IA) Political Developments: Pan-Regional and Global Issues WANA Regional Security and Terrorism Following the end of the humanitarian pause and exchange of some of the hostages and prisoners, the IDF-Hamas hostilities resumed in Gaza on Dec 1 and continued unabated till the end of the month under review. According to the Hamas-run Gaza Ministry of Health, by Dec 31 over 21,672 Gazans were dead, 70% of them being women and children, not counting thousands more feared dead under the rubble. More than 56,000 were injured, overwhelming the healthcare system degraded by IDF actions and lack of supplies. Approximately 1.9 mn of the territory’s 2.2 mn residents were displaced, some of them more than once. Israel estimated that its “Operation Iron Swords” (OIS) in Gaza launched on Oct 8, had “eliminated” some 8000 militants of Hamas and PIJ. Israel admitted having 172 of its military personnel killed in the Gaza fighting. It claimed to have captured over 1000 militants. After four weeks of OIS, the IDF had managed to largely sanitise northern Gaza. It focussed its attention on the south, in general, and Khan Younis and Rafah, its largest cities swelled with refugees from the north and centre, in particular. IDF troops and tanks entered Khan Younis on Dec 5. Despite the intensive use of airpower and missiles by IDF, their progress in urban areas was slow due to the stiff resistance of Hamas and PIJ fighters as well as the concern for hostages held by the militants. Thus the battle lines were drawn for a protracted war of attrition. Despite intense pressure from the US and the international community and high costs, the Israeli leadership showed defiance and steely resolve to continue with the OIS until the achievement of its objectives, viz. decimation of Hamas and release of the hostages. On Dec 24, Israeli Prime Minister Benjamin Netanyahu dismissed reports (published in WSJ on the day before) that the US had convinced Israel not to expand its military activities. On Dec 27, Israel’s Chief of Staff said in a televised statement that the war would go on “for many months”. Israel refused to consider either pause or de-escalatory measures to reduce the collateral damage in Gaza. It, however, reluctantly agreed to some humanitarian gestures such as permitting entry of relief material via the Kerem Shalom crossing (17/12) and by ships from Cyprus (31/12). Despite OIS being waged in Gaza, there was no let up in Israel’s iron-fisted handling of the security situation in the Occupied West Bank (OWB) and East Jerusalem since Oct 7. Israel security agencies and settlers were proactive in curbing the emergence of Hamas PIJ and other militant groups in such resistance hotbeds as Jenin, Nablus, Tulkarm, pockets of East Jerusalem, etc. Between Oct 7 and Dec 31, Israeli military raids and settler attacks have killed over 300 Palestinians, including 79 children. More than 500 people have been killed in the OWB during 2023, according to the UN agency for Palestinian refugees, making it “the deadliest year on record” for Palestinians. Further, Israeli forces arrested more than 4,800 from the West Bank and East Jerusalem since Oct 7. For details on the Israel-Hezbollah tensions: Please see the para on Lebanon. For the Houthi missile attacks on Israel and the Red Sea area: Please see the para on Yemen. WANA and Multilateral Diplomacy: The UN system did not cover itself with glory as the ongoing Israel-Hamas war threatened to expand to other regional theatres during the month under review. The Security Council continued to be mired in indecision on the issue. The rub lay with the US insistence on allowing only humanitarian pauses and not even a temporary cessation of fighting. Thus, on Dec 8, the US vetoed a draft resolution in the UN Security Council asking for a humanitarian ceasefire. This was despite the UN Secretary-General Guterres having taken a rare step of informing the council in his letter that the war “may aggravate existing threats to international peace and security.” He invoked Article 99 of the founding U.N. Charter that allows him to “bring to the attention of the Security Council any matter which in his opinion may threaten the maintenance of international peace and security” – a provision that has not been leveraged for several decades. This situation led to the passage of a cease-fire resolution at the US General Assembly on Dec 12 with a huge majority (153-8-23) but without an implementing mechanism. UNICEF warned on Dec 13 that the “safe zones” declared by Israel are “simply not safe.” World Food Programme declared on Dec 11 that nearly half of Gazans are starving. Eventually, after protracted delays, the Security Council adopted the toned-down resolution 2720 on Dec 22 with both US and Russia abstaining. (Further Reading: “Despite the war in Gaza, talk of a two-state solution persists” The Economist Dec 7.) WANA and the United States: The US continued with its regional policy of shuttle diplomacy by Secretaries of State and Defence and National Security Advisor in containing the Gaza war and prevention of a wider regional conflict. At the diplomatic level, it sought to pursue two contradictory objectives. It sought to ensure Israel’s operational freedom for continuing military campaigns in Gaza, the West Bank and Lebanon by stonewalling the growing demand for a ceasefire. On the other hand, Washington sought to assuage the Arab governments by making politically correct policy statements on the Israel-Palestine issue. To this end, Defence Secretary Lloyd Austin accompanied by Gen. Charles Brown, Jt CoDS visited Israel and Bahrain on Dec 18 to press Israel for transition to a more targeted approach in its campaign against Hamas in Gaza. On Dec 19, they were also to put together “Operation Prosperity Guardian (OPG)”, a coalition to jointly carry out patrols in the southern Red Sea and Gulf of Aden to try to safeguard commercial shipping against attacks by Yemen’s Houthi rebels. Although the US claimed that OPG had over 20 country participants, only 12 names were made public. At the same time, the US State Department approved the sale of artillery shells to Israel twice during the month under its emergency powers to avoid Congressional approval. The US Navy was operationally engaged in the Red Sea to thwart al-Houthi missile and drone attacks on Israel and commercial shipping. While these actions took place sporadically during the month, the most serious of these happened on Dec 31 when the US Navy sank three al-Houthi boats killing 10 sailors. On the diplomatic and geo-political front, US Vice President Kamala Harris used her presence in Dubai for COP28 to make a policy statement on the Gaza conflict on Dec 2. Apart from reiterating the US commitment to Israel’s security and endorsing its legitimate right to conduct military operations against Hamas militants, she demanded respect for international humanitarian law. She asserted that the US would not permit the forced relocation of Palestinians from Gaza or the West Bank, the besieging of Gaza or the redrawing of Gaza’s borders. “The international community must dedicate significant resources to support short- and long-term recovery in Gaza, for example, rebuilding hospitals and housing, restoring electricity and clean water and ensuring that bakeries can reopen and be restocked,” she said. Eventually, the Palestinian Authority (PA) security forces must be strengthened to assume security responsibilities in Gaza, but until then, she said, “There must be security arrangements that are acceptable to Israel, the people of Gaza, the PA, and the international partners.” Further, she said, the PA should be bolstered to the point that it can govern both the West Bank and Gaza. Hamas can no longer run Gaza, she said. “We want to see a unified Gaza and West Bank under the Palestinian Authority (PA), and Palestinian voices and aspirations must be at the centre of this work,” she said. Once the war ends, efforts to rebuild should be pursued with a view toward the goal of a two-state solution in which Israel and the Palestinians live in peace, she added. On Dec 8, an OIC-Arab League-mandated joint delegation of the foreign ministers of Saudi Arabia, Egypt, Qatar, Jordan, PA and Turkey met Secretary of State Anthony Blinken in Washington to press for an immediate end to hostilities in Gaza. On Dec 5, the US announced a visa ban on the Jewish settlers involved in violence in the Israel-occupied West Bank. On Dec 7, the US deputy NSA accused Iran of helping al-Houthis plan and execute drone and missile attacks on Israel and ships in the Red Sea. The White House reiterated on Dec 22 that Iran was “deeply involved” in planning operations against commercial vessels in the Red Sea and its intelligence was critical to enable Yemen’s Houthi movement to target ships. On Dec 13, US National Security Advisor Jake Sullivan met with Saudi Crown Prince Mohammed bin Salman on plans to deter attacks from Yemen-based Houthi rebels against commercial ships in the Red Sea. WANA and Russia: In a rare foreign travel since the beginning of the Ukraine conflict, President Vladimir Putin paid a whirlwind tour to the UAE and Saudi Arabia on Dec 6 where he was received by President Mohammed bin Zayed Al-Nahyan and Crown Prince Mohammed bin Salman Al-Saud respectively. The very next day, back in Moscow, he played the host to the visiting Iranian President Ebrahim Raisi and held five hours of bilateral talks. While the three individual summits with important WANA countries may appear unusual, the exercise appeared aimed at breaking the West-imposed isolation, coordinating the OPEC+ oil cuts and assuring both Riyadh and Abu Dhabi that the surge in Russia’s ties with Tehran was not at their expense. Four WANA Countries to Join BRICS: Following BRICS Group’s expansion last month, four WANA countries, viz. Saudi Arabia, Iran UAE and Egypt were expected to join the group from January 1 2024. Entry of three major oil producers (Saudi Arabia, the UAE and Iran) and two major investors (Saudi Arabia & the UAE) is expected to make the group economically dominant while entry of four WANA and Muslim countries may anchor it to their well-known geopolitical positions on the regional issues. IB) Political Developments Israel There were signs of dissonance between the Israeli war cabinet and the ruling political coalition dominated by the far-right groups. It led to the cancellation of a meeting of Israel’s war cabinet on Dec 28 that was meant to discuss the plan for the “day after” the war as the latter objected it to being beyond the war cabinet’s mandate. Israeli Prime Minister Benjamin Netanyahu’s trial on three corruption cases dating back to 2019 resumed on Dec 4 after a deferral requested by the justice ministry due to the Oct 7 Hamas attack. In light of the ongoing war, hearings were reduced from three times a week. However, on Dec 25, the court decided that from February onwards, the hearings would be held four days a week. In another setback to the beleaguered politician, an opinion poll taken in the last week of December revealed that only 15% of Israelis wanted him to continue after the Gaza war. (Further Reading: “Binyamin Netanyahu is at the mercy of his hardline coalition partners”, The Economist Dec 7.) On Dec 31, under the previously approved rotational plan, Yisrael Katz, hitherto the energy minister became the new foreign minister of Israel by swapping the position with Eli Cohen. The cabinet also gave the green light for postponed municipal elections to take place in February, subject to parliamentary approval. South Africa initiated proceedings at the International Court of Justice on Dec 30 against Israel, accusing that its operations in Gaza amount to “genocide”. Lebanon: The Lebanon-Israel border continue to simmer with tensions as the increasingly acerbic war of words between Hezbollah and Israeli leadership led to intermittent clashes of varying intensity. Although both sides were careful to avoid escalation into a full-blown conflict, their heightened rhetoric coupled with respective domestic compulsions took them nearer to the precipice. For instance, Israeli war cabinet minister Benny Gantz ominously warned on Dec 27 that the situation on the country’s border with Lebanon “must change”, hinting at the possibility of military escalation with the armed group Hezbollah. The same day, Israel’s Foreign Minister Eli Cohen said Israel may target Hezbollah leader Hassan Nasrallah. These sharp warnings coupled with repeated threats to devastate Beirut as Gaza has become, could be taken at its face value or as part of a deliberate psychological warfare to browbeat Hezbollah hotheads. The hostilities have displaced tens of thousands of people in Israel and Lebanon, and more than 150 people, most of them Hezbollah fighters, killed on the Lebanese side since the exchanges began. By the end of the month, Israeli losses were in small double digits. Yemen

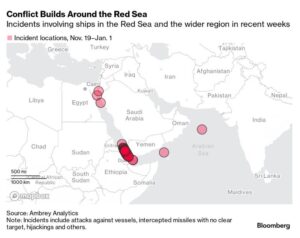

During the month under review, al-Houthi militia in northwest Yemen progressively escalated their anti-Israel role by threatening the commercial shipping in the Red Sea and Baab al-Mandeb strait. The threat acquired an autonomous course of its own – away from Gaza War. While the militia has been launching long-range missiles at Eilat port in southern Israel with limited impact, on Dec 3, al-Houthis fired missiles at three bulk carriers in the Red Sea, who suffered relatively minor damage. However, this incident sharply raised the ante on the security of navigation at a choke point through which nearly 12% of global maritime trade passes. On Dec 9, an al-Houthi spokesman said that only the ships owned by Israeli companies or engaged in its maritime trade would be targeted; however, as ships started observing radio silence to camouflage their movements, any ship travelling through the Red Sea became their target. This had a dramatic impact on sea-borne trade as shippers had to use longer and more time-consuming routes around the Cape of Good Hope connecting Asia with countries in the North Atlantic and the Mediterranean Sea. Moreover, freight and insurance rates for Red Sea travel surged sharply. It also had a short-term impact on oil and gas prices. An additional threat waded into this sordid picture from the notorious Somali pirates who sought to take advantage of the insecurity and confusion in the Gulf of Aden to get back to business after lying low for several years. In possibly the first hijacking of a merchant ship by Somali pirates since 2017, a Maltese-flagged vessel Ruen was taken over on Dec 14. The US Navy led “Operation Prosperity Guardian”, further enraged al-Houthis who regarded it as part of an aggression against the Palestinians. In a saving grace of sorts, the UN special envoy for Yemen stated on Dec 23 that the warring sides in the long-running conflict in Yemen have committed to steps towards a ceasefire and engage in a United Nations-led peace process. This downsized the apprehensions that the Red Sea tensions could disrupt the tenuous informal ceasefire in Yemen and re-ignite the civil war. On Dec 5, the World Food Program announced the suspension of its food distribution programme in the Houthi-controlled areas of Yemen. It attributed this decision to a dip in funding and disagreements with the group over how to focus on the poorest there. Iran: On Dec 23, President Ebrahim Raisi had a teleconversation with President Abdel Fattah el-Sisi of Egypt on the Gaza crisis. This engagement marked a warming of long tense bilateral ties. On Dec 25, Iran signed a free trade agreement with the Eurasian Economic Union (EEU), replacing a temporary pact in place since 2019. The EEU comprised of Russia, Armenia, Belarus, Kazakhstan and Kyrgyzstan. The previous deal facilitated mutual trade with Iran and increased it to $6.2 bn in 2022 from $2.4 bn in 2019. The new deal will eliminate customs duties on almost 90% of goods, while the agreement establishes a preferential regime for almost all trade between Russia and Iran. Russian Economy Minister said the deal would allow Russian businesses to save around 27 bn roubles ($294 mn) annually. Foreign Minister Amir Abdollahian said on Dec 11 that neither Ian nor Israel believed in a two-state solution to the Palestinian issue. A report by the International Atomic Energy Agency revealed by Reuters stated that Iran had undone the slowdown in its uranium enrichment process. While Iran dismissed it as nothing new, five Western countries issued a statement expressing concern over the development. The twin children of Narges Mohammadi, an Iranian human rights campaigner presently detained in Iran, received the Nobel Peace Prize in Oslo on Dec 10. On Dec 24, the Iranian navy announced the induction of the “Talaeiyeh” cruise missile with a range of 1,000 km as well as reconnaissance helicopters. Both were claimed to be made by its military industries. On Dec 6, Iran announced having launched a rocket with a test living space capsule which reached a height of 130 kms. On Dec 15, Jaish al-Adl Baluch militants attacked a police station killing 11 security personnel in Rask town in the impoverished Sunni-majority restive province of Sistan-Baluchestan bordering Pakistan and Afghanistan. Turkey: On Dec 7, President Recep Tayyip Erdogan visited Athens in a bid to improve tense ties with Greece. The ongoing war of words continued between Israel and Turkey reached a crescendo on Dec 27 with President Erdogan saying publicly that Israeli PM Netanyahu was no different from Adolf Hitler and likened Israel’s attacks on Gaza to the treatment of Jewish people by the Nazis. Netanyahu responded by saying “Erdogan, who commits genocide against the Kurds, who holds a world record for imprisoning journalists who oppose his rule, is the last person who can preach morality to us.” On Dec 26, the Turkish parliament’s foreign affairs commission approved the Swedish bid to join NATO. The proposal now needs to be passed by the parliament and ratified by President Erdogan before Stockholm can join NATO. 12 Turkish troops were killed in the clashes with PKK (Kurdistan Workers Party) fighters on Dec 21-22 in northern Iraq. In retaliation over the next week, the Turkish air force hit 71 targets in Iraq and Syria claiming to neutralise at least 59 PKK fighters. On Dec 29, Turkish authorities arrested at least 29 Islamic State activists claiming to have thwarted planned attacks on churches and synagogues in Istanbul as well as the Iraqi embassy in Ankara. Turkey’s stealth drone Anka-3 Made its debut flight on Dec 29. It is equipped with a Ukrainian engine. On Dec 27, Turkey raised the monthly minimum wage in 2024 by 49% to TL 17002 ($578). Despite a sharp rise, it only partially compensated for high inflation which was 61.98% in November. (Further Reading: “Turkey’s economy has improved, but its foreign policy is still messy” The Economist, Dec 11.) Sudan: On Dec 27, Maj Gen Mohamed Hamdan Daglo “Hemedti”, head of Sudan’s paramilitary Rapid Support Forces (RSF), began his first public trip abroad since the civil war broke out in mid-April 2023. He visited Uganda, Ethiopia and Djibouti and was received by the HoS/HoG in the host countries. The regional group IGAD, currently chaired by Djibouti is trying to mediate a ceasefire between RSF and the Sudan Armed Forces (SAF) led by Gen. Abdel Fattah al-Burhan.

Wadi Madani, Sudan’s second largest city fell to RSF on Dec 20, dramatically expanding the territory under Hemedti’s control. RSF already controls most of the Darfur region and vast swathes of the capital Khartoum, forcing SAF command to shift to Port Sudan. (Further Reading: “A supposed haven in Sudan falls to a genocidal militia” The Economist, Dec 20.) On Dec 10, the SAF-led Sudan government expelled 15 UAE embassy diplomats and staffers asking them to leave within 48 hours. While no reasons were made public, the SAF has accused the UAE of supporting the rival RSF through Chad and Libya’s Gen Khalifa Haftar. Syria: Israel’s air and missile attacks on Syrian targets continued during the month. Apart from targeting Syrian, Iranian and Pro-Iranian military installations such as Aleppo and Abu Kamal in the north-east (on Dec 30), they also hit the Syrian air defence base located in Sweida in the south of the country. In an escalation, a targeted Israeli air strike on Dec 25 killed Sayyed Razi Mousavi, a senior adviser in Iran’s Revolutionary Guards responsible for coordinating the military alliance between Syria and Iran. In addition, there were some US air force attacks on the IRGC and pro-Iranian militia targets in Syria during the month in retaliation to the attacks by the pro-Iranian militias on the US military facilities in Syria and Iraq linked to the Israel-Hamas conflict. On Dec 19, the Jordanian air force launched air attacks on Iran-linked drug-smuggling installations located in Sweida and Deraa provinces bordering Jordan. Iraq: The U.S. military carried out retaliatory air strikes on Dec 25 in Iraq after a drone attack earlier in the day by Iran-aligned militants left one U.S. service member in critical condition and wounded two other U.S. personnel. Iraqi government condemned these strikes, which killed one person and wounded 10 others as a “clearly hostile act.” However, President Biden formally informed the US Congress that the air strikes were meant to deter Iran and the allied militants from attacking the US military assets in Iraq. Earlier on Dec 8, Kataib Hezbollah, an Iraqi Shia militia aligned to Iran, had fired several mortar rounds at the US embassy in Baghdad, seven of which landed in its compound. A US airstrike near Kirkuk on Dec 4 killed 5 militia members. By the end of the month, over 100 violent attacks had been made on the US military assets in Iraq and Syria since Oct 7. Results of Iraqi municipal elections, declared on Dec 20, went in favour of the ruling Shia alliance called Coalition Framework, which took 101 of 280 seats. It was helped by a boycott from one of its main rivals, the populist Shia leader Moqtada al-Sadr. 41% of the 16 million voters participated in the elections. Saudi Arabia: On Dec 23, the US approved the allocation of $1 bn for military training to Saudi Arabia. According to a Reuters report on Dec 6, the Saudi leadership had asked the US to show restraint in responding to attacks by Yemen’s Houthis against ships in the Red Sea, two sources familiar with Saudi thinking said, as Riyadh seeks to contain spill over from the Hamas-Israel war upon a tenuous truce in fighting in Yemen. On Dec 5, Saudi Arabia said that it would offer tax incentives for foreign companies that locate their regional headquarters in the kingdom, including a zero per cent rate for the income tax of the regional entity and the withholding tax on approved activities of those entities for 30 years. Relevant to note that the Kingdom had announced in February 2021 plans to cease awarding government contracts to companies whose regional headquarters are not located in the kingdom by Jan. 1, 2024. The programme has so far attracted 200 foreign companies, Saudi Investment Minister Khaled Al-Falih was quoted as saying. Egypt: The Egyptian Presidential election was held on Dec 10-12. The results, announced on Dec 18, gave the incumbent Abdel Fattah el-Sisi an 89.6% vote share paving the way for his third six-year term. During the last week of the month, several media reports indicated that following discussions with various stakeholders including Hamas leader Ismael Haniyeh and PIJ leader Ziad al-Nakhlala both of whom visited Cairo, Egypt has proposed a detailed three-stage framework to bring a modicum of peace and political process back to Gaza through a ceasefire involving the exchange of prisoners and Hamas and PIJ relinquishing power of the territory to a technocratic government. These reports also indicated that Hamas and PIJ had rejected such a proposal, demanding instead a complete end to the Israeli aggression before an “all-for-all” prisoner swap. They also refused to cede power insisting upon the governance issues being decided by the Palestinians themselves and not under a deal imposed from outside. In the same direction, on Dec 27, Egyptian President el-Sisi and Jordan’s King Abdullah bin Hussein declared after their Cairo summit their rejection of any Israeli move to expel the Palestinians in Gaza and the West Bank. On the other hand, Israeli PM Netanyahu said on Dec 30 that the border zone between the Gaza Strip and Egypt should be under Israel’s control. This 14-km long “Philadelphia corridor” was established as a buffer zone controlled and patrolled by Israeli armed forces as part of the 1979 peace treaty. However, in 2005, Israel withdrew from the Gaza Strip and Egypt became the main player in control of the corridor, the only link with the outside world not controlled by Israel. Kuwait: On Dec 16, the Kuwaiti Royal Court announced the death of Emir Sheikh Nawaf Al-Ahmad Al-Sabah. The 86-year-old deceased was ill for some time and handed over most of his duties to the crown prince Sheikh Meshal al-Ahmad Al-Sabah, 83, making him Kuwait’s de facto ruler since 2021. The late emir was buried the next day in the presence of several regional and foreign leaders and Sheikh Meshal was named as Sheikh Nawaf’s successor. Sheikh Meshal becomes Kuwait’s third emir in just over three years. Kuwait, which neighbours Saudi Arabia, Iraq and Iran, holds the world’s seventh-largest oil reserves and is an OPEC member. In his first speech as the emir delivered on Dec 20, Sheikh Meshal criticised lawmakers and the government on Wednesday for decisions he said had damaged the national interests. Somalia: On Dec 2, the UN Security Council agreed to lift the ban on arms deliveries to Somalia. On Dec 18, Somalia’s Foreign Minister Abshir Omar Haruse resigned to pave the way for his participation in the upcoming presidential election on Jan 8 in Puntland, a semi-autonomous region in eastern Somalia. After a multi-year lull, the notorious piracy-related activity seems to resurge, taking advantage of insecurity in the Baab al-Mandeb region. II) Economic Developments Oil & Gas Related Developments: Global Issues: The 28th session of the Conference of the Parties (COP28) to the UN Framework Convention on Climate concluded in Dubai on Dec 13 with the representatives from nearly 200 countries agreeing to “transitioning away from fossil fuels in energy systems, in a just, orderly and equitable manner … to achieve net zero by 2050 in keeping with the science.” The session had to be extended by a day beyond its mandated time to find a modus vivendi as the more than 100 countries lobbied hard for strong language to “phase out” oil, gas and coal use but came up against powerful opposition from the Saudi Arabia-led oil producer group OPEC, which said the world can cut emissions without shunning specific fuels. While the caveat-ridden fuzzy formulation left both sides dissatisfied, it created a historic first to specifically mention the transition away from fossil fuels, viz oil, gas and coal which still account for about 80% of the world’s energy, and projections vary widely about when global demand will finally hit its peak. Members of the OPEC possess nearly 80% of the world’s proven oil reserves along with about a third of global oil output, and rely heavily on those revenues. They had therefore lobbied hard against any “phase out” of the fossil fuels arguing it to be an unrealistic target. They had a degree of support from emerging market consumers of fossil fuels demanding access to the required funds and technology to move to cleaner sources of energy. Dubai Cop28 was also noteworthy for creating a $30 bn climate fund, dubbed “Alterra” for this purpose. The final agreement called on governments to accelerate the transition to cleaner energy – specifically by tripling renewable energy capacity globally by 2030, speeding up efforts to reduce coal use, and accelerating technologies such as carbon capture and storage that can clean up hard-to-decarbonise industries. It also called for greater use of natural gas and nuclear power. Despite multiple hiccups before and during the COP28 summit, its successful conclusion was a father in the cap of the UAE and conference President Dr Sultan Ahmed Al Jaber. In his concluding remarks, he said “We are what we do, not what we say…. We must take the steps necessary to turn this agreement into tangible actions.” That would remain to be seen as the anthropogenic causes continue to push global warming towards its self-imposed 1.5˚C limit. (Further Reading: “Climate talks at last lead to a deal on cutting fossil-fuel use” The Economist, Dec 13.) The Brent futures closed the month under review at $77.15/barrel having fallen over 6.8% during the month under review, with growing concerns about oversupply and flagging Chinese recovery outweighing the geopolitical tensions, including those in the Red Sea. The crude has dropped more than 10% in 2023, a trend accelerated by widespread scepticism in the market about further production cuts by OPEC+. The US natural gas futures fell nearly 44% in 2023 for their biggest annual percentage fall since 2006, pressured by record production, ample inventories and relatively mild weather. On Dec 14, the IEA reduced nearly 400,000 bpd from assessments of consumption growth for Q4/2023 as economic activity weakened in key countries. However, it expected World oil consumption to rise by 1.1 mbpd in 2024, up 130,000 bpd from its previous forecast. It, however, saw soaring production from the US, Brazil and Guyana offsetting production cuts by Saudi Arabia and its OPEC+ allies. On the other hand, OPEC monthly bulletin published a day before the IEA report kept its forecast for world oil demand growth steady at 2.46 mbpd in 2023 and 2.25 mbpd in 2024. It blamed “exaggerated concerns” about demand for a recent drop in prices, as it stuck to its relatively high 2024 oil use prediction. Relevant to note that although IEA and OPEC both forecast growth in crude demand in 2024, the former’s projection is less than half the latter.

Country Specific Developments: In a joint statement issued in Riyadh on Dec 7 after the Russia-Saudi Arabia summit, the world’s two largest crude exporters, called for all OPEC+ members to join an agreement on 2.2 mbpd output cuts for the “good of the global economy”, only days after a fractious meeting of the producers’ club. On Dec 20, ADNOC signed a 15-year agreement with China’s ENN Natural Gas to supply 1 MT/year LNG from 2028 onwards when commercial operations at Ruwais field are expected to begin. On Dec 15, ADNOC agreed to buy $3.62 bn worth of additional stakes in ammonia and urea producer Fertiglobe, making it 86.2% owner in the company. On Dec 20, Abu Dhabi’s Mubadala Energy announced the discovery of a major gas reserve in deep off-shore South Andaman Sea located around 100 km off northern Sumatra in Indonesian waters. With potential gas-in-place for more than 6 trillion cubic feet (tcf) of which 3.3 tcf is estimated to be recoverable, Wood Mackenzie put Layaran the second largest deepwater discovery globally in 2023. On Dec 3, the process of raising the capacity of Kuwait’s mega refinery at al-Zour from 410 kb/d to 615 kb/d began. Bloomberg reported that the US exported 91.2 MMT of LNG in 2023, a record for the country, making it the world’s largest exporter of the commodity. Australia and Qatar followed as the second and third largest LNG exporters respectively. Following economy-related developments took place in WANA countries: The WANA markets saw an IPO boom despite the global decline in such activity. The regional exceptionalism was attributed to the governments trying to raise money by selling their assets to fill the funding gap due decline in oil and gas revenues. Moreover, geopolitical turbulence elsewhere and tepid economic recovery in China also focused investors’ attention on the Gulf markets. For instance, the IPO for MBC Group, the Middle East’s biggest broadcaster, drew $14.5 bn in institutional investor orders for its $222 mn Riyadh IPO — for a subscription coverage of about 66 times. Most observers expect the IPO boom to continue in 2024 as well. Moreover, investors hunting for growth were fixated on big financial outlays of Saudi and Emirati plans to diversify their economies from oil. Further afield, Turkish stocks saw FIIs turn buyers for the first time since 2019 as the Central Bank abandoned President Erdogan’s voodoo monetary policies. Even the Egyptian government succeeded in offloading some of the state assets in the market, thereby meeting a pre-requisite for a badly needed IMF loan. (Further Reading: “Abu Dhabi Becomes ‘Daily Davos’ as Asset Managers Hunt for Cash”, BNN Bloomberg Dec 19; and, “Saudi Arabia Is the New China for Investors Hunting Down Growth”, BNN Bloomberg, Dec 20.) On Dec 26, Saudi Arabia’s cabinet approved contracting rules for firms with their regional headquarters not based in the Kingdom. These are supposed to be barred from the government contracts from 1.1.2024. On Dec 28, Saudi Arabia announced the discovery of significant additional deposits of gold in Mansourah Massarah. According to research consultancy Global SWF, Saudi Arabia’s Public Investment Fund (PIF) emerged as the world’s most active sovereign investor in 2023. It deployed $31.6 bn, a fourth of the total $124.7 bn investments made world’s SWFs. The PIF figure was higher than the $20.7 bn it invested in 2022, it contrasted with a global SWF trend of investments having contracted by bout a fifth over the previous year. Despite greater PIF investments, Bloomberg reported on Dec 7 that some of the Saudi projects under Vision 2030 were getting delayed due to lower oil revenues. At the same time, official figures published on Dec 6 indicated that despite a sharp drop in oil prices and production, Saudi 2023 revenues at $318 bn were about 5% more than forecast. Still, accelerated spending on a multi-trillion-dollar plan to diversify the economy left the budget with a deficit of $22 bn. On Dec 21, Turkey’s Central Bank raised its interest rate by 250 bps to 42.5%. Despite this hefty rise the bank rate still trailed the annual inflation which was 62% in November 2023. The number of passengers using Istanbul International Airport (IAA) grew by 18% to 76 mn in 2023. It currently is the third largest international airport with over 100 airlines using it. With 11 more airlines expected to start using it in 2024, IAA passenger footfalls are expected to reach 85 mn. On Dec 15, the UAE agreed to cap and redistribute its returns on $5 bn thereby retaining a smaller portion of the profits generated by a $30 bn “Alterra”, an investment vehicle launched during the COP28 summit. This UAE decision to impose a ceiling on its profits means outside investors stand to receive as much as 5% of additional returns, making it more attractive for the ESG funds. Abu Dhabi’s CYVN Holding decided to invest $2.2 bn in Nio EV of China. Further, IRH of Abu Dhabi is to invest $1.1 bn in Zambia’s Mopani copper mines. Dubai emirate announced the creation of the Dubai Investment Fund for investment into “strategically important projects.” On Dec 25, the Israeli finance ministry gave out figures that revealed the impact of the war on the nation’s economy. It estimated that the GDP contracted by an annualised 19% during Q4/2023 after a 2.5% growth in Q3. For all of 2023, it projected GDP growth of 2%, translating into flat per capita growth, and 1.6% growth in 2024. It expected the annual inflation rate to end the year at 3.1% and ease to 2.6% in 2024. Owing largely to the cost of the war estimated to last till February 2024, the total budgetary spending in 2024 would rise to 562.1 bn shekels from a planned 513.7 bn and lead to a budget deficit of 5.9% of GDP, up from a target of 2.25%. On Dec 26, Intel announced a $25 bn new Chip-making plant in Israel, The Israeli government would grant a subsidy of $3.2 bn for the Fab38 project is due to open in 2028 and operate through 2035. Intel’s announcement of the country’s largest inbound investment ever came against the sombre backdrop of Israeli tech deals and public offerings having dropped to a 10-year low in 2023 after the war, months of protests and a global downturn battered the local industry. According to a PwC report on Dec 6, there were 45 deals valued at $7.5 bn for Israeli tech companies in 2023, compared to $16.9 bn the previous year.

On Dec 4, IMF stressed that it attached higher priority to lowering inflation in Egypt to the country’s currency reforms. On Dec 20, Egypt and Saudi Arabia signed a $4 bn deal for the green hydrogen project.

III) Bilateral Developments - Sultan Haitham bin Tarik of Oman paid a state visit to India on Dec 16. This was the first visit of its kind in 26 years. During the visit, six bilateral memoranda of understanding were signed. Two rounds of bilateral negotiations for reaching a bilateral comprehensive economic partnership agreement were held during the month preceding the state visit. During the visit, a new ‘India-Oman Joint Vision – A Partnership for Future’ was adopted with concrete action points on 10 different areas. The two sides also announced the third tranche of the Oman-India Joint Investment Fund (OIJIF). The bilateral trade was $12.3 bn in 2022-23, having more than doubled in the previous two years. Oman has an Indian diaspora of over 7 lakh people. The visit was followed up on Dec 18 by discussions between their ministers of commerce and industry in New Delhi. On Dec 12 PTI quoted from a report claiming that over 83.5% of Indian exports worth $3.7 bn would get a significant boost in Oman from the proposed CEPA. (Further Reading: “India – Oman Joint Statement during the State Visit of His Majesty Sultan Haitham bin Tarik of the Sultanate of Oman” Dec 16.)

- During the month under review, Prime Minister Shri Narendra Modi stayed engaged with his WANA counterparts. On Dec 18, he congratulated President Abdul Fattah el-Sisi on winning the presidential elections in Egypt. On Dec 19, he spoke with IsraeliPM Benyamin Netanyahu on the recent developments in the ongoing conflict including maritime security and emphasised the need for humanitarian aid as well as conflict resolution through dialogue and diplomacy. On Dec 27, the PM spoke with SaudiCrown Prince Mohammed bin Salman in the wake of the attack on MV Chem Pluto carrying Saudi crude to India.

- India declared a day of mourning on Dec 17 to mark the passing away of the Amir of Kuwait Sheikh Nawaf Al-Ahmed AlJaber Al-Sabah. PM Modi condoled his death.

- In a high-profile case, on Dec 28, a Qatari court commuted the death sentence passed on 8 ex-Indian navy personnel to prison sentences of 3 to 25 years durations. MEA welcomed the move.

- Two mysterious incidents during the last week of December indicated the ongoing Middle East tensions spilling over to India. On Dec 23 morning, MV Chem Pluto, a tanker, was struck by an uncrewed aerial vehicle approximately 200 kms southwest of Veraval city off India’s west coast. The Japanese-owned tanker – under the Liberian flag but operated by a Dutch entity connected to Israeli shipping tycoon Idan Ofer – was carrying Saudi crude from Jubail to Mangalore port. No crew member was hurt and a fire caused by the explosion was extinguished by the crew. While no country or outfit claimed responsibility for the hit, the Pentagon specifically stated that the attacking drone was “fired from Iran.” On Dec 25, Iran rejected the charge, calling it “baseless.” Indian Navy and Coast Guard rendered the necessary assistance and escorted the ship to Mumbai for inspection. Following this first-ever incident of its kind near the Indian coastline, the Indian Navy deployed more of its assets, mainly destroyers, in the northern and central Arabian Sea and intensified air surveillance. Earlier on Dec 14 night onwards, the Indian Navy was also involved in an anti-piracy mission in the central Arabian Sea involving MV Ruen, a Malta-flagged vessel. In the second incident, an explosion took place near the Israeli embassy in New Delhi on Dec 26. No outfit took responsibility for it and security agencies and police were investigating the matter in a tight-lipped manner.

- Indian Coast Guard patrol vessel Sajag made a call at the Saudi port of Dammam on Dec 5.

- On Dec 15, the Indian cabinet approved the Memorandum of Understanding signed with Saudi Arabia on digitisation and electronic manufacturing.

- On Dec 12, the OIC General Secretariat issued the following statement:

“The General Secretariat of the Organization of Islamic Cooperation (OIC) expresses concern over the verdict rendered by the Supreme Court of India on 11 December 2023, upholding the unilateral actions taken by the Indian government on 5th August 2019 that stripped the special status of the territory of Jammu and Kashmir. “The General Secretariat, in reference to the decisions and resolutions of the Islamic Summit and the OIC Council of Foreign Ministers related to the issue of Jammu and Kashmir, reiterates its call to reverse all illegal and unilateral measures taken since 5 August 2019 aimed at changing the internationally-recognized disputed status of the territory. “The General Secretariat reaffirms its solidarity with the people of Jammu and Kashmir in their quest for the right of self-determination and reiterates its call on the international community to enhance its efforts to resolve the issue of Jammu and Kashmir in accordance with the relevant United Nations Security Council resolutions.” The next day Indian Ministry of External Affairs Spokesman rendered the following response: “India rejects the statement issued by the General Secretariat of the Organization of Islamic Cooperation (OIC) on a judgement of the Indian Supreme Court. It is both ill-informed and ill-intended. That OIC does so at the behest of a serial violator of human rights and an unrepentant promoter of cross-border terrorism makes its action even more questionable. Such statements only undermine OIC’s credibility.” - Among the India-specific oil and natural gas developments during the month were the following: (i) A parliamentary panel recommended on Dec 31 that India should diversify its oil imports by having more grades of crude; (ii) In an S&P Report published on Dec 31, India is anticipated to experience a notable upswing in liquefied natural gas (LNG) imports in 2024, with projections suggesting an 8% year-on-year increase as power and industrial sectors are poised to contribute significantly to the import upswing if spot prices align closely with the levels witnessed in 2023; (iii) India’s fuel demand fell 2% y/y in November 2023; (iv) According to Kpler data, India’s oil imports from Russia declined to 1.48 mbpd in Dec 2023 from the record level of 2.15 mbpd in May this year allegedly due to payment issues; and (v) On Dec 1, India resumed import of crude from Venezuela.

- A case of Indian nurse Nimisha Priya, on death row in al-Houthi controlled area of Yemen for killing a Yemeni national hit the headlines during the month.

- New York Times reported on Dec 31 that Israel was recruiting labour in India and Sri Lanka to replace the Palestinians it no longer allowed.

- On Dec 19, Bloomberg quoted an immigration firm estimating that more millionaires will come to the UAE from India than any other in 2023.

|