, notwithstanding the current government’s avowed right-wing leanings and closeness to the US. India, for its part, is absorbed with other relationships and does not prioritise the South Atlantic.

Political Developments

The right-wing government of Brazil on 15 January suspended its participation in the Community of Latin American and Caribbean States (CELAC), a pan regional body established in 2012. Foreign Minister Ernesto Araujo declared that “CELAC had not been generating results in defence of democracy or in any area…and had become a “stage” for authoritarian states like Venezuela, Cuba and Nicaragua. Brazil did not attend the January CELAC summit in Mexico. He claimed Brazil remains committed to the Organisation of American States, a body that left-wing and more independent countries in the region criticise as US-dominated.

On 19 January, the Mission to Support the Fight against Corruption and Impunity in Honduras (MACCIH), established in 2016 to help the government fight corruption, was wound up. This mirrored the winding up, a few months earlier of CICIG, an internationally backed committee set up in Guatemala over a decade ago. Set up under pressure by the Bush and Obama administrations, these bodies had worked with local authorities to ensure prosecution of high level individuals in both countries. Both had also levelled allegations against sitting Presidents, who manouvered with the Trump administration to seal their fate. In the case of Guatemala, President Jimmy Morales agreed to transfer the Embassy in Israel from Tel Aviv to Jerusalem as a quid pro quo, and retain diplomatic recognition of Taiwan instead of China. Both administrations also signed on to Trump’s so-called safe third country agreement that will allow the United States to return some asylum seekers. Analysts see these steps as a tendency of the Trump administration to favour transactional relations, even dilute US anti-corruption policy, which sometimes puts US business lobbies at a disadvantage.

A tour of Europe and north America by Venezuela’s opposition leader, Juan Guaidó yielded little political advantage but much controversy after Guaidó overtly supported a Canadian suggestion to involve Cuba in a process to open dialogue with the Maduro administration. This was strenuously opposed by the US establishment, which has rolled back Obama’s rapprochement with the communist island’s government. An earlier Norwegian initiative collapsed after a few rounds of talks last year. As Maduro consolidates his hold on the beleaguered country, most analysts believe that a negotiated solution – as opposed to a military ouster of Maduro – is desirable and should involve other players such as Russia, China and Cuba. In 2016 Havana was instrumental in mediating an agreement between the Colombian government and the FARC guerrilla movement that ended the fifty-year old insurrection in that country.

Economic Developments

The outbreak of the Coronavirus in China had little effect on health in LAC but has infected the economies of the region. Most LAC countries have become increasingly reliant on Chinese markets for commodity exports. In the past decade, China has gone from playing a moderate role in Latin American trade to becoming the region’s second-largest trading partner. It is now the top importer of goods from Brazil, Peru, Uruguay, and Chile. Chile is the most exposed: its exports to China account for 8.5 percent of its GDP ( https://qz.com/1798520/coronavirus-is-hurting-latin-americas-china-linked-economies/). It is trying to offload consignments of wine, fruits and seafood destined for China elsewhere in Asia, while shipments of copper to China have been cancelled or delayed. China halted beef imports from Brazil and drastically reduced these imports from Argentina. In 2018 Brazil exported 217 million tons of iron ore (80 percent of total Brazilian exports), 58 million tons of soya beans (60 percent) and 38 million tons of crude oil (60 percent) to China. This could be a temporary phenomenon if the crisis subsides and growth and demand bounces back in the second half of 2020.

In January the US government boosted confidence in Brazil, supporting the latter’s accession to the Organisation for Economic Cooperation and Development (OECD). Earlier the US had indicated it would support Argentina’s accession before Brazil, when Mauricio Macri was President, but turned the tables after the election and assumption of office in December by the left-leaning Alberto Fernandez. Mexico and Chile are members, and Colombia is in line to join the grouping, whose membership will boost investor confidence, since the OECD lays down strict rules for economic governance.

A consortium of US based Apache Corp and France’s Total SA announced they had made a major oil discovery in a closely watched area off the coast of South America’s Caribbean coast of Suriname. Though the final estimates of exploitable reserves are yet to be published, this will mark a turning point for the economy of the tiny Caribbean nation, with a population of around 1 million, of which around 30 percent are of Indian origin. Meanwhile another discovery by US oil major EXXON offshore Guyana raised its recoverable reserves in that country to 8 billion barrels of oil equivalent, and elevated Guyana into a major hydrocarbons player.

On 18 February, the US blacklisted the trading arm of the Russian oil and gas giant Rosneft, which has significant stakes in Venezuela, and its President personally. Rosneft has been responsible for most of the offtake of Venezuela’s production and sale internationally: “As the primary broker of global deals for the sale and transport of Venezuela’s crude oil, Rosneft Trading has propped up the dictatorial Maduro, enabling his repression of the Venezuelan people,” said Secretary of State Mike Pompeo. Rosneft, which is registered in Switzerland and counts oil major BP and Qatar’s sovereign wealth fund as major shareholdres, shrugged off the move, claiming the trade “consists solely in ensuring that previously made payments are repaid. Rosneft owns stakes in five oil and gasfields in Venezuela and loaned PDVSA, Venezuela’s state oil company, $6.5bn between 2014 and 2018. Caracas has been paying that debt back in oil deliveries. https://www.ft.com/content/bea4b5da-5331-11ea-8841-482eed0038b1. Rosneft has even been shipping oil to its subsidiary in India, Nayara Energy, and Reliance.

Focus India-LAC

During the State visit of Brazil’s President Jair Bolsonaro, 15 bilateral documents were signed. The existing matrix of joint committees and commissions was activated to conclude MOUs on investment cooperation and facilitation; agriculture and animal husbandry; biofuels; oil and gas; science and technology; etc. A social security agreement is expected to benefit 4,700 Indian workers in Brazil and 1,000 Brazilian workers in India.

The visit covered a vast landscape, with agreements endorsed by Brazil’s Ministers of External Affairs, Defence, Agriculture, Science and Technology in attendance, apart from a large number of business leaders. The strategic sectors, including defence were also in focus. India’s Jindal Defence formed a joint venture with Brazil’s Taurus Armas to make small arms in India. Unfortunately, term contracts for supply of crude oil could not be finalised due to the reluctance of Brazilian national oil company Petrobras. Indian companies bought $1.6 billion worth of crude oil from Brazil in 2018-19. A decade ago, crude oil and petro-products in exchange constituted over 40 percent of India-Brazil trade but the latter component has fallen in recent years. Indian companies have over $ 2 billion invested in Brazil’s hydrocarbon assets, of a total estimated Indian investment of around $ 7 billion in that country.

Reuters reports, based on data from industry analysts and Venezuelan state oil company PdVSA claim that the country’s oil exports have fallen severely to around 1 million barrels per day (bpd). Shipments to Asia averaged 647,000 bpd, or 65% of total exports in 2019. India was the second-largest receiver of Venezuela oil last year with 217,739 bpd. In January 2020 Venezuela’s largest market was India, receiving 38.5% of total exports. Reliance Industries suspended direct purchases from PDVSA in the second quarter, but resumed them later in 2019 after reaching a new swap deal allowing PDVSA to receive fuel cargoes in exchange. In a statement early February, it said its purchases of Venezuelan crude have been reported and approved by the U.S. government under the sanctions regime imposed by Washington. Media however reported an anonymous statement by a US official: “Whether it’s Rosneft, whether it’s Reliance, whether it’s Repsol, whether it’s Chevron here in the United States, I would tread cautiously towards their activities in Venezuela that are in support, directly or indirectly, of the Maduro dictatorship”. This was shortly before opposition leader Juan Guaido, recognised by the US as the legitimate Venezuelan President, met President Trump in Washington early February. During his visit to India, President Trump told a reporter the US was monitoring Indian purchases of Venezuelan oil, without specifying. Media reports end February indicated that Reliance and Nayara – the main buyers of Venezuelan oil – were planning to wind down purchases.

………………………………………………………………………………………………

COMMENTS

(The views expressed are personal)

………………………………………………………………………………………………